Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The SMAOffsetProtectOptV0 strategy is a trading strategy that uses simple moving averages (SMA), exponential moving averages (EMA), the Elder's Force Index (EWO), and the relative strength index (RSI) to determine buy and sell signals. Here's a breakdown of what the strategy does:

In the populate_indicators method, the strategy calculates the EMA for different time periods (ma_buy_{val} and ma_sell_{val}) and adds them as columns to the dataframe. It also calculates the EWO and RSI indicators and adds them as columns.

In the populate_buy_trend method, the strategy defines conditions for buying: a.

The closing price is below the SMA multiplied by a low offset value.

b. The EWO is above a high threshold value. c. The RSI is below a specific buy threshold value. d. The volume is greater than zero. If any of these conditions are met, the strategy marks the corresponding row as a buy signal by setting the 'buy' column to 1. In the populate_sell_trend method, the strategy defines conditions for selling: a. The closing price is above the SMA multiplied by a high offset value. b. The volume is greater than zero. If these conditions are met, the strategy marks the corresponding row as a sell signal by setting the 'sell' column to 1. The strategy uses a combination of moving averages, EWO, and RSI to identify potential buying opportunities and a simple condition based on the closing price and volume to identify selling opportunities.

In the populate_buy_trend method, the strategy defines conditions for buying: a.

The closing price is below the SMA multiplied by a low offset value.

b. The EWO is above a high threshold value. c. The RSI is below a specific buy threshold value. d. The volume is greater than zero. If any of these conditions are met, the strategy marks the corresponding row as a buy signal by setting the 'buy' column to 1. In the populate_sell_trend method, the strategy defines conditions for selling: a. The closing price is above the SMA multiplied by a high offset value. b. The volume is greater than zero. If these conditions are met, the strategy marks the corresponding row as a sell signal by setting the 'sell' column to 1. The strategy uses a combination of moving averages, EWO, and RSI to identify potential buying opportunities and a simple condition based on the closing price and volume to identify selling opportunities.

startup_candle_count : 30 Recursive Analysis found no issues while using 30 startup_candle_count

Unable to parse Traceback (Logfile Exceeded Limit)

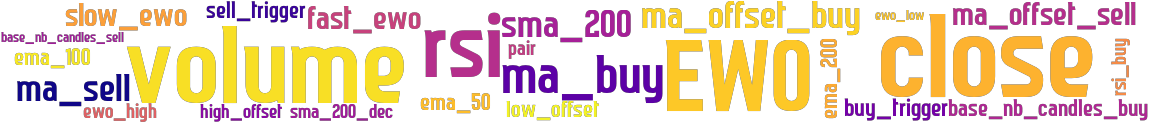

stoploss: -0.5 timeframe: 5m hash(sha256): ba358abb0b7bbcc16603229516ff04563b20e1519fe1b6c7e061b748ad6fa948 indicators: rsi_buy EWO ema_200 ewo_high ema_50 close ewo_low ma_offset_buy ma_sell_val ma_buy_val volume low_offset ma_buy high_offset base_nb_candles_buy sma_200 fast_ewo slow_ewo ma_offset_sell sell_trigger base_nb_candles_sell ma_sell ema_100 rsi buy_trigger sma_200_dec

Similar Strategies: (based on used indicators)

Strategy: SMAOffsetProtectOptV0_2, Similarity Score: 88.89%

last change: 2025-01-15 18:53:35