Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "ClucHAnix_hhll" strategy is a trading strategy that uses various technical indicators to generate buy and sell signals. Here is a breakdown of what the strategy does:

It starts by populating a set of indicators based on the provided dataframe and metadata. It calculates Heikin-Ashi candlestick values (open, close, high, low).

It calculates Bollinger Bands and their deltas.

It calculates exponential moving averages (EMAs) and simple moving averages (SMAs).

It calculates the Hull Moving Average (HMA). It calculates the volume-weighted moving average (VWMA). It calculates the Chaikin Money Flow (CMF). It calculates other indicators such as RSI, Fisher Transform, rate of change (ROCR), highest high (HH), lowest low (LL), etc. It populates the buy trend based on specific conditions. It checks for conditions such as ROCR values, Bollinger Bands, candlestick patterns, and other indicators. If the conditions are met, it marks the corresponding row as a buy signal. It populates the sell trend based on specific conditions. It checks for conditions such as Fisher Transform values, candlestick patterns, moving averages, RSI, and volume. If the conditions are met, it marks the corresponding row as a sell signal. It calculates the volume-weighted moving average (VWMA) and its rate of change. It calculates the VWMA based on the provided dataframe. It calculates the rate of change of the slow VWMA. It calculates the rolling percentage change maximum across a given interval. It calculates the percentage change between high and low or open and close prices. The length of the interval determines the look-back period. Overall, the strategy combines various indicators and conditions to generate buy and sell signals based on the provided data. It utilizes candlestick patterns, moving averages, price and volume relationships, and other technical indicators to make trading decisions.

It calculates Bollinger Bands and their deltas.

It calculates exponential moving averages (EMAs) and simple moving averages (SMAs).

It calculates the Hull Moving Average (HMA). It calculates the volume-weighted moving average (VWMA). It calculates the Chaikin Money Flow (CMF). It calculates other indicators such as RSI, Fisher Transform, rate of change (ROCR), highest high (HH), lowest low (LL), etc. It populates the buy trend based on specific conditions. It checks for conditions such as ROCR values, Bollinger Bands, candlestick patterns, and other indicators. If the conditions are met, it marks the corresponding row as a buy signal. It populates the sell trend based on specific conditions. It checks for conditions such as Fisher Transform values, candlestick patterns, moving averages, RSI, and volume. If the conditions are met, it marks the corresponding row as a sell signal. It calculates the volume-weighted moving average (VWMA) and its rate of change. It calculates the VWMA based on the provided dataframe. It calculates the rate of change of the slow VWMA. It calculates the rolling percentage change maximum across a given interval. It calculates the percentage change between high and low or open and close prices. The length of the interval determines the look-back period. Overall, the strategy combines various indicators and conditions to generate buy and sell signals based on the provided data. It utilizes candlestick patterns, moving averages, price and volume relationships, and other technical indicators to make trading decisions.

Unable to parse Traceback (Logfile Exceeded Limit)

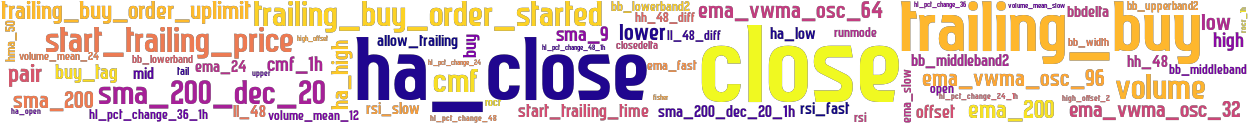

stoploss: -0.99 timeframe: 5m hash(sha256): 7b3b26ebb278fde1a39e924a596f533562f2f861281bb79f8d305d3fd9ac26ff indicators: rocr_1h cmf_1h hh_48 upper hh_48_diff ha_low ll_48 ema_200 hl_pct_change_36 close high_offset_2 tail ll_48_diff bb_lowerband volume_mean_12 bbdelta ema_vwma_osc_32 hh_48_dif rsi_fast bb_middleband2 volume hl_pct_change_24 hl_pct_change_48 sma_200_dec_20 closedelta sma_200_dec_20_1h high_offset rocr open ema_fast hl_pct_change_48_1h volume_mean_slow buy_tag ha_open bb_upperband2 fisher volume_mean_24 high sma_200 mid hl_pct_change_36_1h ema_24 bb_width ema_vwma_osc_64 ha_close cmf hma_50 buy sma_

Similar Strategies: (based on used indicators)

Strategy: ClucHAnix_hhll_Futures3, Similarity Score: 86%

Strategy: ClucHAnix_hhll_Futures_2, Similarity Score: 86%

Strategy: ClucHAnix_hhll_tures, Similarity Score: 86%

Strategy: ClucHAnix_hhll_Futures_2_2, Similarity Score: 84%

last change: 2025-06-02 00:13:55