You will be redirected to the original Strategy in 15 seconds.

The SMAOffsetPlusDemon strategy is a trading strategy that uses a combination of technical indicators to generate buy and sell signals. Here is a short description of what the strategy does:

It calculates several indicators for the trading pair (e.g., BTC/USDT) on a 5-minute timeframe. PLUS_DI and MINUS_DI are indicators that measure the directional movement.

CMF (Chaikin Money Flow) is a volume-based indicator that measures buying and selling pressure.

SMA (Simple Moving Average) with time periods of 50 and 200 are calculated.

RSI (Relative Strength Index) is calculated with a time period of 14. Bollinger Bands are calculated using a window of 20 and 2 standard deviations. The strategy checks various conditions to determine when to enter a buy position: The close price is below the 30-period SMA multiplied by a low offset value. The volume is greater than zero. The BTC SMA delta (percentage difference between the 50-period and 200-period SMAs) is greater than -2. Several conditions related to indicators being below or above certain values, such as CMF, PLUS_DI, and RSI. Conditions related to the close price being below the 97.5% or 70% of the lower Bollinger Band and the body percentage being above 70%. Conditions related to the percentage change in price (pct) and previous close price. The strategy generates a buy signal (assigns a value of 1) when all the buy conditions are met. The strategy also generates a sell signal when the close price is above the 30-period SMA multiplied by a high offset value and the volume is greater than zero. Overall, the strategy aims to identify potential buying opportunities based on a combination of price, volume, and technical indicators, while considering various conditions for entry and exit signals.

CMF (Chaikin Money Flow) is a volume-based indicator that measures buying and selling pressure.

SMA (Simple Moving Average) with time periods of 50 and 200 are calculated.

RSI (Relative Strength Index) is calculated with a time period of 14. Bollinger Bands are calculated using a window of 20 and 2 standard deviations. The strategy checks various conditions to determine when to enter a buy position: The close price is below the 30-period SMA multiplied by a low offset value. The volume is greater than zero. The BTC SMA delta (percentage difference between the 50-period and 200-period SMAs) is greater than -2. Several conditions related to indicators being below or above certain values, such as CMF, PLUS_DI, and RSI. Conditions related to the close price being below the 97.5% or 70% of the lower Bollinger Band and the body percentage being above 70%. Conditions related to the percentage change in price (pct) and previous close price. The strategy generates a buy signal (assigns a value of 1) when all the buy conditions are met. The strategy also generates a sell signal when the close price is above the 30-period SMA multiplied by a high offset value and the volume is greater than zero. Overall, the strategy aims to identify potential buying opportunities based on a combination of price, volume, and technical indicators, while considering various conditions for entry and exit signals.

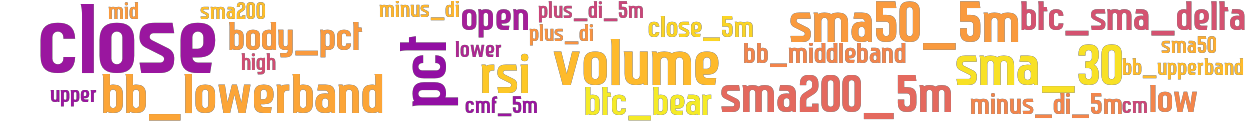

stoploss: -0.2 timeframe: 5m hash(sha256): 5cc4431b48447641cd9657ec561aa762f80837075e25219e62bba9ba000072e7 indicators: body_pct upper close btc_sma_delta minus_di_5m bb_lowerband volume open plus_di_5m plus_di pct cmf_5m high mid sma50 sma50_5m btc_bear minus_di lower cm sma_30 bb_middleband rsi sma200_5m bb_upperband low close_5m sma200

Similar Strategies: (based on used indicators)

Strategy: CHTP_vtest, Similarity Score: 93.1%

last change: 2022-07-26 23:08:24