Strategy: BinHV27_long

Downloaded: 20220522

Stoploss: -0.99

Downloaded: 20220522

Stoploss: -0.99

| Strategy | Buys | Avg Prof% | Cum Prof% | Tot Prof% | Tot Profit% | Avg Duration | Win | Draw | Loss | Win% | DD Stake | DD% | Time | Stake | Exchange | Stoploss | Sharpe | Sortino | Calmar | Month | Stats | sha256 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BinHV27_long | 159 | -0.61 | -97.78 | -293.633 | -29.36 | 4:04:00 | 94 | 0 | 65 | 59.1 | 350.054 | 34.53 | 92.9 | USDT | binance | -5.55 | -5.55 | -5.52 | -2.94 | 202201 | |||

| BinHV27_long | 165 | -0.29 | -47.37 | -142.259 | -14.23 | 3:57:00 | 106 | 0 | 59 | 64.2 | 236.437 | 21.61 | 93.6 | USDT | binance | -6.43 | -6.43 | -6.49 | -4.48 | 202202 | |||

| BinHV27_long | 196 | -0.06 | -12.09 | -36.3143 | -3.63 | 3:55:00 | 123 | 0 | 73 | 62.8 | 183.529 | 17.58 | 104.3 | USDT | binance | -1.48 | -1.48 | -1.8 | -2.96 | 202203 | |||

| BinHV27_long | 181 | -0.4 | -73.22 | -219.884 | -21.99 | 4:17:00 | 101 | 0 | 80 | 55.8 | 262.773 | 25.2 | 104.9 | USDT | binance | -5.86 | -5.86 | -6.04 | -3.87 | 202204 | |||

| BinHV27_long | 174 | -0.33 | -57.47 | -172.585 | -17.26 | 3:11:00 | 120 | 0 | 54 | 69 | 246.473 | 23.89 | 84 | USDT | binance | -2.64 | -2.64 | -2.83 | -3.84 | 202205 | |||

| BinHV27_long | 170 | -0.31 | -51.94 | -155.986 | -15.6 | 3:38:00 | 116 | 0 | 54 | 68.2 | 228.628 | 22.94 | 91.4 | USDT | binance | -1.86 | -1.86 | -2.35 | -4.27 | 202206 | |||

| BinHV27_long | 174 | 0.01 | 2.26 | 6.80152 | 0.68 | 3:47:00 | 106 | 0 | 68 | 60.9 | 80.93 | 8.05 | 82.7 | USDT | binance | 0.75 | 0.75 | 1.04 | 3.5 | 202207 | |||

| BinHV27_long | 213 | -0.08 | -16.19 | -48.6314 | -4.86 | 3:51:00 | 140 | 0 | 73 | 65.7 | 155.373 | 14.04 | 100.3 | USDT | binance | -1.41 | -1.41 | -1.67 | -4.06 | 202208 | |||

| BinHV27_long | 163 | -0.16 | -26.69 | -80.1419 | -8.01 | 4:19:00 | 104 | 0 | 59 | 63.8 | 134.536 | 13.16 | 86.9 | USDT | binance | -2.33 | -2.33 | -2.67 | -5.42 | 202209 | |||

| BinHV27_long | 183 | -0.11 | -20.72 | -62.2258 | -6.22 | 4:18:00 | 101 | 0 | 82 | 55.2 | 112.318 | 11.26 | 97.5 | USDT | binance | -2.79 | -2.79 | -3.3 | -4.59 | 202210 | |||

| BinHV27_long | 181 | -0.03 | -5.21 | -15.6495 | -1.56 | 4:10:00 | 126 | 0 | 55 | 69.6 | 115.981 | 11.03 | 103.2 | USDT | binance | 0.19 | 0.19 | 0.23 | -0.01 | 202211 | |||

| BinHV27_long | 214 | -0.23 | -48.59 | -145.919 | -14.59 | 4:13:00 | 118 | 0 | 96 | 55.1 | 181.474 | 17.52 | 119.9 | USDT | binance | -5.39 | -5.39 | -5.45 | -5.05 | 202212 | |||

