You will be redirected to the original Strategy in 15 seconds.

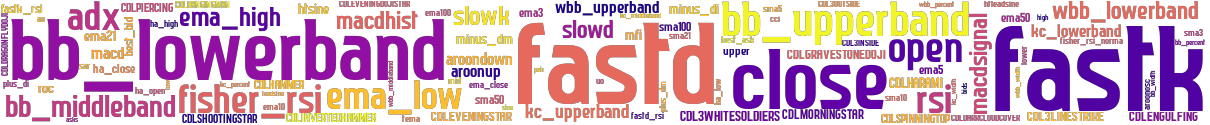

The Scalp strategy is a trading strategy that utilizes various technical indicators to make buying and selling decisions. The strategy is implemented as a class and follows the IStrategy interface. The populate_indicators method adds several technical indicators to the given DataFrame, including the Average Directional Index (ADX), Stochastic Fast (fastk and fastd), Bollinger Bands (bb_lowerband, bb_upperband, and bb_middleband), and Exponential Moving Averages (ema_high, ema_close, and ema_low).

These indicators provide insights into market trends, volatility, and potential reversal points.

The populate_buy_trend method populates the 'buy' column in the DataFrame based on specific conditions.

The strategy looks for opportunities to buy when the following conditions are met: the opening price is lower than the Exponential Moving Average (EMA) of the low, the ADX is greater than 30, and the Stochastic Fast (fastk and fastd) both cross below 30 and fastk crosses above fastd. The populate_sell_trend method populates the 'sell' column in the DataFrame based on specific conditions. The strategy looks for opportunities to sell when either the opening price is higher than or equal to the EMA of the high or when the Stochastic Fast (fastk or fastd) crosses above 70. Overall, the Scalp strategy aims to capture short-term trading opportunities by identifying potential buy signals when certain conditions align and sell signals when the price shows signs of reversal or overbought conditions.

These indicators provide insights into market trends, volatility, and potential reversal points.

The populate_buy_trend method populates the 'buy' column in the DataFrame based on specific conditions.

The strategy looks for opportunities to buy when the following conditions are met: the opening price is lower than the Exponential Moving Average (EMA) of the low, the ADX is greater than 30, and the Stochastic Fast (fastk and fastd) both cross below 30 and fastk crosses above fastd. The populate_sell_trend method populates the 'sell' column in the DataFrame based on specific conditions. The strategy looks for opportunities to sell when either the opening price is higher than or equal to the EMA of the high or when the Stochastic Fast (fastk or fastd) crosses above 70. Overall, the Scalp strategy aims to capture short-term trading opportunities by identifying potential buy signals when certain conditions align and sell signals when the price shows signs of reversal or overbought conditions.

stoploss: -0.04 timeframe: 1m hash(sha256): 77e5251b37032a882c38ee17b5742f690e4e884f16d62d2717d12541b1b995fb

Was not able to fetch indicators from Strategyfile.

last change: 2023-04-26 16:45:37