Strategy: ElliotV8_original_ichiv2_2

Downloaded: 20230109

Stoploss: -0.2

Downloaded: 20230109

Stoploss: -0.2

| Strategy | Buys | Avg Prof% | Cum Prof% | Tot Prof% | Tot Profit% | Avg Duration | Win | Draw | Loss | Win% | DD Stake | DD% | Time | Stake | Exchange | Stoploss | Sharpe | Sortino | Calmar | Month | Stats | sha256 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ElliotV8_original_ichiv2_2 | 80 | 1.16 | 92.48 | 277.732 | 27.77 | 3:14:00 | 69 | 0 | 11 | 86.2 | 53.248 | 4.09 | 58.4 | USDT | binance | 9.72 | 9.72 | 42.96 | 1874.67 | 202201 | |||

| ElliotV8_original_ichiv2_2 | 74 | 0.51 | 37.98 | 114.042 | 11.4 | 5:15:00 | 61 | 0 | 13 | 82.4 | 155.736 | 13.55 | 65.4 | USDT | binance | 2.19 | 2.19 | 3.35 | 20.19 | 202202 | |||

| ElliotV8_original_ichiv2_2 | 137 | 0.27 | 36.85 | 110.656 | 11.07 | 4:39:00 | 105 | 0 | 32 | 76.6 | 112.563 | 9.48 | 83.8 | USDT | binance | 1.07 | 1.07 | 1.8 | 7.06 | 202203 | |||

| ElliotV8_original_ichiv2_2 | 72 | -0.22 | -16.09 | -48.3167 | -4.83 | 4:07:00 | 53 | 0 | 19 | 73.6 | 87.722 | 8.55 | 59.6 | USDT | binance | -1.3 | -1.3 | -1.6 | -7.37 | 202204 | |||

| ElliotV8_original_ichiv2_2 | 166 | -0.27 | -44.18 | -132.663 | -13.27 | 2:52:00 | 123 | 0 | 43 | 74.1 | 304.431 | 28.99 | 73.3 | USDT | binance | -1.6 | -1.6 | -1.94 | -2.88 | 202205 | |||

| ElliotV8_original_ichiv2_2 | 141 | 0.24 | 33.58 | 100.826 | 10.08 | 3:10:00 | 110 | 0 | 31 | 78 | 169.086 | 16.28 | 71.3 | USDT | binance | 2.92 | 2.92 | 6.12 | 73.15 | 202206 | |||

| ElliotV8_original_ichiv2_2 | 119 | 0.48 | 57.02 | 171.222 | 17.12 | 5:09:00 | 92 | 0 | 27 | 77.3 | 91.357 | 7.24 | 82.1 | USDT | binance | 3.47 | 3.47 | 5.8 | 90.87 | 202207 | |||

| ElliotV8_original_ichiv2_2 | 49 | 0.05 | 2.6 | 7.79483 | 0.78 | 8:34:00 | 36 | 0 | 13 | 73.5 | 97.068 | 8.79 | 67.4 | USDT | binance | -1.04 | -1.04 | -1.45 | -4.56 | 202208 | |||

| ElliotV8_original_ichiv2_2 | 29 | 0.25 | 7.12 | 21.3667 | 2.14 | 5:28:00 | 22 | 0 | 7 | 75.9 | 57.35 | 5.33 | 50.2 | USDT | binance | 0.74 | 0.74 | 1.14 | 6.19 | 202209 | |||

| ElliotV8_original_ichiv2_2 | 45 | 0.69 | 31.26 | 93.8872 | 9.39 | 4:28:00 | 36 | 0 | 9 | 80 | 40.894 | 3.66 | 53.1 | USDT | binance | 3.12 | 3.12 | 9.72 | 62.56 | 202210 | |||

| ElliotV8_original_ichiv2_2 | 179 | 0.28 | 50.22 | 150.822 | 15.08 | 3:04:00 | 141 | 0 | 38 | 78.8 | 156.842 | 13.92 | 77.3 | USDT | binance | 2.21 | 2.21 | 3.86 | 44.41 | 202211 | |||

| ElliotV8_original_ichiv2_2 | 14 | 0.44 | 6.13 | 18.4007 | 1.84 | 7:18:00 | 11 | 0 | 3 | 78.6 | 33.547 | 3.31 | 47.2 | USDT | binance | 0.32 | 0.32 | 0.48 | 1.64 | 202212 | |||

| ElliotV8_original_ichiv2_2 | 103 | 0.63 | 64.45 | 193.542 | 19.35 | 6:28:00 | 82 | 0 | 21 | 79.6 | 74.075 | 6.04 | 85.7 | USDT | binance | 4.52 | 4.52 | 9.25 | 196.86 | 202301 | |||

| ElliotV8_original_ichiv2_2 | 126 | 0.16 | 19.78 | 59.4111 | 4.57 | 5:04:00 | 94 | 0 | 32 | 74.6 | 98.114 | 6.76 | 82.4 | USDT | binance | 3.52 | 3.52 | 7.08 | 46.12 | 202302 | |||

| ElliotV8_original_ichiv2_2 | 68 | 0.24 | 16.32 | 48.9781 | 3.77 | 5:06:00 | 51 | 0 | 17 | 75 | 73.28 | 5.42 | 64.7 | USDT | binance | 2.7 | 2.7 | 8.74 | 42.88 | 202303 | |||

| ElliotV8_original_ichiv2_2 | 37 | -0.19 | -7.08 | -21.2545 | -1.63 | 4:23:00 | 26 | 0 | 11 | 70.3 | 102.931 | 7.45 | 53 | USDT | binance | -1.08 | -1.08 | -1.92 | -13.98 | 202304 | |||

| ElliotV8_original_ichiv2_2 | 22 | 1.27 | 27.87 | 83.6794 | 6.44 | 6:16:00 | 18 | 0 | 4 | 81.8 | 17.538 | 1.31 | 49.8 | USDT | binance | 5.9 | 5.9 | 8.46 | 302.06 | 202305 | |||

| ElliotV8_original_ichiv2_2 | 47 | 0.24 | 11.31 | 33.9381 | 2.61 | 3:35:00 | 37 | 0 | 10 | 78.7 | 77.076 | 5.85 | 45.4 | USDT | binance | 1.31 | 1.31 | 1.38 | 28.42 | 202306 | |||

| ElliotV8_original_ichiv2_2 | 63 | 0.38 | 23.65 | 71.0357 | 5.46 | 3:48:00 | 51 | 0 | 12 | 81 | 81.832 | 5.87 | 35.3 | USDT | binance | 3.44 | 3.44 | 4.35 | 59.24 | 202307 | |||

| ElliotV8_original_ichiv2_2 | 32 | 0.48 | 15.38 | 46.1599 | 3.55 | 3:15:00 | 26 | 0 | 6 | 81.2 | 36.15 | 2.69 | 27.2 | USDT | binance | 2.44 | 2.44 | 8.21 | 81.22 | 202308 | |||

