The CCIStrategy is a trading strategy that uses several technical indicators to generate buy and sell signals for cryptocurrency trading. Here is a brief explanation of what the strategy does:

Indicator Calculation: The strategy calculates various technical indicators such as CCI (Commodity Channel Index), RSI (Relative Strength Index), MFI (Money Flow Index), and Chaikin Money Flow (CMF) using historical price data. Resampling: The strategy resamples the original price data to a different time interval, which helps identify trends and filter out noise in the data.

It calculates moving averages of different periods (short, medium, long) based on the resampled data.

Buy Signal: The strategy generates a buy signal when certain conditions are met, including low values of CCI, negative CMF, and low values of MFI.

Additionally, it checks for an uptrend confirmation by comparing the resampled moving averages. Sell Signal: The strategy generates a sell signal when certain conditions are met, including high values of CCI, positive CMF, and a crossing of the resampled moving averages. Additional Function: The strategy includes a function called "chaikin_mf" that calculates the Chaikin Money Flow indicator based on the provided data. Overall, the CCIStrategy combines multiple indicators to identify potential entry and exit points for cryptocurrency trades, aiming for a minimal ROI (return on investment) and implementing a stop loss mechanism to manage risk.

It calculates moving averages of different periods (short, medium, long) based on the resampled data.

Buy Signal: The strategy generates a buy signal when certain conditions are met, including low values of CCI, negative CMF, and low values of MFI.

Additionally, it checks for an uptrend confirmation by comparing the resampled moving averages. Sell Signal: The strategy generates a sell signal when certain conditions are met, including high values of CCI, positive CMF, and a crossing of the resampled moving averages. Additional Function: The strategy includes a function called "chaikin_mf" that calculates the Chaikin Money Flow indicator based on the provided data. Overall, the CCIStrategy combines multiple indicators to identify potential entry and exit points for cryptocurrency trades, aiming for a minimal ROI (return on investment) and implementing a stop loss mechanism to manage risk.

Unable to parse Traceback (Logfile Exceeded Limit)

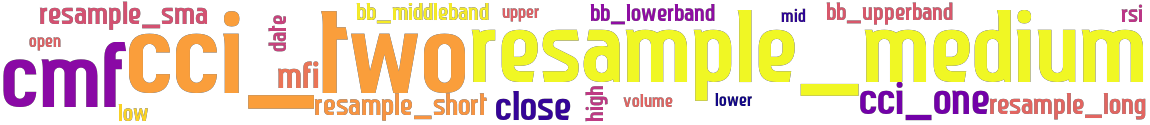

stoploss: -0.02 timeframe: 1m hash(sha256): 240903388d6a07204efec46718e09b162841f9888ec4b24e64cfe4f0f2553da1 indicators: resample_medium upper resample_long cci_one close mfi bb_lowerband volume resample_short date high mid cmf open high low close lower cm bb_middleband rsi bb_upperband resample_sma low cci_two

Similar Strategies: (based on used indicators)

Strategy: CCIStrategy_124, Similarity Score: 96.15%

Strategy: CCIStrategy_2, Similarity Score: 96.15%

Strategy: CCIStrategy_263, Similarity Score: 96.15%

Strategy: CCIStrategy_3, Similarity Score: 96.15%

Strategy: CCIStrategy_5, Similarity Score: 96.15%

Strategy: tSmoothScalp20230110, Similarity Score: 96.15%

Strategy: ZBCDstra, Similarity Score: 88.46%

last change: 2025-01-13 17:32:33