Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The strategy implemented in the provided code is called "adaptive." It is a backtesting strategy for trading. Here is a short description of what the strategy does:

The strategy uses various technical indicators to make buy and sell decisions. It calculates the Williams %R oscillator, which shows the current closing price in relation to the high and low of the past N days.

It calculates the MAMA, FAMA, and KAMA indicators.

It calculates the CTI (Composite Timing Indicator).

It calculates the RSI (Relative Strength Index) for different time periods. For the buy signal, it checks multiple conditions, including the alignment of the MAMA, FAMA, and KAMA indicators, the value of the Williams %R, the difference between MAMA and FAMA, the CTI value, and the price increase over certain periods. It also considers the RSI values. For the sell signal, no specific conditions are provided in the code. The strategy aims to generate a minimal return on investment (ROI) of 0.02 (2%) and has an optimal stop loss of -0.109 (10.9%). The strategy operates on a 5-minute timeframe. Please note that the provided code is a simplified version, and further customization or refinement may be required based on specific trading requirements and market conditions.

It calculates the MAMA, FAMA, and KAMA indicators.

It calculates the CTI (Composite Timing Indicator).

It calculates the RSI (Relative Strength Index) for different time periods. For the buy signal, it checks multiple conditions, including the alignment of the MAMA, FAMA, and KAMA indicators, the value of the Williams %R, the difference between MAMA and FAMA, the CTI value, and the price increase over certain periods. It also considers the RSI values. For the sell signal, no specific conditions are provided in the code. The strategy aims to generate a minimal return on investment (ROI) of 0.02 (2%) and has an optimal stop loss of -0.109 (10.9%). The strategy operates on a 5-minute timeframe. Please note that the provided code is a simplified version, and further customization or refinement may be required based on specific trading requirements and market conditions.

Unable to parse Traceback (Logfile Exceeded Limit)

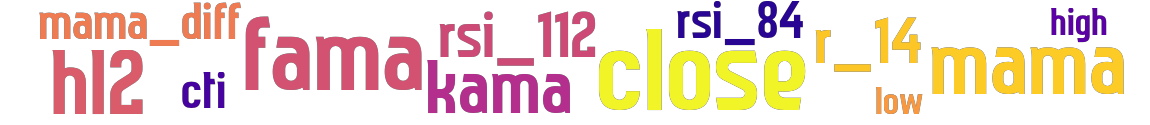

stoploss: -0.109 timeframe: 5m hash(sha256): 2fa1c2695efd554fe9f9ab509b6354bfb2a4c0fdbdca7ef3f1ec7a2373eff0b8 indicators: hl2 high rsi_112 mama_diff kama close rsi_84 fama mama low mama_dif cti r_14

No similar strategies found. (based on used indicators)

last change: 2025-01-15 18:16:17