Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NostalgiaForInfinityX2 strategy is a trading strategy implemented as a class that inherits from the IStrategy interface. It consists of several methods that perform different tasks:

populate_indicators: This method populates informative indicators related to Bitcoin (BTC) and merges them with the base timeframe data. It uses different timeframes for BTC information and other indicators.

The purpose is to gather relevant information for analysis.

populate_entry_trend: This method determines the conditions for entering a trade.

It checks various parameters and indicators such as moving averages (ema), Bollinger Bands (bb), and volume. If the specified conditions are met, an entry tag is assigned to the data. populate_exit_trend: This method determines the conditions for exiting a trade. Currently, it initializes exit conditions but does not provide any specific logic for exiting trades. should_long_entry: This method checks if a long entry should be made based on the provided rate, time in force, and entry tag. It compares the rate with the closing price from the analyzed dataframe and applies slippage calculations to decide if the entry should be allowed. should_long_exit: This method determines if a long exit should be made based on the provided rate, time in force, exit reason, and other parameters. It updates the profit target cache accordingly. Overall, the NostalgiaForInfinityX2 strategy involves populating indicators, defining conditions for entry and exit, and making decisions based on the provided data to determine if trades should be executed. Please note that the provided code is partial and may require additional implementation or modifications to function properly in a backtesting website.

The purpose is to gather relevant information for analysis.

populate_entry_trend: This method determines the conditions for entering a trade.

It checks various parameters and indicators such as moving averages (ema), Bollinger Bands (bb), and volume. If the specified conditions are met, an entry tag is assigned to the data. populate_exit_trend: This method determines the conditions for exiting a trade. Currently, it initializes exit conditions but does not provide any specific logic for exiting trades. should_long_entry: This method checks if a long entry should be made based on the provided rate, time in force, and entry tag. It compares the rate with the closing price from the analyzed dataframe and applies slippage calculations to decide if the entry should be allowed. should_long_exit: This method determines if a long exit should be made based on the provided rate, time in force, exit reason, and other parameters. It updates the profit target cache accordingly. Overall, the NostalgiaForInfinityX2 strategy involves populating indicators, defining conditions for entry and exit, and making decisions based on the provided data to determine if trades should be executed. Please note that the provided code is partial and may require additional implementation or modifications to function properly in a backtesting website.

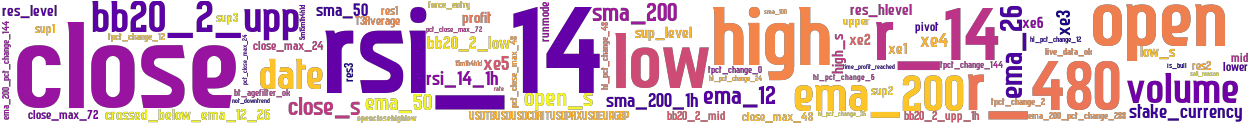

stoploss: -0.99 timeframe: 5m hash(sha256): e79854feb656b2e1510c0ade3eecf75ce15e74d3ccdec035542b1b54cb21df2b indicators: sma_200_1h upper close res1 low_s pct_close_max_24 profit volume xe1 sma_50 hl_pct_change_6 rsi_14 high tpct_change_2 r_480 crossed_below_ema_12_26 xe6 openclosehighlow bb20_2_mid ema_12 tpct_change_12 T3Average runmode ema_26 res_level close_max_48 pct_close_max_72 pivot USDTBUSDUSDCDAITUSDPAXUSDEURGBP bb20_2_upp_1h live_data_ok 5m15m1h4h1d bb20_2_low hl_pct_change_12 sell_reason tpct_change_0 ema_200_pct_change_144 lower stake_currency high_s open_s close_s sup_level xe3 sma_100 date open high

Similar Strategies: (based on used indicators)

Strategy: NostalgiaForInfinityX2_9, Similarity Score: 97.96%

Strategy: NostalgiaForInfinityX2_5, Similarity Score: 83.67%

Strategy: NostalgiaForInfinityX2_6, Similarity Score: 83.67%

Strategy: NostalgiaForInfinityX2_7, Similarity Score: 83.67%

Strategy: NostalgiaForInfinityX2_10, Similarity Score: 77.55%

last change: 2025-08-04 07:38:03