Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ReinforcedAverageStrategy is a proof-of-concept trading strategy that buys and sells based on crossovers. Here is a breakdown of how the strategy works:

Indicators:

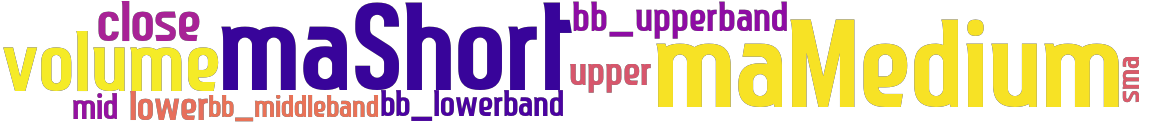

Moving Averages: The strategy calculates two moving averages, namely "maShort" with a time period of 8 and "maMedium" with a time period of 21. Bollinger Bands: The strategy also calculates Bollinger Bands with a window of 20 and 2 standard deviations.

Three bands are generated: "bb_lowerband," "bb_upperband," and "bb_middleband." Simple Moving Average: Another indicator, the simple moving average (SMA), is calculated with a time period of 50 on a resampled version of the dataframe.

Buy Signal: The strategy generates a buy signal when the following conditions are met: The "maShort" crosses above the "maMedium." The closing price is higher than the resampled SMA.

The volume is greater than 0. Sell Signal: The strategy generates a sell signal when the following condition is met: The "maMedium" crosses above the "maShort." The volume is greater than 0. ROI and Stoploss: The minimal return on investment (ROI) for the strategy is set to 0.5, meaning that the strategy aims for a 0.5% gain on each trade. The stoploss is set at -0.2, indicating that if the trade's value drops by 0.2%, it will be sold. Timeframe and Trailing Stoploss: The strategy operates on a 4-hour timeframe. Trailing stoploss is disabled in this strategy. Note: This strategy is not optimized for performance and is primarily intended as a proof of concept.

Three bands are generated: "bb_lowerband," "bb_upperband," and "bb_middleband." Simple Moving Average: Another indicator, the simple moving average (SMA), is calculated with a time period of 50 on a resampled version of the dataframe.

Buy Signal: The strategy generates a buy signal when the following conditions are met: The "maShort" crosses above the "maMedium." The closing price is higher than the resampled SMA.

The volume is greater than 0. Sell Signal: The strategy generates a sell signal when the following condition is met: The "maMedium" crosses above the "maShort." The volume is greater than 0. ROI and Stoploss: The minimal return on investment (ROI) for the strategy is set to 0.5, meaning that the strategy aims for a 0.5% gain on each trade. The stoploss is set at -0.2, indicating that if the trade's value drops by 0.2%, it will be sold. Timeframe and Trailing Stoploss: The strategy operates on a 4-hour timeframe. Trailing stoploss is disabled in this strategy. Note: This strategy is not optimized for performance and is primarily intended as a proof of concept.

stoploss: -0.2 timeframe: 4h hash(sha256): 4a3d3cd38f68e18c6ddf4a94b85cb0640c7aeddce1d7f90462b053b605b774cf

Was not able to fetch indicators from Strategyfile.

last change: 2023-06-30 12:21:45