Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "SMAOffsetProtectOptV1" strategy is a trading strategy implemented in Python for backtesting purposes. Here is a short description of what the strategy does:

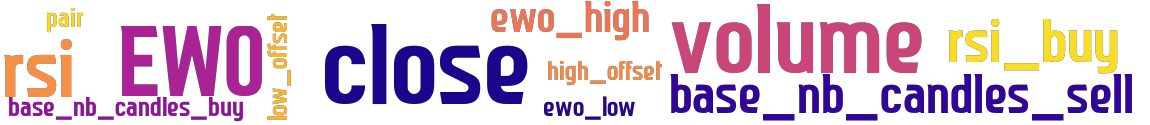

The strategy uses a combination of moving averages (MA), Elliott Wave Oscillator (EWO), and Relative Strength Index (RSI) indicators to generate buy and sell signals for trading. It operates on candlestick data with a timeframe of 5 minutes.

During the buy signal generation, the strategy looks for two conditions: The closing price is below a specific moving average value (calculated using the "base_nb_candles_buy" parameter) multiplied by a certain offset value (specified by the "low_offset" parameter).

Additionally, the EWO value (calculated using the "EWO" function) is above a certain threshold (specified by the "ewo_high" parameter), and the RSI value (calculated using the "ta.RSI" function) is below a specific value (defined by the "rsi_buy" parameter).

The closing price is below the moving average value multiplied by the low offset, and the EWO value is below another threshold (specified by the "ewo_low" parameter). If any of these conditions are met, a buy signal is generated for the corresponding candle. During the sell signal generation, the strategy looks for the following condition: The closing price is above a specific moving average value (calculated using the "base_nb_candles_sell" parameter) multiplied by a certain offset value (specified by the "high_offset" parameter). If this condition is met, a sell signal is generated for the corresponding candle. The strategy incorporates a minimal return-on-investment (ROI) table, specifying the desired profit targets for different time periods. It also includes a stop-loss mechanism, where the position is closed if the price drops by a certain percentage (specified by the "stoploss" parameter). The strategy can be further optimized by adjusting various parameters, such as the moving average lengths, offset values, EWO thresholds, and RSI thresholds. Note: The provided code snippet contains dependencies and references to external libraries and functions. To fully execute the strategy, make sure to import the required libraries and set up the necessary infrastructure.

During the buy signal generation, the strategy looks for two conditions: The closing price is below a specific moving average value (calculated using the "base_nb_candles_buy" parameter) multiplied by a certain offset value (specified by the "low_offset" parameter).

Additionally, the EWO value (calculated using the "EWO" function) is above a certain threshold (specified by the "ewo_high" parameter), and the RSI value (calculated using the "ta.RSI" function) is below a specific value (defined by the "rsi_buy" parameter).

The closing price is below the moving average value multiplied by the low offset, and the EWO value is below another threshold (specified by the "ewo_low" parameter). If any of these conditions are met, a buy signal is generated for the corresponding candle. During the sell signal generation, the strategy looks for the following condition: The closing price is above a specific moving average value (calculated using the "base_nb_candles_sell" parameter) multiplied by a certain offset value (specified by the "high_offset" parameter). If this condition is met, a sell signal is generated for the corresponding candle. The strategy incorporates a minimal return-on-investment (ROI) table, specifying the desired profit targets for different time periods. It also includes a stop-loss mechanism, where the position is closed if the price drops by a certain percentage (specified by the "stoploss" parameter). The strategy can be further optimized by adjusting various parameters, such as the moving average lengths, offset values, EWO thresholds, and RSI thresholds. Note: The provided code snippet contains dependencies and references to external libraries and functions. To fully execute the strategy, make sure to import the required libraries and set up the necessary infrastructure.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -0.5 timeframe: 5m hash(sha256): 56716a0cc9c475ee8296d5a569a96f51e35861c6b190a4798536c792aebaebb7 indicators: rsi_buy ma_sell_val volume EWO ewo_high low_offset close ewo_low rsi high_offset base_nb_candles_sell base_nb_candles_buy ma_buy_val

No similar strategies found. (based on used indicators)

last change: 2025-01-14 05:57:01