| ElliotV8_original_ichiv2_2 | 62 | 0.45 | 28.17 | 84.6037 | 6.51 | 4:37:00 | 49 | 0 | 13 | 79 | 83.244 | 5.68 | 39 | USDT | binance | 4.02 | 4.02 | 4.5 | 75.46 | 202309 | |||

| ElliotV8_original_ichiv2_2 | 50 | 0.64 | 32.06 | 96.2526 | 7.4 | 6:12:00 | 41 | 0 | 9 | 82 | 161.576 | 11.9 | 45.8 | USDT | binance | 5.16 | 5.16 | 5.44 | 38.35 | 202310 | |||

| ElliotV8_original_ichiv2_2 | 190 | 0.4 | 76.7 | 230.21 | 17.71 | 4:10:00 | 155 | 0 | 35 | 81.6 | 147.096 | 10.49 | 82.1 | USDT | binance | 11.24 | 11.24 | 11.66 | 111.21 | 202311 | |||

| ElliotV8_original_ichiv2_2 | 258 | 0.69 | 178.96 | 537.347 | 41.33 | 3:47:00 | 214 | 0 | 44 | 82.9 | 148.382 | 8.11 | 94.5 | USDT | binance | 28.79 | 28.79 | 37.89 | 324.43 | 202312 | |||

| ElliotV8_original_ichiv2_2 | 111 | 0.65 | 71.64 | 215.15 | 16.55 | 3:36:00 | 92 | 0 | 19 | 82.9 | 121.041 | 8.53 | 59.7 | USDT | binance | 10.26 | 10.26 | 10.35 | 123.6 | 202401 | |||

| ElliotV8_original_ichiv2_2 | 138 | 0.62 | 85.94 | 258.037 | 19.85 | 4:50:00 | 109 | 0 | 29 | 79 | 69.431 | 4.9 | 57.5 | USDT | binance | 17.66 | 17.66 | 46.69 | 266.62 | 202402 | |||

| ElliotV8_original_ichiv2_2 | 181 | -0.23 | -40.92 | -122.581 | -9.43 | 6:43:00 | 132 | 0 | 49 | 72.9 | 214.014 | 15.38 | 56.4 | USDT | binance | -5.42 | -5.42 | -6.96 | -39.04 | 202403 | |||

| ElliotV8_original_ichiv2_2 | 79 | -0.02 | -1.9 | -5.65737 | -0.44 | 4:12:00 | 59 | 0 | 20 | 74.7 | 76.97 | 5.86 | 28 | USDT | binance | -0.29 | -0.29 | -0.38 | -4.89 | 202404 | |||

| ElliotV8_original_ichiv2_2 | 61 | 0.67 | 41.12 | 123.478 | 9.5 | 5:07:00 | 48 | 0 | 13 | 78.7 | 53.606 | 3.97 | 31.7 | USDT | binance | 7.54 | 7.54 | 33.42 | 152.3 | 202405 | |||

| ElliotV8_original_ichiv2_2 | 49 | 1.21 | 59.15 | 177.604 | 13.66 | 3:21:00 | 43 | 0 | 6 | 87.8 | 29.766 | 2.19 | 21.5 | USDT | binance | 13.29 | 13.29 | 23.6 | 411.83 | 202406 | |||

| ElliotV8_original_ichiv2_2 | 26 | 0.02 | 0.62 | 1.84333 | 0.14 | 5:22:00 | 20 | 0 | 6 | 76.9 | 41.65 | 3.12 | 21.6 | USDT | binance | 0.1 | 0.1 | 0.25 | 2.9 | 202407 | |||

| ElliotV8_original_ichiv2_2 | 49 | 0.7 | 34.28 | 102.914 | 7.92 | 5:06:00 | 38 | 0 | 11 | 77.6 | 44.231 | 3.37 | 24.1 | USDT | binance | 6.79 | 6.79 | 51.4 | 154.79 | 202408 | |||

| ElliotV8_original_ichiv2_2 | 34 | 1.24 | 42.13 | 126.517 | 9.73 | 3:28:00 | 29 | 0 | 5 | 85.3 | 30.853 | 2.22 | 18.6 | USDT | binance | 10.65 | 10.65 | 182.43 | 299.72 | 202409 | |||

| ElliotV8_original_ichiv2_2 | 67 | -0.23 | -15.17 | -45.5382 | -3.5 | 5:06:00 | 48 | 0 | 19 | 71.6 | 102.085 | 7.75 | 27.2 | USDT | binance | -2.28 | -2.28 | -4.73 | -28.8 | 202410 | |||

| ElliotV8_original_ichiv2_2 | 207 | 0.54 | 112.75 | 338.363 | 26.03 | 3:39:00 | 165 | 0 | 42 | 79.7 | 166.239 | 11.34 | 41.8 | USDT | binance | 21.46 | 21.46 | 50.43 | 151.19 | 202411 | |||

| ElliotV8_original_ichiv2_2 | 131 | 0.15 | 19.71 | 59.1618 | 4.55 | 5:16:00 | 98 | 0 | 33 | 74.8 | 123.314 | 8.73 | 37.7 | USDT | binance | 3.23 | 3.23 | 7.97 | 32.14 | 202412 | |||

| ElliotV8_original_ichiv2_2 | 42 | 0.55 | 22.99 | 69.0213 | 5.31 | 4:30:00 | 33 | 0 | 9 | 78.6 | 35.291 | 2.57 | 21.8 | USDT | binance | 4.46 | 4.46 | 14.66 | 127.24 | 202501 | |||

| ElliotV8_original_ichiv2_2 | 81 | -0.1 | -8.26 | -24.8667 | -1.91 | 3:47:00 | 60 | 0 | 21 | 74.1 | 154.845 | 11.1 | 25.9 | USDT | binance | -1.24 | -1.24 | -1.63 | -11.76 | 202502 | |||

| ElliotV8_original_ichiv2_2 | 52 | -0.13 | -6.93 | -20.7191 | -1.59 | 3:17:00 | 39 | 0 | 13 | 75 | 108.752 | 8.12 | 22.3 | USDT | binance | -0.98 | -0.98 | -1.59 | -12.51 | 202503 | |||

| ElliotV8_original_ichiv2_2 | 101 | 0.37 | 37.37 | 112.248 | 8.63 | 3:52:00 | 79 | 0 | 22 | 78.2 | 60.436 | 4.63 | 29.7 | USDT | binance | 5.97 | 5.97 | 7.59 | 122.92 | 202504 | |||

| ElliotV8_original_ichiv2_2 | 76 | 0.54 | 41.35 | 124.165 | 9.55 | 5:20:00 | 62 | 0 | 14 | 81.6 | 54.826 | 3.79 | 29.1 | USDT | binance | 7.24 | 7.24 | 12.7 | 160.5 | 202505 | |||

