Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "bbandrsi" strategy is a trading strategy that combines Bollinger Bands (BB) and the Relative Strength Index (RSI) indicators. Here's a breakdown of what the strategy does:

Indicators:

Moving Average Convergence Divergence (MACD): The strategy calculates the MACD indicator based on the closing price of the asset. Relative Strength Index (RSI): The strategy calculates the RSI indicator based on the closing price of the asset.

Exponential Moving Averages (EMA): The strategy calculates four EMAs with different time periods (100, 200, 20, and 25) based on the closing price of the asset.

Choppiness Index: The strategy calculates the Choppiness Index indicator based on the price data.

Buy Signals: The strategy generates buy signals under the following conditions: When the MFI (Money Flow Index) is below 20, RSI is below 37, EMA2 is below EMA1, and the closing price is below the lower Bollinger Band. When the closing price has a bullish trend (previous two candles have lower prices than the current candle), the Choppiness Index is increasing, RSI is between 55 and 65, and the previous EMA3 is below the current EMA3. Sell Signals: The strategy generates a sell signal when the RSI is above 70. Risk Management: Minimal ROI: The strategy sets a minimal return on investment (ROI) for each trade. The ROI values decrease over time, indicating a gradual exit from positions. Stop Loss: The strategy sets a fixed stop loss at -10% to limit losses. Trailing Stop: The strategy uses a trailing stop to protect profits. It has a positive offset of 0.5% and activates only after the offset is reached. Timeframe: The strategy is designed to be used on a 5-minute timeframe. Plotting: The strategy provides a visualization of the Bollinger Bands (lower, middle, and upper) and the Money Flow Index (MFI) indicator. This strategy aims to identify buying opportunities based on oversold conditions and bullish trends, while also considering volatility using Bollinger Bands. It implements risk management measures such as stop loss and trailing stop to control downside risk and protect profits.

Exponential Moving Averages (EMA): The strategy calculates four EMAs with different time periods (100, 200, 20, and 25) based on the closing price of the asset.

Choppiness Index: The strategy calculates the Choppiness Index indicator based on the price data.

Buy Signals: The strategy generates buy signals under the following conditions: When the MFI (Money Flow Index) is below 20, RSI is below 37, EMA2 is below EMA1, and the closing price is below the lower Bollinger Band. When the closing price has a bullish trend (previous two candles have lower prices than the current candle), the Choppiness Index is increasing, RSI is between 55 and 65, and the previous EMA3 is below the current EMA3. Sell Signals: The strategy generates a sell signal when the RSI is above 70. Risk Management: Minimal ROI: The strategy sets a minimal return on investment (ROI) for each trade. The ROI values decrease over time, indicating a gradual exit from positions. Stop Loss: The strategy sets a fixed stop loss at -10% to limit losses. Trailing Stop: The strategy uses a trailing stop to protect profits. It has a positive offset of 0.5% and activates only after the offset is reached. Timeframe: The strategy is designed to be used on a 5-minute timeframe. Plotting: The strategy provides a visualization of the Bollinger Bands (lower, middle, and upper) and the Money Flow Index (MFI) indicator. This strategy aims to identify buying opportunities based on oversold conditions and bullish trends, while also considering volatility using Bollinger Bands. It implements risk management measures such as stop loss and trailing stop to control downside risk and protect profits.

startup_candle_count : 50 rsi: 0.539% ema3: -0.010% ema4: -0.016%

Unable to parse Traceback (Logfile Exceeded Limit)

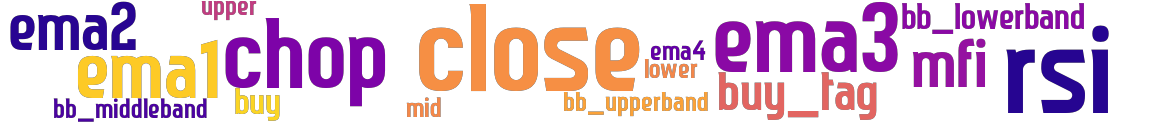

stoploss: -0.1 timeframe: 5m hash(sha256): 5f895582c33590c2ba397788d14bb9a349de8f0437560f267464c25fa16194b6 indicators: ema2 upper mid lower bb_middleband rsi chop close ema4 bb_upperband ema1 mfi bb_lowerband buy buy_tag ema3

No similar strategies found. (based on used indicators)

last change: 2025-01-08 20:09:09