You will be redirected to the original Strategy in 15 seconds.

The strategy implemented in this code is called "Elliotv8." It is a backtesting trading strategy that aims to generate buy and sell signals based on various indicators and conditions. Here is a breakdown of how the strategy works:

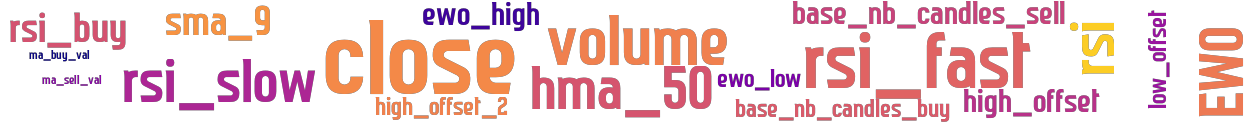

Indicators:

Exponential Moving Averages (EMA): Calculates EMA values for different time periods. Hull Moving Average (HMA): Calculates the HMA value for a window of 50.

Elliott Wave Oscillator (EWO): Calculates the EWO value based on EMA values.

Relative Strength Index (RSI): Calculates the RSI values for different time periods.

Buy Signal: The strategy generates a buy signal when the following conditions are met: RSI Fast is below 35. Close price is below the buy EMA multiplied by a low offset value. EWO value is above a specified high threshold. RSI value is below a specified RSI buy threshold. Volume is greater than 0. Close price is below the sell EMA multiplied by a high offset value. Sell Signal: The strategy generates a sell signal when the following conditions are met: Close price is above the Hull Moving Average (HMA) with a specific period (50). Close price is above the sell EMA multiplied by a high offset_2 value. RSI value is above 50. Volume is greater than 0. RSI Fast is greater than RSI Slow. Other Parameters and Settings: ROI table: Specifies the return on investment percentages at different time intervals. Stoploss: Sets the stop loss value at -0.32. Trailing Stop: Enables trailing stop functionality. Sell Signal Settings: Determines whether to use sell signals, consider only profit, and sets a sell profit offset. Order Time in Force: Specifies the time in force for buy and sell orders. Timeframe: Sets the optimal timeframe for the strategy (5 minutes). Candle Count: Specifies the number of startup candles and whether to process only new candles. Overall, the strategy combines multiple indicators and conditions to identify potential buying and selling opportunities in the market. It utilizes moving averages, oscillators, and volume to make informed trading decisions.

Elliott Wave Oscillator (EWO): Calculates the EWO value based on EMA values.

Relative Strength Index (RSI): Calculates the RSI values for different time periods.

Buy Signal: The strategy generates a buy signal when the following conditions are met: RSI Fast is below 35. Close price is below the buy EMA multiplied by a low offset value. EWO value is above a specified high threshold. RSI value is below a specified RSI buy threshold. Volume is greater than 0. Close price is below the sell EMA multiplied by a high offset value. Sell Signal: The strategy generates a sell signal when the following conditions are met: Close price is above the Hull Moving Average (HMA) with a specific period (50). Close price is above the sell EMA multiplied by a high offset_2 value. RSI value is above 50. Volume is greater than 0. RSI Fast is greater than RSI Slow. Other Parameters and Settings: ROI table: Specifies the return on investment percentages at different time intervals. Stoploss: Sets the stop loss value at -0.32. Trailing Stop: Enables trailing stop functionality. Sell Signal Settings: Determines whether to use sell signals, consider only profit, and sets a sell profit offset. Order Time in Force: Specifies the time in force for buy and sell orders. Timeframe: Sets the optimal timeframe for the strategy (5 minutes). Candle Count: Specifies the number of startup candles and whether to process only new candles. Overall, the strategy combines multiple indicators and conditions to identify potential buying and selling opportunities in the market. It utilizes moving averages, oscillators, and volume to make informed trading decisions.

stoploss: -0.32 timeframe: 5m hash(sha256): 623521c1ab642c601a76b755edf84dcede35817a66b1d5228089959bbee067b2

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08