Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The Fakebuy strategy is a trading strategy implemented as a class in Python. It extends the IStrategy class, indicating that it is a specific type of strategy. Here's a breakdown of what the strategy does:

populate_indicators method:

Initializes trade-related data for the specified trading pair.

If the strategy is running in live or dry run mode: Retrieves the active trade and other open trades for the trading pair.

Adjusts the minimum and maximum rates for the active trade based on the current rate.

Calculates various trade-related information such as current profit, peak profit, and average profit for other trades. Populates various indicators in the input dataframe object, such as Bollinger Bands, RMI (Relative Momentum Index), ROCR (Rate of Change Ratio), EMA (Exponential Moving Average), and others. Merges additional informative data from a different timeframe into the dataframe. populate_buy_trend method: Retrieves buy parameters specific to the strategy. Retrieves trade-related data for the specified trading pair. Defines conditions for potential buy signals based on the strategy's rules: If there is an active trade with a peak profit greater than 0: The current profit should be greater than 80% of the peak profit. The RMI (Relative Momentum Index) indicator should be greater than or equal to 60. Otherwise: Sets conditions for a "fake buy" signal based on various indicators such as ROCR, Bollinger Bands, close price, tail, EMA, and volume. Marks the corresponding rows in the dataframe where the conditions for a buy signal are met. populate_sell_trend method: Retrieves trade-related data for the specified trading pair. Defines conditions for potential sell signals based on the strategy's rules: If there is an active trade: The current profit should be negative but greater than the defined stop loss. The "dn_trend" indicator should be equal to 1. The RMI (Relative Momentum Index) indicator should be less than 50. The volume should be greater than 0. If there are other trades: The average profit of other trades should be greater than or equal to -0.005. If there are no active or other trades: The volume should be less than 0. Marks the corresponding rows in the dataframe where the conditions for a sell signal are met. The strategy includes some custom methods that retrieve the current price from the order book or ticker data for a given trading pair. Additionally, there are examples of price protection and timeout functionality. Please note that the description provided is based on the code snippet you provided. The strategy's full functionality and purpose may depend on additional code or configuration settings outside the given snippet.

If the strategy is running in live or dry run mode: Retrieves the active trade and other open trades for the trading pair.

Adjusts the minimum and maximum rates for the active trade based on the current rate.

Calculates various trade-related information such as current profit, peak profit, and average profit for other trades. Populates various indicators in the input dataframe object, such as Bollinger Bands, RMI (Relative Momentum Index), ROCR (Rate of Change Ratio), EMA (Exponential Moving Average), and others. Merges additional informative data from a different timeframe into the dataframe. populate_buy_trend method: Retrieves buy parameters specific to the strategy. Retrieves trade-related data for the specified trading pair. Defines conditions for potential buy signals based on the strategy's rules: If there is an active trade with a peak profit greater than 0: The current profit should be greater than 80% of the peak profit. The RMI (Relative Momentum Index) indicator should be greater than or equal to 60. Otherwise: Sets conditions for a "fake buy" signal based on various indicators such as ROCR, Bollinger Bands, close price, tail, EMA, and volume. Marks the corresponding rows in the dataframe where the conditions for a buy signal are met. populate_sell_trend method: Retrieves trade-related data for the specified trading pair. Defines conditions for potential sell signals based on the strategy's rules: If there is an active trade: The current profit should be negative but greater than the defined stop loss. The "dn_trend" indicator should be equal to 1. The RMI (Relative Momentum Index) indicator should be less than 50. The volume should be greater than 0. If there are other trades: The average profit of other trades should be greater than or equal to -0.005. If there are no active or other trades: The volume should be less than 0. Marks the corresponding rows in the dataframe where the conditions for a sell signal are met. The strategy includes some custom methods that retrieve the current price from the order book or ticker data for a given trading pair. Additionally, there are examples of price protection and timeout functionality. Please note that the description provided is based on the code snippet you provided. The strategy's full functionality and purpose may depend on additional code or configuration settings outside the given snippet.

startup_candle_count : 168 ema-slow: -0.002%

Unable to parse Traceback (Logfile Exceeded Limit)

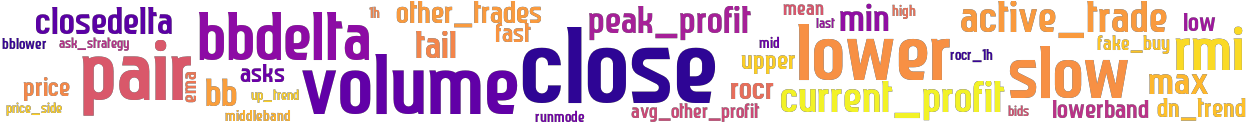

stoploss: -0.085 timeframe: 5m hash(sha256): 5e07dd92c40c78d793d6556a8526f801d54ba5cc4d4014fbe752c06b9f5e0452 indicators: rocr_1h closedeltaclose closebblower active_trade upper asks rmifast close tail bbdelta other_trades emaslow avg_other_profit volume price_side bbdeltaclose closedelta rocr max ask_strategy high bids mid bbdeltatail current_profit rmislow up_trend price fake_buy min dn_trend lower bblowerband rocr1h peak_profit volumemeanslow bbmiddleband runmode last low

No similar strategies found. (based on used indicators)

last change: 2025-06-01 23:50:47