| BinHV27_long | 209 | 0.16 | 33.04 | 99.2148 | 9.92 | 4:00:00 | 140 | 0 | 69 | 67 | 50.421 | 4.46 | 116.1 | USDT | binance | 3.93 | 3.93 | 5.73 | 59.73 | 202301 | |||

| BinHV27_long | 218 | -0.18 | -39.76 | -119.327 | -9.18 | 3:42:00 | 141 | 0 | 77 | 64.7 | 198.635 | 14.98 | 112.7 | USDT | binance | -14.1 | -14.1 | -12.25 | -41.82 | 202302 | |||

| BinHV27_long | 203 | -0.16 | -32.28 | -96.9533 | -7.46 | 4:14:00 | 127 | 0 | 76 | 62.6 | 215.532 | 16.46 | 142.4 | USDT | binance | -11.1 | -11.1 | -9.98 | -27.92 | 202303 | |||

| BinHV27_long | 234 | -0.12 | -27.36 | -82.1567 | -6.32 | 4:15:00 | 147 | 0 | 87 | 62.8 | 170.564 | 12.4 | 134.2 | USDT | binance | -11.12 | -11.12 | -9.42 | -32.45 | 202304 | |||

| BinHV27_long | 242 | -0.14 | -34.9 | -104.779 | -8.06 | 4:30:00 | 142 | 0 | 100 | 58.7 | 122.32 | 9.29 | 141.7 | USDT | binance | -15.11 | -15.11 | -12.79 | -53.49 | 202305 | |||

| BinHV27_long | 223 | -0.44 | -98.9 | -296.962 | -22.84 | 4:27:00 | 125 | 0 | 98 | 56.1 | 332.021 | 25.59 | 138.4 | USDT | binance | -22.16 | -22.16 | -16.52 | -56.84 | 202306 | |||

| BinHV27_long | 255 | -0.22 | -56.74 | -170.368 | -13.11 | 4:13:00 | 134 | 0 | 121 | 52.5 | 189.391 | 14.36 | 105.5 | USDT | binance | -24.6 | -24.6 | -21.82 | -58.13 | 202307 | |||

| BinHV27_long | 287 | -0.38 | -110.29 | -331.023 | -25.46 | 4:04:00 | 133 | 0 | 154 | 46.3 | 328.999 | 25.35 | 111.7 | USDT | binance | -35.71 | -35.71 | -29.01 | -61.91 | 202308 | |||

| BinHV27_long | 252 | -0.2 | -49.18 | -147.644 | -11.36 | 4:28:00 | 139 | 0 | 113 | 55.2 | 150.409 | 11.55 | 106.3 | USDT | binance | -29.09 | -29.09 | -29.91 | -64.75 | 202309 | |||

| BinHV27_long | 266 | -0.04 | -11.57 | -34.7251 | -2.67 | 4:11:00 | 160 | 0 | 106 | 60.2 | 137.045 | 10.43 | 125.1 | USDT | binance | -5.71 | -5.71 | -5.31 | -15.79 | 202310 | |||

| BinHV27_long | 309 | 0.15 | 45.11 | 135.443 | 10.42 | 3:32:00 | 205 | 0 | 104 | 66.3 | 89.036 | 5.94 | 121.6 | USDT | binance | 20.38 | 20.38 | 19.22 | 115.64 | 202311 | |||

| BinHV27_long | 267 | -0.12 | -32.86 | -98.6403 | -7.59 | 3:51:00 | 162 | 0 | 105 | 60.7 | 134.035 | 10.24 | 125.5 | USDT | binance | -12.19 | -12.19 | -11.44 | -47.19 | 202312 | |||

| BinHV27_long | 229 | -0.25 | -56.3 | -168.991 | -13 | 3:58:00 | 133 | 0 | 96 | 58.1 | 202.747 | 15.35 | 112.4 | USDT | binance | -19.34 | -19.34 | -18.58 | -53.95 | 202401 | |||

| BinHV27_long | 266 | 0.05 | 14.37 | 43.1638 | 3.32 | 3:43:00 | 179 | 0 | 87 | 67.3 | 97.938 | 7.38 | 99.7 | USDT | binance | 6.8 | 6.8 | 5.76 | 29.63 | 202402 | |||

