Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "Obelisk_Ichimoku_ZEMA_v1" strategy is a backtesting strategy that utilizes the Ichimoku Cloud indicator and a ZEMA (Zero Lag Exponential Moving Average) indicator. Here's a breakdown of what the strategy does:

In the "populate_indicators" method:

It checks if the timeframe is set to 5 minutes and raises an assertion error if not. If the timeframe matches the informative timeframe, it applies slow timeframe indicators to the given dataframe and metadata.

Otherwise, it ensures that a DataProvider is available for multiple timeframes and retrieves the informative dataframe.

The informative dataframe is also processed with slow timeframe indicators.

The informative and main dataframes are merged based on the timeframe and informative timeframe, with forward filling of missing values. Certain columns are skipped during the merge. Fast timeframe indicators are applied to the main dataframe. The updated dataframe is returned. In the "populate_buy_trend" method: A buy trend is populated based on certain conditions: The Ichimoku Cloud is considered valid. The market is not in a bearish trend. The closing price is below a calculated ZEMA value multiplied by a low offset value. The "buy" column in the dataframe is set to 1 for the matching rows. The updated dataframe is returned. In the "populate_sell_trend" method: A sell trend is populated based on the condition: The closing price is above a calculated ZEMA value multiplied by a high offset value. The "sell" column in the dataframe is set to 1 for the matching rows. The updated dataframe is returned. In the "synchronize_portfolio" method (not shown in the code snippet): This method determines whether to sell an asset in the portfolio based on the sell reason, current time, and other parameters. If the sell reason is 'roi' (return on investment) and the latest analyzed dataframe indicates a positive trend, it returns False (indicating not to sell). The strategy also includes a plot configuration dictionary that specifies the colors for various indicators and subplots used in visualizing the backtesting results. Overall, the strategy combines the Ichimoku Cloud indicator, ZEMA indicator, and specific buy/sell conditions to generate trading signals for backtesting purposes.

Otherwise, it ensures that a DataProvider is available for multiple timeframes and retrieves the informative dataframe.

The informative dataframe is also processed with slow timeframe indicators.

The informative and main dataframes are merged based on the timeframe and informative timeframe, with forward filling of missing values. Certain columns are skipped during the merge. Fast timeframe indicators are applied to the main dataframe. The updated dataframe is returned. In the "populate_buy_trend" method: A buy trend is populated based on certain conditions: The Ichimoku Cloud is considered valid. The market is not in a bearish trend. The closing price is below a calculated ZEMA value multiplied by a low offset value. The "buy" column in the dataframe is set to 1 for the matching rows. The updated dataframe is returned. In the "populate_sell_trend" method: A sell trend is populated based on the condition: The closing price is above a calculated ZEMA value multiplied by a high offset value. The "sell" column in the dataframe is set to 1 for the matching rows. The updated dataframe is returned. In the "synchronize_portfolio" method (not shown in the code snippet): This method determines whether to sell an asset in the portfolio based on the sell reason, current time, and other parameters. If the sell reason is 'roi' (return on investment) and the latest analyzed dataframe indicates a positive trend, it returns False (indicating not to sell). The strategy also includes a plot configuration dictionary that specifies the colors for various indicators and subplots used in visualizing the backtesting results. Overall, the strategy combines the Ichimoku Cloud indicator, ZEMA indicator, and specific buy/sell conditions to generate trading signals for backtesting purposes.

startup_candle_count : 500 Recursive Analysis found no issues while using 500 startup_candle_count

Biased Indicators

chikou_span

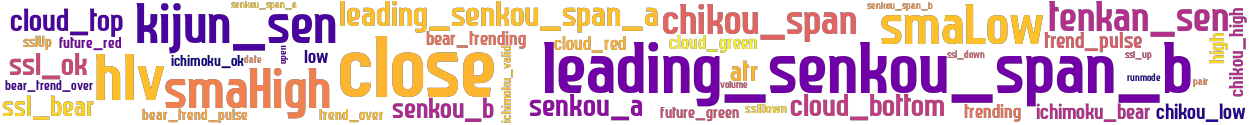

stoploss: -0.294 timeframe: 5m hash(sha256): 275da95e2e4afd2c6bebf10ce7897cafc667eb10615f70a685e6b132858c02b1 indicators: ichimoku_ok close ichimoku_bear senkou_a zema trending tenkan_sen trend_over cloud_red ssl_bear smaHigh ssl_ok chikou_high bear_trend_pulse leading_senkou_span_a bear_trend_over senkou_a senkou_b ssl_up sslDown future_red date open high low close volume leading_senkou_span_b hlv trend_pulse smaLow ichimoku_valid high sslUp kijun_sen senkou_span_a chikou_span senkou_b cloud_bottom ssl_down senkou_span_b atr zema_sell zema_buy cloud_green bear_trending zema_len runmode low cloud_top future_green c

Similar Strategies: (based on used indicators)

Strategy: Obelisk_Ichimoku_ZEMA_v1_555, Similarity Score: 98.11%

Strategy: TestStrat, Similarity Score: 96.23%

Strategy: TestStrat01, Similarity Score: 96.23%

Strategy: s05lchimoku_zema_hyper, Similarity Score: 84.91%

Strategy: lchimoku_zema_hyper, Similarity Score: 81.13%

Strategy: s10lchimoku_zema_hyper, Similarity Score: 79.25%

Strategy: teststrat05, Similarity Score: 79.25%

Strategy: Ichi_SMA_v1, Similarity Score: 75.47%

Strategy: Obelisk_Ichimoku_Slow_v1_3_338, Similarity Score: 75.47%

Strategy: Obelisk_Ichimoku_Slow_v1_2, Similarity Score: 73.58%

Strategy: Obelisk_Ichimoku_Slow_v1_3, Similarity Score: 73.58%

last change: 2023-07-05 11:34:09