| ElliotV8_original_ichiv2_2 | 26 | -0.2 | -5.26 | -15.7231 | -1.21 | 3:15:00 | 21 | 0 | 5 | 80.8 | 120.883 | 8.69 | 18.4 | USDT | binance | -0.54 | -0.54 | -0.5 | -9.17 | 202506 | |||

| ElliotV8_original_ichiv2_2 | 71 | 0.09 | 6.52 | 19.5606 | 1.5 | 5:38:00 | 53 | 0 | 18 | 74.6 | 67.185 | 5 | 29.2 | USDT | binance | 1.1 | 1.1 | 3.15 | 19.16 | 202507 | |||

| ElliotV8_original_ichiv2_2 | 265 | 0.93 | 245.25 | 736.491 | 73.65 | 2:32:00 | 222 | 0 | 43 | 83.8 | 145.349 | 7.72 | 87.7 | BUSD | binance | 7.55 | 7.55 | 19.88 | 10180.3 | 202201 | |||

| ElliotV8_original_ichiv2_2 | 215 | 0.47 | 101.35 | 304.359 | 30.44 | 3:18:00 | 173 | 0 | 42 | 80.5 | 133.394 | 9.86 | 89.4 | BUSD | binance | 3.95 | 3.95 | 6.77 | 232.13 | 202202 | |||

| ElliotV8_original_ichiv2_2 | 292 | 0.43 | 124.32 | 373.34 | 37.33 | 3:35:00 | 232 | 0 | 60 | 79.5 | 165.44 | 13.87 | 113.3 | BUSD | binance | 3.68 | 3.68 | 5.9 | 169.11 | 202203 | |||

| ElliotV8_original_ichiv2_2 | 155 | 0.99 | 153.33 | 460.463 | 46.05 | 2:50:00 | 132 | 0 | 23 | 85.2 | 121.785 | 7.77 | 70.6 | BUSD | binance | 5.83 | 5.83 | 15.78 | 669.56 | 202204 | |||

| ElliotV8_original_ichiv2_2 | 319 | 1.08 | 345.09 | 1036.31 | 103.63 | 2:12:00 | 275 | 0 | 44 | 86.2 | 234.298 | 21.24 | 90.4 | BUSD | binance | 8.05 | 8.05 | 15.93 | 39493.4 | 202205 | |||

| ElliotV8_original_ichiv2_2 | 154 | 0.56 | 85.62 | 257.117 | 25.71 | 3:34:00 | 124 | 0 | 30 | 80.5 | 147.86 | 12.95 | 79 | BUSD | binance | 4.83 | 4.83 | 8.29 | 242.87 | 202206 | |||

| ElliotV8_original_ichiv2_2 | 165 | 1.02 | 168.84 | 507.039 | 50.7 | 3:38:00 | 138 | 0 | 27 | 83.6 | 72.097 | 4.57 | 82.8 | BUSD | binance | 8.85 | 8.85 | 24.57 | 3570.5 | 202207 | |||

| ElliotV8_original_ichiv2_2 | 82 | 1.04 | 85.59 | 257.025 | 25.7 | 5:11:00 | 69 | 0 | 13 | 84.1 | 69.336 | 5.23 | 69.1 | BUSD | binance | 5.68 | 5.68 | 10.27 | 146.28 | 202208 | |||

| ElliotV8_original_ichiv2_2 | 123 | 0.77 | 94.27 | 283.082 | 28.31 | 3:25:00 | 101 | 0 | 22 | 82.1 | 96.558 | 7.25 | 69.5 | BUSD | binance | 5.01 | 5.01 | 13.4 | 373.55 | 202209 | |||

| ElliotV8_original_ichiv2_2 | 54 | -0.29 | -15.41 | -46.2848 | -4.63 | 4:24:00 | 38 | 0 | 16 | 70.4 | 113.887 | 10.85 | 55.8 | BUSD | binance | -1.96 | -1.96 | -2.27 | -5.98 | 202210 | |||

| ElliotV8_original_ichiv2_2 | 199 | 0.3 | 60.17 | 180.684 | 18.07 | 2:38:00 | 152 | 0 | 47 | 76.4 | 166.205 | 12.88 | 76.3 | BUSD | binance | 2.99 | 2.99 | 5.99 | 116.76 | 202211 | |||

| ElliotV8_original_ichiv2_2 | 116 | 0.97 | 112.23 | 337.027 | 33.7 | 2:13:00 | 99 | 0 | 17 | 85.3 | 78.653 | 7.43 | 57.4 | BUSD | binance | 9.16 | 9.16 | 43.72 | 2336.51 | 202212 | |||

| ElliotV8_original_ichiv2_2 | 168 | 0.82 | 138.26 | 415.183 | 41.52 | 3:47:00 | 140 | 0 | 28 | 83.3 | 113.746 | 7.48 | 85.6 | BUSD | binance | 7.1 | 7.1 | 14.64 | 1948.86 | 202301 | |||

| ElliotV8_original_ichiv2_2 | 182 | 0.65 | 118.15 | 354.997 | 27.31 | 3:41:00 | 148 | 0 | 34 | 81.3 | 129.338 | 7.37 | 83.6 | BUSD | binance | 19.94 | 19.94 | 24.42 | 252.96 | 202302 | |||

| ElliotV8_original_ichiv2_2 | 64 | 0.71 | 45.57 | 136.834 | 10.53 | 5:51:00 | 51 | 0 | 13 | 79.7 | 70.771 | 4.76 | 65.6 | BUSD | binance | 8.63 | 8.63 | 21.69 | 136.4 | 202303 | |||

| ElliotV8_original_ichiv2_2 | 59 | 1.26 | 74.27 | 223 | 17.15 | 4:12:00 | 50 | 0 | 9 | 84.7 | 60.245 | 4.04 | 57.3 | BUSD | binance | 15.94 | 15.94 | 28.41 | 279.56 | 202304 | |||

| ElliotV8_original_ichiv2_2 | 34 | -0.7 | -23.78 | -71.3975 | -5.49 | 4:13:00 | 22 | 0 | 12 | 64.7 | 139.082 | 10.57 | 51.1 | BUSD | binance | -3.49 | -3.49 | -10.08 | -32.02 | 202305 | |||

| ElliotV8_original_ichiv2_2 | 49 | 0.25 | 12.13 | 36.4134 | 2.8 | 4:38:00 | 40 | 0 | 9 | 81.6 | 134.317 | 9.46 | 49.2 | BUSD | binance | 1.61 | 1.61 | 1.54 | 18.86 | 202306 | |||

| ElliotV8_original_ichiv2_2 | 45 | -0.25 | -11.08 | -33.2648 | -2.56 | 3:15:00 | 32 | 0 | 13 | 71.1 | 108.234 | 8.03 | 30.1 | BUSD | binance | -1.69 | -1.69 | -3.68 | -19.64 | 202307 | |||

