You will be redirected to the original Strategy in 15 seconds.

The NASOSRv6_private_Reinuvader_20211121 strategy is a trading strategy that involves the following steps:

Populating Indicators: The strategy starts by populating various indicators based on the provided DataFrame and metadata. These indicators include informative_1h indicators, normal time frame indicators, RSI (Relative Strength Index) for different periods, linear regression angle, moving averages, MACD (Moving Average Convergence Divergence), EWO (Elliott Wave Oscillator), Heikin Ashi candlestick data, Bollinger Bands, and more. Buy Trend Conditions: Next, the strategy defines conditions for buying assets.

It checks for multiple criteria, including the rolling maximum of the 1-hour close price, the trendline value, the relative price, RSI values, EWO values, and volume.

If these conditions are met, the strategy sets the 'buy' and 'buy_tag' values to indicate a buy signal.

Additional Buy Conditions: The strategy includes additional buy conditions with variations in parameters such as low offset, EWO thresholds, RSI thresholds, and moving averages. These conditions further refine the buy signals. It's important to note that this is a simplified description based on the provided code snippets, and there might be additional details or context required to fully understand and implement the strategy.

It checks for multiple criteria, including the rolling maximum of the 1-hour close price, the trendline value, the relative price, RSI values, EWO values, and volume.

If these conditions are met, the strategy sets the 'buy' and 'buy_tag' values to indicate a buy signal.

Additional Buy Conditions: The strategy includes additional buy conditions with variations in parameters such as low offset, EWO thresholds, RSI thresholds, and moving averages. These conditions further refine the buy signals. It's important to note that this is a simplified description based on the provided code snippets, and there might be additional details or context required to fully understand and implement the strategy.

startup_candle_count : 400 rsi_36: -0.001% rsi_72: -0.190% rsi_84: -0.369% rsi_112: -0.975% EWO: 1.969%

Traceback (most recent call last): File "/freqtrade/freqtrade/strategy/strategy_wrapper.py", line 27, in wrapper return f(*args, **kwargs) ^^^^^^^^^^^^^^^^^^ File "/freqtrade/user_data/strategies/NASOSRv6_private_Reinuvader_20211121.py", line 220, in confirm_trade_exit trade.sell_reason = f"{trade.buy_tag}->{sell_reason}" ^^^^^^^^^^^^^^^^^ AttributeError: property 'sell_reason' of 'LocalTrade' object has no setter

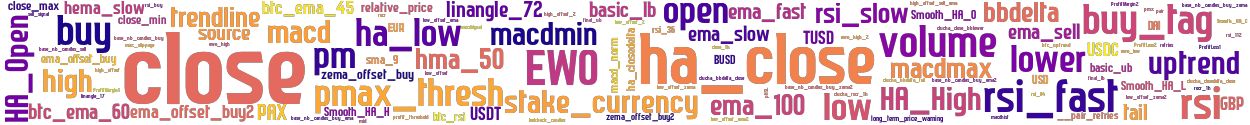

stoploss: -0.15 timeframe: 5m hash(sha256): b610eebf71e852938e606151543beb9845fe192034fcf79698e17bddf9b7cc75 indicators: rsi_buy base_nb_candles_buy_ema ProfitMargin1 high_offset_2 close rsi_36 HA_Close macdmin sell_signal rsi_fast HA_High volume base_nb_candles_buy_zema relative_price ProfitLoss2 low_offset retries source ha_closedelta clucha_bbdelta_close high pHSL final_ub lookback_candles ha_high pm ema_slow long_term_price_warning Smooth_HA_C basic_ub HA_OpenHA_Closelow ewo_high ewo_low USDTBUSDUSDCDAITUSDPAXUSDEURGBP bbdelta HA_OpenHA_Closehigh zema_offset_buy ma_sell_val Smooth_HA_L base_nb_candles_buy_zema

Similar Strategies: (based on used indicators)

Strategy: NASOSRv6_private_Reinuvader_20211121_3, Similarity Score: 97.56%

last change: 2024-02-04 00:07:37