You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix strategy is a backtesting strategy that uses various technical indicators to generate buy and sell signals for trading. Here's a breakdown of what the strategy does:

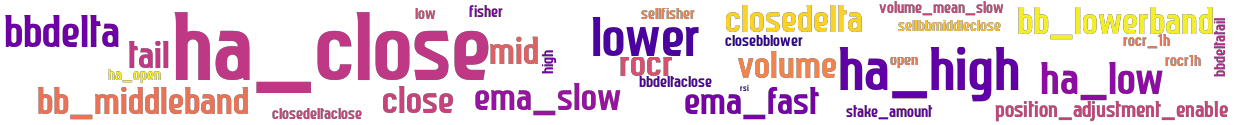

In the populate_indicators method, the strategy calculates and adds several indicators to the input dataframe, including Heikin-Ashi candles, Bollinger Bands, price deltas, tails, exponential moving averages (EMA), ROCR (Rate of Change Ratio), RSI (Relative Strength Index), and Fisher Transform. The strategy retrieves informative data on a higher timeframe (1 hour) and merges it with the current timeframe data using the merge_informative_pair function.

In the populate_buy_trend method, the strategy determines the conditions for a buy signal.

It checks if the ROCR on the higher timeframe is above a specified threshold, and then evaluates additional conditions involving Bollinger Bands, price deltas, tails, and exponential moving averages.

If all conditions are met, a 'buy' signal is generated. In the populate_sell_trend method, the strategy determines the conditions for a sell signal. It checks if the Fisher Transform value is above a specified threshold and evaluates conditions involving the previous and current candle's high and close prices, the fast EMA, Bollinger Bands, and volume. If all conditions are met, a 'sell' signal is generated. The ClucDCA class extends the ClucHAnix class, indicating that it is a modified version of the original strategy with additional functionality. Overall, the ClucHAnix strategy combines multiple indicators to generate buy and sell signals based on specific conditions.

In the populate_buy_trend method, the strategy determines the conditions for a buy signal.

It checks if the ROCR on the higher timeframe is above a specified threshold, and then evaluates additional conditions involving Bollinger Bands, price deltas, tails, and exponential moving averages.

If all conditions are met, a 'buy' signal is generated. In the populate_sell_trend method, the strategy determines the conditions for a sell signal. It checks if the Fisher Transform value is above a specified threshold and evaluates conditions involving the previous and current candle's high and close prices, the fast EMA, Bollinger Bands, and volume. If all conditions are met, a 'sell' signal is generated. The ClucDCA class extends the ClucHAnix class, indicating that it is a modified version of the original strategy with additional functionality. Overall, the ClucHAnix strategy combines multiple indicators to generate buy and sell signals based on specific conditions.

stoploss: -0.99 timeframe: 1m hash(sha256): 22ce1c9236fc8e4f7c5098e39622988b3a885ba3ce9a5cf249188b32fee7836b

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-12 08:13:20