| ElliotV8_original_ichiv2_2 | 42 | -0.24 | -9.9 | -29.703 | -2.28 | 7:58:00 | 29 | 0 | 13 | 69 | 90.706 | 6.66 | 40.9 | BUSD | binance | -1.47 | -1.47 | -4.21 | -21.83 | 202308 | |||

| ElliotV8_original_ichiv2_2 | 82 | 0.18 | 14.44 | 43.5012 | 3.35 | 3:17:00 | 64 | 0 | 18 | 78 | 119.984 | 8.2 | 36 | BUSD | binance | 1.88 | 1.88 | 2 | 25.99 | 202309 | |||

| ElliotV8_original_ichiv2_2 | 33 | 1.02 | 33.78 | 101.426 | 7.8 | 6:32:00 | 28 | 0 | 5 | 84.8 | 48.488 | 3.37 | 35 | BUSD | binance | 5.96 | 5.96 | 7.7 | 142.76 | 202310 | |||

| ElliotV8_original_ichiv2_2 | 65 | 0.5 | 32.37 | 97.1369 | 7.47 | 4:42:00 | 52 | 0 | 13 | 80 | 61.97 | 4.28 | 36.8 | BUSD | binance | 5.05 | 5.05 | 5.36 | 115.06 | 202311 | |||

| ElliotV8_original_ichiv2_2 | 196 | 0.65 | 126.53 | 379.963 | 38 | 2:51:00 | 157 | 0 | 39 | 80.1 | 155.396 | 12.64 | 82.2 | USDT | kucoin | 5.45 | 5.45 | 13.71 | 967.12 | 202201 | |||

| ElliotV8_original_ichiv2_2 | 246 | 1.12 | 275 | 825.815 | 82.58 | 2:40:00 | 212 | 0 | 34 | 86.2 | 87.118 | 8.06 | 87 | USDT | kucoin | 8.54 | 8.54 | 25.73 | 19482 | 202202 | |||

| ElliotV8_original_ichiv2_2 | 157 | 0.68 | 107.13 | 321.726 | 32.17 | 3:55:00 | 127 | 0 | 30 | 80.9 | 72.679 | 5.87 | 84.6 | USDT | kucoin | 4.91 | 4.91 | 9.76 | 220.27 | 202203 | |||

| ElliotV8_original_ichiv2_2 | 89 | 0.67 | 59.43 | 178.483 | 17.85 | 4:31:00 | 70 | 0 | 19 | 78.7 | 62.783 | 5.75 | 69.7 | USDT | kucoin | 4.13 | 4.13 | 9.39 | 115.41 | 202204 | |||

| ElliotV8_original_ichiv2_2 | 228 | 0.38 | 87.75 | 263.508 | 26.35 | 3:18:00 | 178 | 0 | 50 | 78.1 | 191.525 | 18.29 | 94.7 | USDT | kucoin | 3.36 | 3.36 | 6.4 | 254.04 | 202205 | |||

| ElliotV8_original_ichiv2_2 | 112 | 0.46 | 52.02 | 156.223 | 15.62 | 4:13:00 | 88 | 0 | 24 | 78.6 | 138.994 | 12.81 | 74.8 | USDT | kucoin | 2.84 | 2.84 | 4.74 | 45.19 | 202206 | |||

| ElliotV8_original_ichiv2_2 | 151 | 0.56 | 84.86 | 254.842 | 25.48 | 4:24:00 | 119 | 0 | 32 | 78.8 | 75.852 | 7.72 | 88.6 | USDT | kucoin | 7.79 | 7.79 | 29.14 | 1879.97 | 202207 | |||

| ElliotV8_original_ichiv2_2 | 80 | 1 | 79.82 | 239.696 | 23.97 | 3:26:00 | 68 | 0 | 12 | 85 | 65.986 | 5.53 | 60.7 | USDT | kucoin | 6.53 | 6.53 | 15.62 | 318.28 | 202208 | |||

| ElliotV8_original_ichiv2_2 | 39 | 0.72 | 27.92 | 83.8307 | 8.38 | 4:59:00 | 30 | 0 | 9 | 76.9 | 69.256 | 6.41 | 55.1 | USDT | kucoin | 2.38 | 2.38 | 5.12 | 27.04 | 202209 | |||

| ElliotV8_original_ichiv2_2 | 72 | 0.68 | 49.07 | 147.371 | 14.74 | 4:06:00 | 59 | 0 | 13 | 81.9 | 70.241 | 6.37 | 62.1 | USDT | kucoin | 4.09 | 4.09 | 7.37 | 94.89 | 202210 | |||

| ElliotV8_original_ichiv2_2 | 120 | 0.81 | 97.78 | 293.632 | 29.36 | 4:14:00 | 96 | 0 | 24 | 80 | 82.191 | 7.11 | 77.4 | USDT | kucoin | 4.82 | 4.82 | 10.4 | 520.55 | 202211 | |||

| ElliotV8_original_ichiv2_2 | 56 | -0.15 | -8.26 | -24.8162 | -2.48 | 4:42:00 | 39 | 0 | 17 | 69.6 | 180.431 | 15.61 | 60.3 | USDT | kucoin | -0.16 | -0.16 | -0.2 | -0.95 | 202212 | |||

| ElliotV8_original_ichiv2_2 | 205 | 1.35 | 276.41 | 830.065 | 83.01 | 4:12:00 | 173 | 0 | 32 | 84.4 | 82.605 | 4.39 | 108.9 | USDT | kucoin | 9.8 | 9.8 | 32.56 | 31895.8 | 202301 | |||

| ElliotV8_original_ichiv2_2 | 149 | 1.11 | 166.08 | 498.728 | 38.36 | 4:06:00 | 126 | 0 | 23 | 84.6 | 79.388 | 4.23 | 80.9 | USDT | kucoin | 30.8 | 30.8 | 55.21 | 642.2 | 202302 | |||

| ElliotV8_original_ichiv2_2 | 75 | 1.11 | 83.56 | 250.923 | 19.3 | 5:28:00 | 61 | 0 | 14 | 81.3 | 68.875 | 4.54 | 67.3 | USDT | kucoin | 11.5 | 11.5 | 16.06 | 261.98 | 202303 | |||

| ElliotV8_original_ichiv2_2 | 59 | 0.67 | 39.58 | 118.854 | 9.14 | 4:10:00 | 48 | 0 | 11 | 81.4 | 64.45 | 4.94 | 56.3 | USDT | kucoin | 5.95 | 5.95 | 9.65 | 117.9 | 202304 | |||

| ElliotV8_original_ichiv2_2 | 44 | 0 | -0.09 | -0.268612 | -0.02 | 6:12:00 | 35 | 0 | 9 | 79.5 | 145.135 | 10.28 | 57 | USDT | kucoin | -0.01 | -0.01 | -0.01 | -0.12 | 202305 | |||

