The provided code snippet represents a trading strategy implemented as a Python class named "DonchianChannel" that inherits from an interface "IStrategy." The strategy involves several technical indicators to make trading decisions. Here's a concise breakdown of what the strategy does:

Indicators Population:

The populate_indicators method takes a DataFrame containing price and other data. It calculates various technical indicators such as Bollinger Bands, Donchian Channels, Average Directional Index (ADX), Directional Movement (DM) indicators, Moving Average Convergence Divergence (MACD), Stochastic Fast indicators, Relative Strength Index (RSI), Fisher Transform of RSI, Exponential Moving Averages (EMA), and more.

These indicators are added as new columns to the DataFrame.

Entry Trend Conditions: The populate_entry_trend method populates a 'buy' column in the DataFrame based on predefined conditions.

The conditions involve different technical indicators like SAR (Stop and Reverse), Simple Moving Average (SMA), Exponential Moving Average (EMA), Average Directional Index (ADX), Directional Movement (DM) delta, MACD, and Fisher Transform of RSI. If the conditions are met, the 'buy' column for the corresponding rows is set to 1. Exit Trend Conditions: The populate_exit_trend method populates a 'sell' column in the DataFrame based on predefined conditions. Similar to the entry conditions, it involves technical indicators like SAR, SMA, EMA, ADX, DM delta, and MACD. The 'sell' column is set to 1 for rows where the exit conditions are met. Additionally, there's a part that clears the 'sell' signals if a 'hold' condition is met for the 'sell_hold' parameter. The strategy appears to use a combination of various technical indicators to determine both entry and exit points for trading. The decision to buy or sell is based on the crossover or other conditions of these indicators. The strategy aims to provide a systematic way to automate trading decisions based on these indicators.

These indicators are added as new columns to the DataFrame.

Entry Trend Conditions: The populate_entry_trend method populates a 'buy' column in the DataFrame based on predefined conditions.

The conditions involve different technical indicators like SAR (Stop and Reverse), Simple Moving Average (SMA), Exponential Moving Average (EMA), Average Directional Index (ADX), Directional Movement (DM) delta, MACD, and Fisher Transform of RSI. If the conditions are met, the 'buy' column for the corresponding rows is set to 1. Exit Trend Conditions: The populate_exit_trend method populates a 'sell' column in the DataFrame based on predefined conditions. Similar to the entry conditions, it involves technical indicators like SAR, SMA, EMA, ADX, DM delta, and MACD. The 'sell' column is set to 1 for rows where the exit conditions are met. Additionally, there's a part that clears the 'sell' signals if a 'hold' condition is met for the 'sell_hold' parameter. The strategy appears to use a combination of various technical indicators to determine both entry and exit points for trading. The decision to buy or sell is based on the crossover or other conditions of these indicators. The strategy aims to provide a systematic way to automate trading decisions based on these indicators.

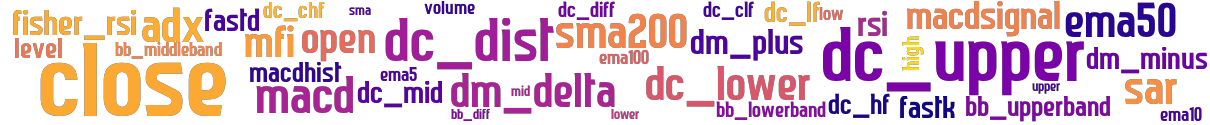

stoploss: 0 timeframe: 5m hash(sha256): 97034213237580bd53d8279f62beebda28fe052d1265c065dee93a2f9f813eed indicators: upper dc_lf close dc_h dm_delta bb_lowerband mfi ema5 dc_hf macdhist fastk dc_cl level open dm_plus fastd ema10 sar high macdsignal mid bb_diff dc_upper fisher_rsi dc_diff dc_lower ema100 dc_clf dc_dif macd dc_ch dc_mid dc_dist dc_chf adx lower dc_l bb_middleband rsi bb_upperband low ema50 dm_minus sma200

Similar Strategies: (based on used indicators)

Strategy: DonchianChannel, Similarity Score: 97.78%

Strategy: DonchianBounce, Similarity Score: 82.22%

Strategy: DonchianBounce_2, Similarity Score: 82.22%

last change: 2025-01-07 12:43:01