Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NostalgiaForInfinityNext strategy is a backtesting strategy that involves populating indicators and defining buy conditions for trading. Here's a breakdown of its functionality:

Populating Indicators: The strategy populates various indicators based on different timeframes. It retrieves BTC-related information for informative timeframes (5 minutes and 1 hour) and merges it with the main dataframe.

Indicators like EMAs (Exponential Moving Averages), SMAs (Simple Moving Averages), RSI (Relative Strength Index), MFI (Money Flow Index), and more are calculated and added to the dataframe.

Informative Timeframe: If an informative timeframe is specified, additional indicators are calculated based on that timeframe and merged with the main dataframe.

Resampling to Another Timeframe: If a resampling timeframe is specified, the main dataframe is resampled to that timeframe, and additional indicators are calculated and merged accordingly. Indicators for the Normal Timeframe: Indicators specific to the normal timeframe (5 minutes) are calculated and added to the dataframe. Populating Buy Trend: This step defines the conditions for entering a buy position. It iterates through different buy protection parameters and checks various conditions based on those parameters, including EMAs, close prices, SMA trends, safe dips, safe pumps, BTC downtrend, and more. The buy conditions are defined using logic expressions based on different indicators such as RSI, MFI, BB (Bollinger Bands), volume, and CTI (Composite Trading Index). The strategy combines multiple indicators and conditions to determine optimal buy positions for trading based on the provided parameters.

Indicators like EMAs (Exponential Moving Averages), SMAs (Simple Moving Averages), RSI (Relative Strength Index), MFI (Money Flow Index), and more are calculated and added to the dataframe.

Informative Timeframe: If an informative timeframe is specified, additional indicators are calculated based on that timeframe and merged with the main dataframe.

Resampling to Another Timeframe: If a resampling timeframe is specified, the main dataframe is resampled to that timeframe, and additional indicators are calculated and merged accordingly. Indicators for the Normal Timeframe: Indicators specific to the normal timeframe (5 minutes) are calculated and added to the dataframe. Populating Buy Trend: This step defines the conditions for entering a buy position. It iterates through different buy protection parameters and checks various conditions based on those parameters, including EMAs, close prices, SMA trends, safe dips, safe pumps, BTC downtrend, and more. The buy conditions are defined using logic expressions based on different indicators such as RSI, MFI, BB (Bollinger Bands), volume, and CTI (Composite Trading Index). The strategy combines multiple indicators and conditions to determine optimal buy positions for trading based on the provided parameters.

Biased Indicators

chikou_span_1h

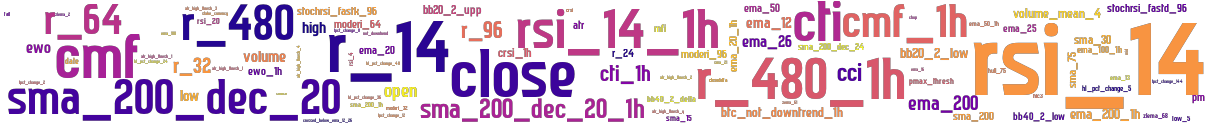

stoploss: -0.5 timeframe: 5m hash(sha256): 630dde5975c466494dced05284b7f3fd0d51f4fea7dc57284e00e74202bb5268 indicators: sma_200_1h upper safe_pump_type safe_pump_24_30 leading_senkou_span_b_1h close ema_15 senkou_a sell_pump_36_2 sma_5 sell_pump_24_1_1h res1 safe_pump_period ema_25 ema_200_1h ewo 39 tenkan_sen safe_dump_50 sma200_rising_val r_480_1h safe_pump_24_100 volume rsi_4 sma_200_dec_20 leading_senkou_span_a senkou_a senkou_b safe_pump_24_120 safe_dips_70 ema_20 source safe_pump_48_30 hl_pct_change_48_1h oc_pct_change_48 rsi_14 sell_pump_48_1_1h high hl_pct_change_36_1h tpct_change_2 safe_dips_30 r_480 cci

Similar Strategies: (based on used indicators)

Strategy: coba, Similarity Score: 93.18%

Strategy: NostalgiaForInfinityNext_ChangeToTower_V5_2, Similarity Score: 90.91%

Strategy: NostalgiaForInfinityNext_ChangeToTower_V5_3, Similarity Score: 90.91%

Strategy: NFI7_7_2, Similarity Score: 88.64%

Strategy: NFi_772_KC, Similarity Score: 88.64%

Strategy: NFi_772_KC, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext772, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_0, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_105, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_75, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_772SLMod, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_98, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_v772, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityV7_258, Similarity Score: 88.64%

Strategy: NostalgiaForInfinityNext_818, Similarity Score: 86.36%

Strategy: NostalgiaForInfinityNext_ChangeToTower_V6, Similarity Score: 84.09%

Strategy: NostalgiaForInfinity772martinsk3, Similarity Score: 81.82%

Strategy: NostalgiaForInfinityNext, Similarity Score: 79.55%

Strategy: NostalgiaForInfinityNext7_15_5, Similarity Score: 79.55%

Strategy: NostalgiaForInfinityNext_272, Similarity Score: 79.55%

Strategy: NostalgiaForInfinityNext_548, Similarity Score: 79.55%

Strategy: NostalgiaForInfinityNext_744, Similarity Score: 79.55%

last change: 2023-10-02 13:10:45