The FreqGymNormalized strategy is a trading strategy that aims to backtest various trading strategies using technical analysis (TA) indicators. The strategy consists of three main methods: populate_indicators, populate_buy_trend, and populate_sell_trend. In the populate_indicators method, the strategy calculates multiple TA indicators and adds them to the given DataFrame.

These indicators include: PLUS_DI: Normalized value of the Plus Directional Indicator.

MINUS_DI: Normalized value of the Minus Directional Indicator.

UO: Normalized value of the Ultimate Oscillator. HT_SINE: Normalized values of the Hilbert Transform - Sine and Hilbert Transform - Lead Sine. BOP: Normalized value of the Balance of Power. STOCH: Normalized values of the Stochastic Oscillator (Slow %K and Slow %D). STOCHF: Normalized value of the Fast Stochastic Oscillator %K. Bollinger Bands: Two sets of Bollinger Bands (with different standard deviations) indicating whether the lower band is greater than the closing price. ADX: Normalized values of the Average Directional Index for different time periods. AROON: Normalized values of the Aroon Up, Aroon Down, and Aroon Oscillator for different time periods. CMO: Normalized value of the Chande Momentum Oscillator for different time periods. DX: Normalized value of the Directional Movement Index for different time periods. MFI: Normalized value of the Money Flow Index for different time periods. WILLR: Normalized value of the Williams %R for different time periods. RSI: Normalized value of the Relative Strength Index for different time periods. Fisher RSI: Normalized value of the Fisher Transform of RSI for different time periods. STOCHRSI: Normalized values of the Stochastic RSI (Fast %K and Fast %D). LINEARREG_ANGLE: Normalized value of the Linear Regression Angle for different time periods. After calculating these indicators, the method returns the DataFrame with all the mandatory indicators. In the populate_buy_trend method, the strategy generates a buy signal based on the TA indicators calculated in the previous step. It uses an RL (Reinforcement Learning) model to predict the action, and the buy signal is set to 1 if the predicted action is a buy. In the populate_sell_trend method, similar to the populate_buy_trend method, the strategy generates a sell signal based on the TA indicators and the RL model's predictions. The sell signal is set to 1 if the predicted action is a sell. Overall, this strategy aims to populate a DataFrame with TA indicators, generate buy and sell signals based on those indicators using an RL model, and provide the backtesting capability for various trading strategies.

These indicators include: PLUS_DI: Normalized value of the Plus Directional Indicator.

MINUS_DI: Normalized value of the Minus Directional Indicator.

UO: Normalized value of the Ultimate Oscillator. HT_SINE: Normalized values of the Hilbert Transform - Sine and Hilbert Transform - Lead Sine. BOP: Normalized value of the Balance of Power. STOCH: Normalized values of the Stochastic Oscillator (Slow %K and Slow %D). STOCHF: Normalized value of the Fast Stochastic Oscillator %K. Bollinger Bands: Two sets of Bollinger Bands (with different standard deviations) indicating whether the lower band is greater than the closing price. ADX: Normalized values of the Average Directional Index for different time periods. AROON: Normalized values of the Aroon Up, Aroon Down, and Aroon Oscillator for different time periods. CMO: Normalized value of the Chande Momentum Oscillator for different time periods. DX: Normalized value of the Directional Movement Index for different time periods. MFI: Normalized value of the Money Flow Index for different time periods. WILLR: Normalized value of the Williams %R for different time periods. RSI: Normalized value of the Relative Strength Index for different time periods. Fisher RSI: Normalized value of the Fisher Transform of RSI for different time periods. STOCHRSI: Normalized values of the Stochastic RSI (Fast %K and Fast %D). LINEARREG_ANGLE: Normalized value of the Linear Regression Angle for different time periods. After calculating these indicators, the method returns the DataFrame with all the mandatory indicators. In the populate_buy_trend method, the strategy generates a buy signal based on the TA indicators calculated in the previous step. It uses an RL (Reinforcement Learning) model to predict the action, and the buy signal is set to 1 if the predicted action is a buy. In the populate_sell_trend method, similar to the populate_buy_trend method, the strategy generates a sell signal based on the TA indicators and the RL model's predictions. The sell signal is set to 1 if the predicted action is a sell. Overall, this strategy aims to populate a DataFrame with TA indicators, generate buy and sell signals based on those indicators using an RL model, and provide the backtesting capability for various trading strategies.

Unable to parse Traceback (Logfile Exceeded Limit)

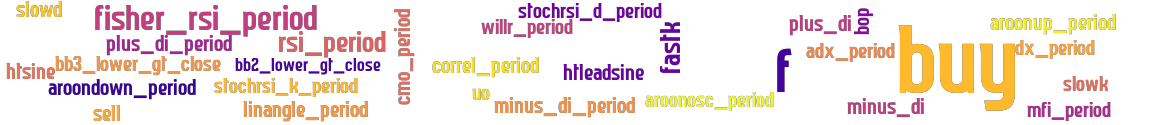

stoploss: -0.99 timeframe: 5m hash(sha256): ba649dbb83a49a597a1dc9bd57b42329964d0016aa2ae4ee27aae38c1275eedf indicators: sell htsine f"aroondown_period uo f"aroonosc_period f"dx_period fastk htleadsine f"linangle_period slowd f"rsi_period bb3_lower_gt_close plus_di f"mfi_period f"plus_di_period slowk bb2_lower_gt_close f"adx_period f"willr_period buy f"stochrsi_k_period f"aroonup_period f"stochrsi_d_period minus_di f"cmo_period f"minus_di_period bop f"fisher_rsi_period

Similar Strategies: (based on used indicators)

Strategy: FreqGym_normalized_0, Similarity Score: 96.55%

Strategy: FreqGym_normalized, Similarity Score: 93.1%

last change: 2025-01-13 16:46:01