The "MRHUMAN" strategy is a trading strategy implemented in Python using the Freqtrade library. It uses various technical indicators to make buy and sell decisions for trading. Here's a breakdown of the important parts of the strategy:

Indicators:

MACD: Calculates the Moving Average Convergence Divergence indicator and adds the MACD line, MACD signal line, and MACD histogram to the dataframe.

CCI: Calculates the Commodity Channel Index and adds it to the dataframe.

RSI: Calculates the Relative Strength Index and adds it to the dataframe.

EMA: Calculates Exponential Moving Averages with different time periods (30, 60, and 360) and adds them to the dataframe. Smooth: Calculates the smoothed RSI using a 5-period EMA and adds it to the dataframe. Bollinger Bands: Calculates the Bollinger Bands using a window of 20 and 2 standard deviations and adds the lower and upper bands to the dataframe. ADX: Calculates the Average Directional Index and adds it to the dataframe. +DI and -DI: Calculates the Plus Directional Indicator and Minus Directional Indicator and adds them to the dataframe. Buy Trend: The strategy identifies three different buy conditions: Down: When ADX is above 20, plus DI is lower than minus DI, MACD is below the MACD signal, CCI is below -28, smoothed RSI is below 32, and the low price is below the lower Bollinger Band. Side: When ADX is below 20, MACD is below the MACD signal, CCI is below 53, smoothed RSI is below 30, and the low price is below the lower Bollinger Band. Up: When ADX is above 20, plus DI is higher than minus DI, MACD is below the MACD signal, CCI is below 34, smoothed RSI is below 46, and the low price is below the lower Bollinger Band. If any of these conditions are met, a buy signal (1) is generated for the corresponding candle in the dataframe. Sell Trend: The strategy identifies three different sell conditions: Down: When ADX is above 20, plus DI is lower than minus DI, MACD is above the MACD signal, and smoothed RSI is above 72. Side: When ADX is below 20, MACD is above the MACD signal, and smoothed RSI is above 37. Up: When ADX is above 20, plus DI is higher than minus DI, MACD is above the MACD signal, and smoothed RSI is above 96. If any of these conditions are met, a sell signal (1) is generated for the corresponding candle in the dataframe. The strategy also defines parameters such as the ROI table, stop loss value, trailing stop settings, and the timeframe for the backtesting. Please note that this description provides a general understanding of the strategy, but it's recommended to refer to the actual code and documentation for more detailed information and usage instructions.

CCI: Calculates the Commodity Channel Index and adds it to the dataframe.

RSI: Calculates the Relative Strength Index and adds it to the dataframe.

EMA: Calculates Exponential Moving Averages with different time periods (30, 60, and 360) and adds them to the dataframe. Smooth: Calculates the smoothed RSI using a 5-period EMA and adds it to the dataframe. Bollinger Bands: Calculates the Bollinger Bands using a window of 20 and 2 standard deviations and adds the lower and upper bands to the dataframe. ADX: Calculates the Average Directional Index and adds it to the dataframe. +DI and -DI: Calculates the Plus Directional Indicator and Minus Directional Indicator and adds them to the dataframe. Buy Trend: The strategy identifies three different buy conditions: Down: When ADX is above 20, plus DI is lower than minus DI, MACD is below the MACD signal, CCI is below -28, smoothed RSI is below 32, and the low price is below the lower Bollinger Band. Side: When ADX is below 20, MACD is below the MACD signal, CCI is below 53, smoothed RSI is below 30, and the low price is below the lower Bollinger Band. Up: When ADX is above 20, plus DI is higher than minus DI, MACD is below the MACD signal, CCI is below 34, smoothed RSI is below 46, and the low price is below the lower Bollinger Band. If any of these conditions are met, a buy signal (1) is generated for the corresponding candle in the dataframe. Sell Trend: The strategy identifies three different sell conditions: Down: When ADX is above 20, plus DI is lower than minus DI, MACD is above the MACD signal, and smoothed RSI is above 72. Side: When ADX is below 20, MACD is above the MACD signal, and smoothed RSI is above 37. Up: When ADX is above 20, plus DI is higher than minus DI, MACD is above the MACD signal, and smoothed RSI is above 96. If any of these conditions are met, a sell signal (1) is generated for the corresponding candle in the dataframe. The strategy also defines parameters such as the ROI table, stop loss value, trailing stop settings, and the timeframe for the backtesting. Please note that this description provides a general understanding of the strategy, but it's recommended to refer to the actual code and documentation for more detailed information and usage instructions.

Unable to parse Traceback (Logfile Exceeded Limit)

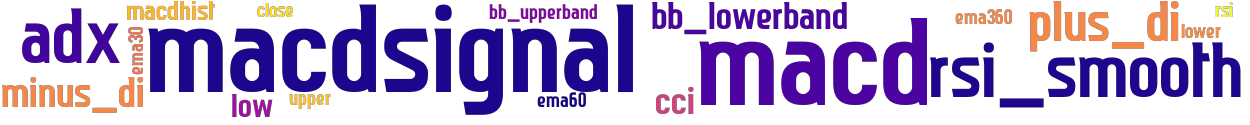

stoploss: -0.292 timeframe: 5m hash(sha256): bca9eaf91b4abf073a7ece8f23acc06d21736bde21e7cbdb4dde69ff9909c2a9 indicators: macdsignal ema30 ema360 lower upper adx minus_di ema60 rsi_smooth rsi cci close macd bb_lowerband bb_upperband low plus_di macdhist

No similar strategies found. (based on used indicators)

last change: 2025-01-14 09:31:19