| ElliotV8_original_ichiv2_2 | 64 | 0.88 | 56.47 | 169.562 | 13.04 | 4:10:00 | 55 | 0 | 9 | 85.9 | 60.53 | 4.64 | 50.6 | USDT | kucoin | 8.67 | 8.67 | 7.48 | 178.92 | 202306 | |||

| ElliotV8_original_ichiv2_2 | 44 | -0.09 | -4.08 | -12.2647 | -0.94 | 4:08:00 | 32 | 0 | 12 | 72.7 | 144.208 | 10.11 | 29 | USDT | kucoin | -0.59 | -0.59 | -1.23 | -5.75 | 202307 | |||

| ElliotV8_original_ichiv2_2 | 49 | 0.11 | 5.37 | 16.1199 | 1.24 | 3:06:00 | 38 | 0 | 11 | 77.6 | 65.697 | 4.96 | 28.1 | USDT | kucoin | 0.78 | 0.78 | 1.53 | 15.91 | 202308 | |||

| ElliotV8_original_ichiv2_2 | 75 | 0.19 | 14.2 | 42.6535 | 3.28 | 3:33:00 | 58 | 0 | 17 | 77.3 | 104.516 | 7.27 | 33.1 | USDT | kucoin | 1.75 | 1.75 | 1.93 | 28.75 | 202309 | |||

| ElliotV8_original_ichiv2_2 | 44 | 0.15 | 6.7 | 20.1088 | 1.55 | 8:19:00 | 34 | 0 | 10 | 77.3 | 46.733 | 3.51 | 48.7 | USDT | kucoin | 0.97 | 0.97 | 1.44 | 27.19 | 202310 | |||

| ElliotV8_original_ichiv2_2 | 235 | 0.81 | 190.53 | 572.171 | 44.01 | 3:51:00 | 190 | 0 | 45 | 80.9 | 135.42 | 6.78 | 95.3 | USDT | kucoin | 30.2 | 30.2 | 49.58 | 413.27 | 202311 | |||

| ElliotV8_original_ichiv2_2 | 244 | 0.58 | 141.75 | 425.69 | 32.75 | 4:46:00 | 196 | 0 | 48 | 80.3 | 112.778 | 6.14 | 113.3 | USDT | kucoin | 20.95 | 20.95 | 27.47 | 328.66 | 202312 | |||

| ElliotV8_original_ichiv2_2 | 113 | 0.71 | 80.74 | 242.449 | 18.65 | 2:48:00 | 93 | 0 | 20 | 82.3 | 96.84 | 7.24 | 51.2 | USDT | kucoin | 12.64 | 12.64 | 15.58 | 158.66 | 202401 | |||

| ElliotV8_original_ichiv2_2 | 96 | 0.14 | 13.12 | 39.3925 | 3.03 | 5:37:00 | 71 | 0 | 25 | 74 | 107.939 | 7.46 | 50.2 | USDT | kucoin | 2.21 | 2.21 | 3.73 | 26.77 | 202402 | |||

| ElliotV8_original_ichiv2_2 | 265 | 0.37 | 99.16 | 297.783 | 22.91 | 4:16:00 | 211 | 0 | 54 | 79.6 | 229.122 | 13.29 | 66.9 | USDT | kucoin | 13.53 | 13.53 | 16.24 | 106.25 | 202403 | |||

| ElliotV8_original_ichiv2_2 | 33 | 0.22 | 7.18 | 21.5543 | 1.66 | 5:15:00 | 24 | 0 | 9 | 72.7 | 83.248 | 5.93 | 37.3 | USDT | kucoin | 1.1 | 1.1 | 4.41 | 17.82 | 202404 | |||

| ElliotV8_original_ichiv2_2 | 89 | -0.32 | -28.79 | -86.4705 | -6.65 | 4:12:00 | 65 | 0 | 24 | 73 | 113.584 | 8.7 | 42.3 | USDT | kucoin | -3.7 | -3.7 | -4.81 | -47.1 | 202405 | |||

| ElliotV8_original_ichiv2_2 | 71 | -0.86 | -60.71 | -182.315 | -14.02 | 5:39:00 | 46 | 0 | 25 | 64.8 | 255.201 | 18.61 | 42.5 | USDT | kucoin | -8.63 | -8.63 | -20.22 | -48 | 202406 | |||

| ElliotV8_original_ichiv2_2 | 38 | 0.3 | 11.53 | 34.6213 | 2.66 | 5:45:00 | 29 | 0 | 9 | 76.3 | 60.425 | 4.72 | 37.7 | USDT | kucoin | 1.67 | 1.67 | 3.93 | 34.74 | 202407 | |||

| ElliotV8_original_ichiv2_2 | 58 | 1.21 | 70.26 | 0.00703347 | 7.81 | 3:45:00 | 50 | 0 | 8 | 90.2 | 0.00198923 | 2.04 | 23.6 | USDT | kucoin | 8.8 | 8.8 | 7.4 | 243.73 | 202408 | |||

| ElliotV8_original_ichiv2_2 | 25 | 1.2 | 29.88 | 89.7355 | 6.9 | 7:51:00 | 21 | 0 | 4 | 84 | 46.891 | 3.58 | 35.9 | USDT | kucoin | 5.2 | 5.2 | 12.25 | 126.93 | 202409 | |||

| ElliotV8_original_ichiv2_2 | 27 | -0.33 | -8.78 | -26.3586 | -2.03 | 7:24:00 | 19 | 0 | 8 | 70.4 | 76.833 | 5.69 | 36 | USDT | kucoin | -1.27 | -1.27 | -2.54 | -21.96 | 202410 | |||

| ElliotV8_original_ichiv2_2 | 285 | 0.78 | 222.62 | 668.452 | 51.42 | 3:19:00 | 234 | 0 | 51 | 82.1 | 275.172 | 16.33 | 61.9 | USDT | kucoin | 32.26 | 32.26 | 34.6 | 200.58 | 202411 | |||

| ElliotV8_original_ichiv2_2 | 122 | -0.07 | -8.39 | -25.1995 | -1.94 | 6:05:00 | 89 | 0 | 33 | 73 | 146.611 | 10.41 | 55.4 | USDT | kucoin | -1.32 | -1.32 | -3.95 | -11.47 | 202412 | |||

| ElliotV8_original_ichiv2_2 | 86 | 0.28 | 23.77 | 71.3827 | 5.49 | 3:27:00 | 69 | 0 | 17 | 80.2 | 151.733 | 10.74 | 41 | USDT | kucoin | 2.89 | 2.89 | 3.61 | 31.52 | 202501 | |||

| ElliotV8_original_ichiv2_2 | 62 | 0.02 | 1.31 | 3.94135 | 0.3 | 4:46:00 | 45 | 0 | 17 | 72.6 | 118.369 | 8.36 | 40 | USDT | kucoin | 0.19 | 0.19 | 0.47 | 2.47 | 202502 | |||

