Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "WhenLambo" strategy is a trading strategy that uses various indicators and conditions to generate buy and sell signals for backtesting purposes. Here is a brief explanation of its important parts:

populate_indicators:

This function calculates and populates different indicators such as moving averages (MA), Exponential Moving Averages (EMA), Heikin Ashi candlesticks, EWO (Elliott Wave Oscillator), and RSI (Relative Strength Index) based on the provided data. It also calculates HMA (Hull Moving Average) for different timeframes.

populate_buy_trend: This function defines the conditions for generating buy signals.

It uses several conditions, including the bullish MACD crossover, HMA crossover, RSI below a certain threshold, and the price crossing below the moving average with specific offsets.

If any of the conditions are met, the "buy" column in the dataframe is set to 1, indicating a buy signal. populate_sell_trend: This function defines the conditions for generating sell signals. It uses conditions such as the bearish HMA crossover and MACD crossover, indicating potential downtrends. If any of the conditions are met, the "sell" column in the dataframe is set to 1, indicating a sell signal. The strategy combines different indicators and conditions to determine the optimal times to enter or exit trades. It utilizes moving averages, MACD, RSI, and HMA crossovers to identify potential trends and reversals in the market. The buy and sell signals are generated based on these conditions, which can be used for backtesting and evaluating the strategy's performance.

populate_buy_trend: This function defines the conditions for generating buy signals.

It uses several conditions, including the bullish MACD crossover, HMA crossover, RSI below a certain threshold, and the price crossing below the moving average with specific offsets.

If any of the conditions are met, the "buy" column in the dataframe is set to 1, indicating a buy signal. populate_sell_trend: This function defines the conditions for generating sell signals. It uses conditions such as the bearish HMA crossover and MACD crossover, indicating potential downtrends. If any of the conditions are met, the "sell" column in the dataframe is set to 1, indicating a sell signal. The strategy combines different indicators and conditions to determine the optimal times to enter or exit trades. It utilizes moving averages, MACD, RSI, and HMA crossovers to identify potential trends and reversals in the market. The buy and sell signals are generated based on these conditions, which can be used for backtesting and evaluating the strategy's performance.

startup_candle_count : 200 Recursive Analysis found no issues while using 200 startup_candle_count

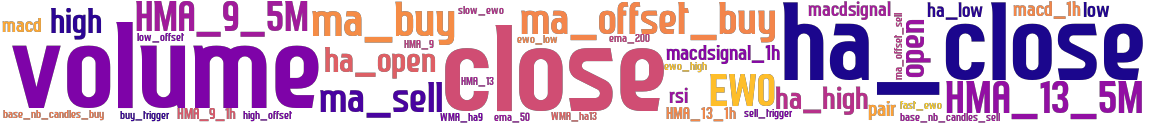

stoploss: -0.5 timeframe: 5m hash(sha256): 8415348ea3533104eda8a99c498f6dba2c30361c373e4ce53361a3ecaa2cb811 indicators: WMA_ha9 HMA_9 EWO ha_low ewo_high close ewo_low ma_offset_buy HMA_9_1h macd_1h HMA_13_1h macdsignal_1h volume low_offset ma_buy high_offset HMA_13_5M open HMA_9_5M base_nb_candles_buy ha_open high macdsignal HMA_13 fast_ewo slow_ewo ma_offset_sell ha_close sell_trigger macd base_nb_candles_sell WMA_ha13 ma_sell ha_high rsi buy_trigger low

No similar strategies found. (based on used indicators)

last change: 2023-07-05 06:59:35