You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix strategy is a trading strategy that uses various indicators and conditions to determine buy and sell signals. Here is a short description of what the strategy does:

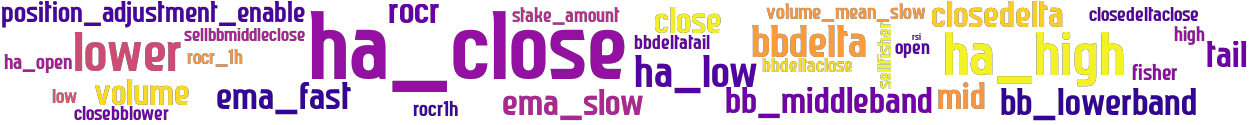

In the populate_indicators method, the strategy populates the dataframe with several indicators such as Heikin-Ashi candles, Bollinger Bands, exponential moving averages (EMAs), RSI (Relative Strength Index), and more. It also retrieves additional informative data for a different timeframe.

The populate_buy_trend method populates the dataframe with buy signals based on certain conditions.

These conditions include the rate of change (ROC), Bollinger Bands, candlestick patterns, and exponential moving averages.

If the conditions are met, a "buy" signal is assigned to the corresponding rows. The populate_sell_trend method populates the dataframe with sell signals based on specific conditions. These conditions involve the Fisher Transform indicator, candlestick patterns, exponential moving averages, and volume. If the conditions are satisfied, a "sell" signal is assigned to the respective rows. The ClucDCA class extends the ClucHAnix strategy, likely adding additional functionality or modifications specific to a dollar-cost averaging (DCA) approach. Overall, the strategy combines multiple indicators and conditions to generate buy and sell signals for trading.

The populate_buy_trend method populates the dataframe with buy signals based on certain conditions.

These conditions include the rate of change (ROC), Bollinger Bands, candlestick patterns, and exponential moving averages.

If the conditions are met, a "buy" signal is assigned to the corresponding rows. The populate_sell_trend method populates the dataframe with sell signals based on specific conditions. These conditions involve the Fisher Transform indicator, candlestick patterns, exponential moving averages, and volume. If the conditions are satisfied, a "sell" signal is assigned to the respective rows. The ClucDCA class extends the ClucHAnix strategy, likely adding additional functionality or modifications specific to a dollar-cost averaging (DCA) approach. Overall, the strategy combines multiple indicators and conditions to generate buy and sell signals for trading.

stoploss: -0.99 timeframe: 1m hash(sha256): 7f642eda493e5eb15b8684fc939cbc68dfc38152f619cd5dd1b2f19f50aa57b8

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08