| ElliotV8_original_ichiv2_2 | 93 | 0.16 | 14.51 | 43.5627 | 3.35 | 4:32:00 | 72 | 0 | 21 | 77.4 | 170.994 | 11.33 | 48.7 | USDT | kucoin | 1.7 | 1.7 | 2.28 | 18.22 | 202503 | |||

| ElliotV8_original_ichiv2_2 | 47 | -0.19 | -8.88 | -26.6613 | -2.05 | 5:36:00 | 32 | 0 | 15 | 68.1 | 80.864 | 5.97 | 40.8 | USDT | kucoin | -1.31 | -1.31 | -3.28 | -21.87 | 202504 | |||

| ElliotV8_original_ichiv2_2 | 42 | 0.08 | 3.21 | 9.65131 | 0.74 | 8:33:00 | 32 | 0 | 10 | 76.2 | 89.256 | 6.66 | 44.6 | USDT | kucoin | 0.54 | 0.54 | 1.37 | 6.87 | 202505 | |||

| ElliotV8_original_ichiv2_2 | 23 | 0.33 | 7.52 | 22.5923 | 1.74 | 5:54:00 | 16 | 0 | 7 | 69.6 | 45.272 | 3.41 | 35 | USDT | kucoin | 1.23 | 1.23 | 20.6 | 33.58 | 202506 | |||

| ElliotV8_original_ichiv2_2 | 47 | -0.84 | -39.53 | -118.694 | -9.13 | 6:24:00 | 32 | 0 | 15 | 68.1 | 240.202 | 17.33 | 39.6 | USDT | kucoin | -4.22 | -4.22 | -4.98 | -32.46 | 202507 | |||

| ElliotV8_original_ichiv2_2 | 166 | 0.27 | 45.52 | 0.00455663 | 5.7 | 4:05:00 | 131 | 0 | 35 | 78.9 | 0.00346843 | 4.2 | 88.1 | BTC | binance | 2.23 | 2.23 | 3.72 | 17.53 | 202201 | |||

| ElliotV8_original_ichiv2_2 | 238 | 0.47 | 111.38 | 0.0111487 | 13.94 | 3:17:00 | 187 | 0 | 51 | 78.6 | 0.00368097 | 4.41 | 95.9 | BTC | binance | 3.35 | 3.35 | 6.12 | 44.77 | 202202 | |||

| ElliotV8_original_ichiv2_2 | 161 | 0.42 | 67.48 | 0.00675483 | 8.44 | 4:31:00 | 123 | 0 | 38 | 76.4 | 0.00320908 | 3.71 | 92.6 | BTC | binance | 2.58 | 2.58 | 4.37 | 26.68 | 202203 | |||

| ElliotV8_original_ichiv2_2 | 113 | 0.6 | 67.65 | 0.00677207 | 8.47 | 3:28:00 | 90 | 0 | 23 | 79.6 | 0.00282682 | 3.19 | 67.6 | BTC | binance | 2.66 | 2.66 | 5.59 | 31.58 | 202204 | |||

| ElliotV8_original_ichiv2_2 | 231 | 0.07 | 16.09 | 0.0016103 | 2.01 | 3:28:00 | 175 | 0 | 56 | 75.8 | 0.00628131 | 7.65 | 97 | BTC | binance | 0.03 | 0.03 | 0.05 | 0.23 | 202205 | |||

| ElliotV8_original_ichiv2_2 | 202 | 0.85 | 171.09 | 0.0171263 | 21.41 | 3:32:00 | 166 | 0 | 36 | 82.2 | 0.00299329 | 3.68 | 90.4 | BTC | binance | 6.92 | 6.92 | 17.51 | 86.07 | 202206 | |||

| ElliotV8_original_ichiv2_2 | 225 | 0.77 | 172.31 | 0.0172477 | 21.56 | 2:56:00 | 181 | 0 | 44 | 80.4 | 0.0033728 | 3.75 | 87.6 | BTC | binance | 6.26 | 6.26 | 14.86 | 75.15 | 202207 | |||

| ElliotV8_original_ichiv2_2 | 118 | 0.65 | 76.79 | 0.00768642 | 9.61 | 4:37:00 | 95 | 0 | 23 | 80.5 | 0.00233759 | 2.7 | 78.5 | BTC | binance | 4.22 | 4.22 | 7.54 | 46.05 | 202208 | |||

| ElliotV8_original_ichiv2_2 | 106 | 0 | -0.31 | -0.00003085 | -0.04 | 3:42:00 | 79 | 0 | 27 | 74.5 | 0.00755058 | 8.63 | 66.8 | BTC | binance | -0.41 | -0.41 | -0.6 | -1.39 | 202209 | |||

| ElliotV8_original_ichiv2_2 | 69 | 0.06 | 4.43 | 0.00044345 | 0.55 | 4:46:00 | 50 | 0 | 19 | 72.5 | 0.00221749 | 2.68 | 62.8 | BTC | binance | 1.65 | 1.65 | 2.48 | 7.94 | 202210 | |||

| ElliotV8_original_ichiv2_2 | 155 | 0.29 | 44.76 | 0.00448038 | 5.6 | 3:29:00 | 119 | 0 | 36 | 76.8 | 0.0034647 | 3.94 | 79.9 | BTC | binance | 2.9 | 2.9 | 5.03 | 21.97 | 202211 | |||

| ElliotV8_original_ichiv2_2 | 82 | 0.78 | 63.93 | 0.00639956 | 8 | 2:21:00 | 67 | 0 | 15 | 81.7 | 0.00183303 | 2.21 | 54.7 | BTC | binance | 5.79 | 5.79 | 13.77 | 123.84 | 202212 | |||

| ElliotV8_original_ichiv2_2 | 153 | 0.4 | 61.56 | 0.00616217 | 7.7 | 5:48:00 | 120 | 0 | 33 | 78.4 | 0.00545715 | 6.44 | 101.5 | BTC | binance | 3.39 | 3.39 | 5.97 | 16.27 | 202301 | |||

| ElliotV8_original_ichiv2_2 | 158 | 0.5 | 79.26 | 0.00793267 | 8.81 | 4:17:00 | 125 | 0 | 33 | 79.1 | 0.00464735 | 4.8 | 87.7 | BTC | binance | 12.81 | 12.81 | 23.32 | 125.36 | 202302 | |||

| ElliotV8_original_ichiv2_2 | 59 | -0.23 | -13.35 | -0.00133577 | -1.48 | 4:41:00 | 41 | 0 | 18 | 69.5 | 0.00310061 | 3.41 | 60.2 | BTC | binance | -1.84 | -1.84 | -3.14 | -27.73 | 202303 | |||

