You will be redirected to the original Strategy in 15 seconds.

The StrategyScalpingFast2 is a trading strategy that aims to profit from short-term price fluctuations in the market. Here's a breakdown of its key components:

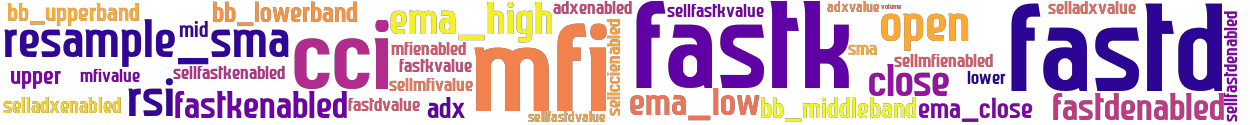

Indicator Population:

The strategy populates various indicators, such as simple moving average (SMA), exponential moving averages (EMA) for high, close, and low prices, stochastic fast (fastk and fastd), average directional index (ADX), commodity channel index (CCI), relative strength index (RSI), money flow index (MFI), and Bollinger Bands. Buy Trend:

Conditions for entering a buy position are checked based on the following criteria:

Volume is greater than 0.

The opening price is lower than the EMA low.

The resampled SMA is lower than the current closing price.

Additional conditions can be enabled/disabled based on user-defined parameters (adx, mfi, fastk, fastd). If enabled, the respective indicator values are checked against user-defined threshold values. If both fastk and fastd are enabled, a crossover condition between them is also considered. Sell Trend: Conditions for exiting a buy position and initiating a sell position are checked based on the following criteria: The opening price is equal to or higher than the EMA high. Additional conditions can be enabled/disabled based on user-defined parameters (sell-fastk, sell-fastd, sell-cci, sell-mfi, sell-adx). If enabled, the respective indicator values are checked against user-defined threshold values. Crossover conditions between sell-fastk and sell-fastd are considered. The strategy utilizes a combination of technical indicators to identify potential buy and sell signals. It is designed for scalping, which involves taking advantage of short-term market movements.

The opening price is lower than the EMA low.

The resampled SMA is lower than the current closing price.

Additional conditions can be enabled/disabled based on user-defined parameters (adx, mfi, fastk, fastd). If enabled, the respective indicator values are checked against user-defined threshold values. If both fastk and fastd are enabled, a crossover condition between them is also considered. Sell Trend: Conditions for exiting a buy position and initiating a sell position are checked based on the following criteria: The opening price is equal to or higher than the EMA high. Additional conditions can be enabled/disabled based on user-defined parameters (sell-fastk, sell-fastd, sell-cci, sell-mfi, sell-adx). If enabled, the respective indicator values are checked against user-defined threshold values. Crossover conditions between sell-fastk and sell-fastd are considered. The strategy utilizes a combination of technical indicators to identify potential buy and sell signals. It is designed for scalping, which involves taking advantage of short-term market movements.

stoploss: -0.326 timeframe: 1m hash(sha256): 7273442bb90561b77130f41152ff296965ece706408b2124f9c3cc18b5e34921

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-11 14:52:52