Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The SMAOG strategy is a backtesting strategy for trading. Here's a short description of what the strategy does:

The strategy uses Simple Moving Average (SMA) and Exponential Moving Average (EMA) indicators to make buy and sell decisions. It defines parameters for buying and selling, such as the number of candles to consider for the base (buy/sell) and offset values.

The strategy calculates various indicators like moving averages, RSI (Relative Strength Index), and checks if the pair is bad based on certain thresholds.

For the buy trend, it checks if the EMA 50 is above the EMA 200, the current close price is above the EMA 200, the pair is not considered bad, the close price is below a buy offset, and the volume is positive.

If all conditions are met, a buy signal is generated. For the sell trend, it checks if the close price is above a sell offset and satisfies certain additional conditions like a decrease in opening price, RSI below 50, or a decrease in RSI. If the conditions are met, a sell signal is generated. The strategy includes parameters for stop loss, minimal return on investment (ROI), trailing stop, and other configuration options. It populates indicators and trends based on the provided data using the populate_indicators, populate_buy_trend, and populate_sell_trend functions. Note: This description provides a brief overview of the strategy based on the provided code. Further details about the strategy's logic and effectiveness may require a deeper analysis.

The strategy calculates various indicators like moving averages, RSI (Relative Strength Index), and checks if the pair is bad based on certain thresholds.

For the buy trend, it checks if the EMA 50 is above the EMA 200, the current close price is above the EMA 200, the pair is not considered bad, the close price is below a buy offset, and the volume is positive.

If all conditions are met, a buy signal is generated. For the sell trend, it checks if the close price is above a sell offset and satisfies certain additional conditions like a decrease in opening price, RSI below 50, or a decrease in RSI. If the conditions are met, a sell signal is generated. The strategy includes parameters for stop loss, minimal return on investment (ROI), trailing stop, and other configuration options. It populates indicators and trends based on the provided data using the populate_indicators, populate_buy_trend, and populate_sell_trend functions. Note: This description provides a brief overview of the strategy based on the provided code. Further details about the strategy's logic and effectiveness may require a deeper analysis.

Unable to parse Traceback (Logfile Exceeded Limit)

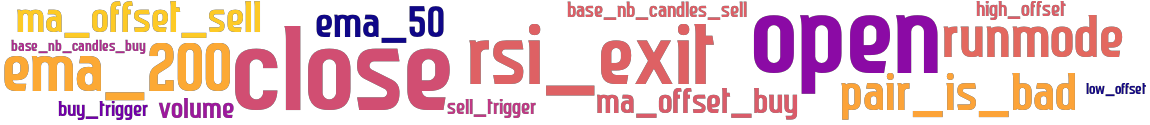

stoploss: -0.23 timeframe: 5m hash(sha256): 00ec54e21a665af61aea436cc1bb521f5ee11c1f7bc9370b94f4ac7029276ab2 indicators: volume ema_200 ema_50 low_offset _is_bad ma_offset_sell close sell_trigger ma_offset_buy high_offset buy_trigger base_nb_candles_sell runmode open rsi_exit base_nb_candles_buy

Similar Strategies: (based on used indicators)

Strategy: HSMAOG6, Similarity Score: 94.12%

Strategy: SMAOG, Similarity Score: 94.12%

Strategy: SMAOG_273, Similarity Score: 94.12%

Strategy: SMAOG_273_20250611_1557, Similarity Score: 94.12%

Strategy: SMAOG_821, Similarity Score: 94.12%

last change: 2024-08-02 06:56:38