| ElliotV8_original_ichiv2_2 | 80 | 0.28 | 22.61 | 0.00226339 | 2.51 | 2:41:00 | 61 | 0 | 19 | 76.2 | 0.00256753 | 2.71 | 57.1 | BTC | binance | 3.59 | 3.59 | 6.47 | 61.05 | 202304 | |||

| ElliotV8_original_ichiv2_2 | 88 | 0.49 | 42.93 | 0.00429229 | 4.77 | 2:33:00 | 74 | 0 | 14 | 84.1 | 0.00536004 | 5.53 | 57.8 | BTC | binance | 5.72 | 5.72 | 5.7 | 53.19 | 202305 | |||

| ElliotV8_original_ichiv2_2 | 49 | 0.31 | 15.4 | 0.00154023 | 1.71 | 3:41:00 | 41 | 0 | 8 | 83.7 | 0.0030068 | 3.24 | 49.2 | BTC | binance | 1.84 | 1.84 | 1.64 | 33.66 | 202306 | |||

| ElliotV8_original_ichiv2_2 | 70 | 0.06 | 4.37 | 0.00043728 | 0.49 | 4:18:00 | 52 | 0 | 18 | 74.3 | 0.00452272 | 4.79 | 40.4 | BTC | binance | 0.55 | 0.55 | 0.58 | 6.25 | 202307 | |||

| ElliotV8_original_ichiv2_2 | 63 | 0.86 | 54.16 | 0.00542106 | 6.02 | 3:44:00 | 52 | 0 | 11 | 82.5 | 0.00204064 | 2.09 | 37.3 | BTC | binance | 8.93 | 8.93 | 11.07 | 183.2 | 202308 | |||

| ElliotV8_original_ichiv2_2 | 84 | 1.13 | 95.17 | 0.00952527 | 10.58 | 2:50:00 | 71 | 0 | 13 | 84.5 | 0.0027707 | 2.71 | 35.6 | BTC | binance | 15.59 | 15.59 | 15.55 | 248.85 | 202309 | |||

| ElliotV8_original_ichiv2_2 | 90 | 0.74 | 66.2 | 0.00662576 | 7.36 | 2:38:00 | 75 | 0 | 15 | 83.3 | 0.00233118 | 2.44 | 41.8 | BTC | binance | 8.97 | 8.97 | 8.45 | 186.22 | 202310 | |||

| ElliotV8_original_ichiv2_2 | 155 | 0.29 | 44.91 | 0.00449594 | 5 | 5:22:00 | 117 | 0 | 38 | 75.5 | 0.00401302 | 4.4 | 81.5 | BTC | binance | 7 | 7 | 14.25 | 72.35 | 202311 | |||

| ElliotV8_original_ichiv2_2 | 177 | 0.32 | 56.35 | 0.00564483 | 6.27 | 5:04:00 | 135 | 0 | 42 | 76.3 | 0.00307116 | 3.19 | 87.9 | BTC | binance | 9.35 | 9.35 | 18.65 | 121.26 | 202312 | |||

| ElliotV8_original_ichiv2_2 | 103 | 0.53 | 54.78 | 0.00548381 | 6.09 | 3:18:00 | 85 | 0 | 18 | 82.5 | 0.00347805 | 3.73 | 56.2 | BTC | binance | 6.06 | 6.06 | 6.49 | 100.71 | 202401 | |||

| ElliotV8_original_ichiv2_2 | 121 | 0.73 | 88.42 | 0.00884922 | 9.83 | 4:02:00 | 95 | 0 | 26 | 78.5 | 0.00276989 | 3.01 | 48.7 | BTC | binance | 16.86 | 16.86 | 41.53 | 223.25 | 202402 | |||

| ElliotV8_original_ichiv2_2 | 291 | 0.58 | 169.48 | 0.0169619 | 18.85 | 3:42:00 | 230 | 0 | 61 | 79 | 0.0045691 | 4.74 | 52 | BTC | binance | 28.39 | 28.39 | 47.83 | 253.39 | 202403 | |||

| ElliotV8_original_ichiv2_2 | 57 | -0.18 | -10.23 | -0.00102365 | -1.14 | 4:14:00 | 40 | 0 | 17 | 70.2 | 0.00345637 | 3.76 | 23.2 | BTC | binance | -1.31 | -1.31 | -1.8 | -19.27 | 202404 | |||

| ElliotV8_original_ichiv2_2 | 37 | -0.45 | -16.62 | -0.00166361 | -1.85 | 7:21:00 | 23 | 0 | 14 | 62.2 | 0.00309024 | 3.43 | 25.5 | BTC | binance | -2.52 | -2.52 | -7.25 | -33.23 | 202405 | |||

| ElliotV8_original_ichiv2_2 | 67 | 0.58 | 38.74 | 0.00387718 | 4.31 | 3:10:00 | 52 | 0 | 15 | 77.6 | 0.00285724 | 3.08 | 24.5 | BTC | binance | 6.39 | 6.39 | 15.4 | 89.03 | 202406 | |||

| ElliotV8_original_ichiv2_2 | 17 | 0.83 | 14.15 | 0.00141623 | 1.57 | 11:19:00 | 10 | 0 | 7 | 58.8 | 0.00131785 | 1.46 | 21.6 | BTC | binance | 1.34 | 1.34 | 8.2 | 68.66 | 202407 | |||

| ElliotV8_original_ichiv2_2 | 58 | 1.21 | 70.26 | 0.00703347 | 7.81 | 3:45:00 | 50 | 0 | 8 | 86.2 | 0.00198923 | 2.04 | 22.2 | BTC | binance | 8.8 | 8.8 | 7.4 | 243.73 | 202408 | |||

| ElliotV8_original_ichiv2_2 | 34 | 1.47 | 50.06 | 0.00501087 | 5.57 | 3:11:00 | 30 | 0 | 4 | 88.2 | 0.00077567 | 0.83 | 19.5 | BTC | binance | 12.6 | 12.6 | 32.8 | 439.58 | 202409 | |||

| ElliotV8_original_ichiv2_2 | 57 | 0.23 | 13.29 | 0.00133036 | 1.48 | 5:05:00 | 44 | 0 | 13 | 77.2 | 0.00467806 | 4.94 | 26.8 | BTC | binance | 1.81 | 1.81 | 3.2 | 18.45 | 202410 | |||

| ElliotV8_original_ichiv2_2 | 304 | 0.74 | 223.89 | 0.0224074 | 24.9 | 4:20:00 | 245 | 0 | 59 | 80.6 | 0.0044356 | 3.98 | 61.2 | BTC | binance | 36.37 | 36.37 | 50.6 | 398.76 | 202411 | |||

| ElliotV8_original_ichiv2_2 | 191 | 0.27 | 52.35 | 0.00523844 | 5.82 | 4:56:00 | 147 | 0 | 44 | 77 | 0.00757289 | 7.63 | 46.2 | BTC | binance | 7.11 | 7.11 | 10.04 | 47.01 | 202412 | |||

