Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "YouPig" strategy is a trading strategy implemented as a class in Python. Here's a short description of what the strategy does:

The "populate_indicators" method calculates various technical indicators for the input DataFrame. These indicators include exponential moving averages (EMAs) of different time periods, Bollinger Bands, minimum and maximum values, Commodity Channel Index (CCI), Money Flow Index (MFI), Relative Strength Index (RSI), and average price.

The "populate_buy_trend" method populates the buy signal for the given DataFrame based on the calculated indicators.

It checks for specific conditions, such as the moving average crossover, lower price touching Bollinger Bands, CCI and RSI thresholds, and other conditions related to exponential moving averages and volume.

The "populate_sell_trend" method populates the sell signal for the given DataFrame based on the calculated indicators. It checks for conditions like the price being above certain EMAs, maximum price, upper Bollinger Band, and MFI threshold, as well as patterns of consecutive higher closing prices and high RSI values. The code snippet at the end performs some additional processing, including resampling the DataFrame, calculating a simple moving average (SMA), dropping unnecessary columns, and interpolating missing values. Finally, it merges the processed DataFrame with the original DataFrame and returns the result. Overall, the strategy uses a combination of technical indicators to generate buy and sell signals for trading.

The "populate_buy_trend" method populates the buy signal for the given DataFrame based on the calculated indicators.

It checks for specific conditions, such as the moving average crossover, lower price touching Bollinger Bands, CCI and RSI thresholds, and other conditions related to exponential moving averages and volume.

The "populate_sell_trend" method populates the sell signal for the given DataFrame based on the calculated indicators. It checks for conditions like the price being above certain EMAs, maximum price, upper Bollinger Band, and MFI threshold, as well as patterns of consecutive higher closing prices and high RSI values. The code snippet at the end performs some additional processing, including resampling the DataFrame, calculating a simple moving average (SMA), dropping unnecessary columns, and interpolating missing values. Finally, it merges the processed DataFrame with the original DataFrame and returns the result. Overall, the strategy uses a combination of technical indicators to generate buy and sell signals for trading.

startup_candle_count : 50 ema_20: -0.010% rsi: 0.269% ema20: -0.010% adx: -7.240%

Biased Indicators

resample_sma

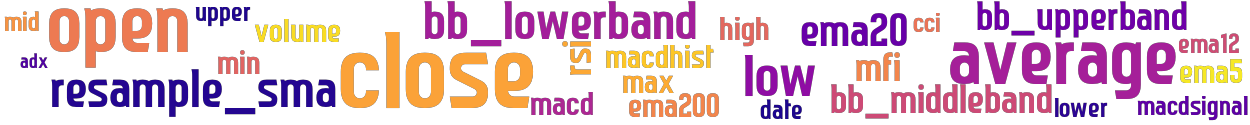

stoploss: -0.035 timeframe: 5m hash(sha256): c6cb59aa78b072a83ea6153801c89195b69a747cb24751b9e77b49cdb8b87277 indicators: upper ema20 close bb_lowerband mfi ema5 macdhist ema12 volume average date max open high macdsignal mid cci macd open high low close ema200 min adx lower bb_middleband rsi bb_upperband low resample_sma

Similar Strategies: (based on used indicators)

Strategy: DuperFivish, Similarity Score: 93.75%

Strategy: ReinforcedQuickie_v2, Similarity Score: 84.38%

last change: 2023-07-04 03:57:36