You will be redirected to the original Strategy in 15 seconds.

The RalliV1 strategy is a trading strategy implemented as a class in Python. It is designed for backtesting purposes on a trading website. Here's a short description of what the strategy does:

populate_indicators method:

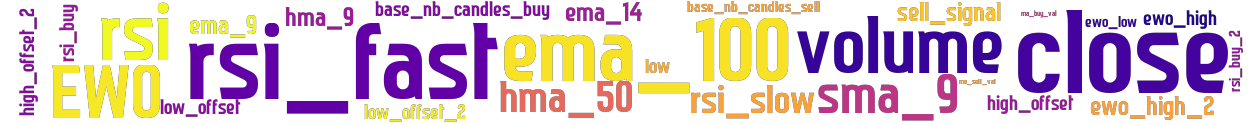

Calculates various indicators such as exponential moving averages (EMA), Hull moving averages (HMA), simple moving averages (SMA), and the Elder's Force Index (EWO) based on the provided candlestick data.

These indicators include moving averages with different time periods, RSI (Relative Strength Index), and other technical indicators.

populate_buy_trend method: Defines a set of conditions for determining when to buy.

Checks multiple conditions involving the calculated indicators, such as the values of moving averages, RSI, EWO, and volume. If any of the conditions are met, it marks the corresponding row in the DataFrame as a "buy" signal. populate_sell_trend method: Defines a set of conditions for determining when to sell. Checks conditions based on the values of indicators like HMA, EMA, SMA, RSI, and volume. If any of the conditions are met, it marks the corresponding row in the DataFrame as a "sell" signal. Overall, the strategy combines various technical indicators to generate buy and sell signals based on predefined conditions. The implementation considers different moving averages, RSI values, and other indicators to make trading decisions.

These indicators include moving averages with different time periods, RSI (Relative Strength Index), and other technical indicators.

populate_buy_trend method: Defines a set of conditions for determining when to buy.

Checks multiple conditions involving the calculated indicators, such as the values of moving averages, RSI, EWO, and volume. If any of the conditions are met, it marks the corresponding row in the DataFrame as a "buy" signal. populate_sell_trend method: Defines a set of conditions for determining when to sell. Checks conditions based on the values of indicators like HMA, EMA, SMA, RSI, and volume. If any of the conditions are met, it marks the corresponding row in the DataFrame as a "sell" signal. Overall, the strategy combines various technical indicators to generate buy and sell signals based on predefined conditions. The implementation considers different moving averages, RSI values, and other indicators to make trading decisions.

stoploss: -0.189 timeframe: 5m hash(sha256): 735fb2919d4d499ad2760f6ea48d3ac4c50a6e6361a79895724ea290f33f64d1

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-11 17:32:31