| ElliotV8_original_ichiv2_2 | 45 | 0.94 | 42.42 | 0.00424604 | 4.72 | 7:29:00 | 34 | 0 | 11 | 75.6 | 0.00359945 | 3.83 | 25.7 | BTC | binance | 5.75 | 5.75 | 20.81 | 75.96 | 202501 | |||

| ElliotV8_original_ichiv2_2 | 38 | 0.55 | 20.77 | 0.00207905 | 2.31 | 5:28:00 | 30 | 0 | 8 | 78.9 | 0.00210621 | 2.3 | 21.8 | BTC | binance | 3.15 | 3.15 | 3.73 | 68.46 | 202502 | |||

| ElliotV8_original_ichiv2_2 | 51 | 0.78 | 39.54 | 0.00395673 | 4.4 | 4:37:00 | 42 | 0 | 9 | 82.4 | 0.00200891 | 2.1 | 23.1 | BTC | binance | 6.69 | 6.69 | 14.31 | 128.89 | 202503 | |||

| ElliotV8_original_ichiv2_2 | 51 | 0.62 | 31.86 | 0.00318944 | 3.54 | 6:50:00 | 40 | 0 | 11 | 78.4 | 0.00244155 | 2.65 | 26.9 | BTC | binance | 5 | 5 | 10.39 | 85.13 | 202504 | |||

| ElliotV8_original_ichiv2_2 | 66 | 0.19 | 12.73 | 0.00127429 | 1.42 | 5:56:00 | 46 | 0 | 20 | 69.7 | 0.00553057 | 5.71 | 28.3 | BTC | binance | 1.81 | 1.81 | 5.97 | 15.78 | 202505 | |||

| ElliotV8_original_ichiv2_2 | 28 | 0.9 | 25.06 | 0.00250866 | 2.79 | 8:13:00 | 20 | 0 | 8 | 71.4 | 0.00248259 | 2.73 | 24 | BTC | binance | 3.41 | 3.41 | 8.58 | 67.23 | 202506 | |||

| ElliotV8_original_ichiv2_2 | 102 | 0.88 | 90.21 | 0.0090293 | 10.03 | 6:16:00 | 80 | 0 | 22 | 78.4 | 0.00334816 | 3.47 | 36.2 | BTC | binance | 13.67 | 13.67 | 27.49 | 184.38 | 202507 |

Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ElliotV8_original_ichiv2 strategy is a trading strategy that uses various technical indicators to generate buy and sell signals in the market. Here is a breakdown of the strategy:

Indicator Calculation:

Calculates exponential moving averages (EMA) for different time periods. Calculates the Hull Moving Average (HMA) with a window of 50.

Calculates the simple moving average (SMA) with a time period of 9.

Calculates the Elder's Force Index (EWO) using custom EWO function.

Calculates the Relative Strength Index (RSI) for different time periods. Calculates Bollinger Bands with 2 standard deviations. Buy Signal Generation: Conditions for buy signals are checked using the calculated indicators. Checks if the RSI fast is less than 35. Checks if the close price is below the buy moving average multiplied by a low offset value. Checks if the EWO is above a high EWO threshold. Checks if the RSI is below a buy RSI threshold. Checks if the volume is greater than 0. Checks if the close price is below the sell moving average multiplied by a high offset value. If the conditions are met, the 'buy' signal is assigned a value of 1. Sell Signal Generation: Conditions for sell signals are checked using the calculated indicators. Checks if the close price is above the Hull Moving Average (HMA) and the sell moving average multiplied by a high offset. Checks if the RSI is above 50. Checks if the volume is greater than 0. Checks if the RSI fast is greater than the RSI slow. If the conditions are met, the 'sell' signal is assigned a value of 1. Exit Signal Generation: No specific exit conditions are defined in this strategy. Stop Loss: Defines a stop loss condition called "sell_stoploss_deadfish" based on various criteria, including profit, Bollinger Bands width, close price relative to Bollinger Bands middle band, and volume. Overall, the strategy aims to generate buy signals when certain conditions related to indicators, RSI, EWO, and volume are met, and sell signals when conditions related to the close price, moving averages, RSI, and volume are met.

Calculates the simple moving average (SMA) with a time period of 9.

Calculates the Elder's Force Index (EWO) using custom EWO function.

Calculates the Relative Strength Index (RSI) for different time periods. Calculates Bollinger Bands with 2 standard deviations. Buy Signal Generation: Conditions for buy signals are checked using the calculated indicators. Checks if the RSI fast is less than 35. Checks if the close price is below the buy moving average multiplied by a low offset value. Checks if the EWO is above a high EWO threshold. Checks if the RSI is below a buy RSI threshold. Checks if the volume is greater than 0. Checks if the close price is below the sell moving average multiplied by a high offset value. If the conditions are met, the 'buy' signal is assigned a value of 1. Sell Signal Generation: Conditions for sell signals are checked using the calculated indicators. Checks if the close price is above the Hull Moving Average (HMA) and the sell moving average multiplied by a high offset. Checks if the RSI is above 50. Checks if the volume is greater than 0. Checks if the RSI fast is greater than the RSI slow. If the conditions are met, the 'sell' signal is assigned a value of 1. Exit Signal Generation: No specific exit conditions are defined in this strategy. Stop Loss: Defines a stop loss condition called "sell_stoploss_deadfish" based on various criteria, including profit, Bollinger Bands width, close price relative to Bollinger Bands middle band, and volume. Overall, the strategy aims to generate buy signals when certain conditions related to indicators, RSI, EWO, and volume are met, and sell signals when conditions related to the close price, moving averages, RSI, and volume are met.

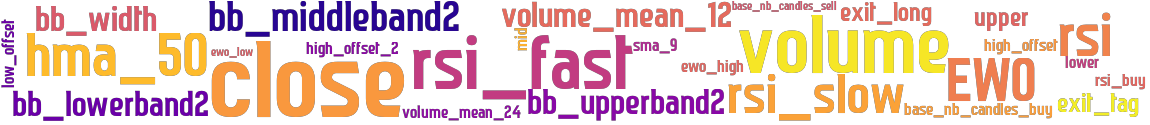

stoploss: -0.2 timeframe: 5m hash(sha256): a6101fe0dec94843c89577de0aff154bce9899a3dcf0643bce87db62a6575b4a indicators: rsi_buy upper EWO ewo_high close high_offset_2 ewo_low exit_long exit_tag volume_mean_12 rsi_fast ma_sell_val ma_buy_val bb_middleband2 volume low_offset high_offset base_nb_candles_buy bb_upperband2 volume_mean_24 mid bb_width base_nb_candles_sell hma_50 sma_9 lower rsi_slow rsi bb_lowerband2

No similar strategies found. (based on used indicators)

last change: 2025-08-04 05:13:26