| BinHV27_long | 333 | 0.28 | 93.81 | 281.567 | 21.66 | 2:54:00 | 240 | 0 | 93 | 72.1 | 102.074 | 6.6 | 58.5 | USDT | binance | 37.17 | 37.17 | 31.92 | 209 | 202403 | |||

| BinHV27_long | 192 | -0.54 | -103.41 | -310.388 | -23.88 | 3:56:00 | 121 | 0 | 71 | 63 | 325.81 | 25.29 | 50.4 | USDT | binance | -21.75 | -21.75 | -16.69 | -62.2 | 202404 | |||

| BinHV27_long | 237 | -0.13 | -31.73 | -95.2231 | -7.32 | 4:13:00 | 126 | 0 | 111 | 53.2 | 121.036 | 9.2 | 65.6 | USDT | binance | -15.53 | -15.53 | -16.83 | -50.71 | 202405 | |||

| BinHV27_long | 243 | -0.26 | -63.68 | -191.186 | -14.71 | 4:07:00 | 130 | 0 | 113 | 53.5 | 224.023 | 16.89 | 60 | USDT | binance | -25.19 | -25.19 | -24.22 | -57.37 | 202406 | |||

| BinHV27_long | 236 | -0.21 | -50.14 | -150.517 | -11.58 | 3:49:00 | 142 | 0 | 94 | 60.2 | 195.115 | 14.95 | 59 | USDT | binance | -17.42 | -17.42 | -15.02 | -49.34 | 202407 | |||

| BinHV27_long | 189 | -0.41 | -77.22 | -231.814 | -17.83 | 4:02:00 | 124 | 0 | 65 | 65.6 | 246.219 | 18.93 | 49.7 | USDT | binance | -18.79 | -18.79 | -14.07 | -62.05 | 202408 | |||

| BinHV27_long | 223 | 0.1 | 22.43 | 67.3584 | 5.18 | 3:57:00 | 141 | 0 | 82 | 63.2 | 70.432 | 5.33 | 55.5 | USDT | binance | 13.85 | 13.85 | 14.3 | 66.34 | 202409 | |||

| BinHV27_long | 198 | -0.13 | -25.27 | -75.9045 | -5.84 | 4:22:00 | 121 | 0 | 77 | 61.1 | 91.704 | 7.1 | 55.4 | USDT | binance | -10.75 | -10.75 | -11.11 | -52.4 | 202410 | |||

| BinHV27_long | 214 | 0.09 | 19.47 | 58.4623 | 4.5 | 3:31:00 | 145 | 0 | 69 | 67.8 | 105.738 | 7.39 | 48.3 | USDT | binance | 7.66 | 7.66 | 7.07 | 40.07 | 202411 | |||

| BinHV27_long | 241 | -0.07 | -17.97 | -53.9313 | -4.15 | 3:35:00 | 159 | 0 | 82 | 66 | 187.442 | 13.31 | 54.4 | USDT | binance | -6.32 | -6.32 | -6.27 | -19.85 | 202412 | |||

| BinHV27_long | 190 | -0.34 | -65.42 | -196.473 | -15.11 | 4:06:00 | 122 | 0 | 68 | 64.2 | 275.931 | 20.08 | 50.2 | USDT | binance | -16.75 | -16.75 | -14.11 | -46.39 | 202501 | |||

| BinHV27_long | 140 | -0.43 | -60.83 | -182.599 | -18.26 | 3:44:00 | 88 | 0 | 52 | 62.9 | 182.949 | 18.29 | 40.5 | USDT | binance | -15.16 | -15.16 | -11.43 | -68.13 | 202502 | |||

| BinHV27_long | 219 | -0.27 | -60.16 | -180.696 | -13.9 | 4:00:00 | 127 | 0 | 92 | 58 | 212.296 | 16.21 | 55.7 | USDT | binance | -18.29 | -18.29 | -16.36 | -54.62 | 202503 | |||

| BinHV27_long | 187 | -0.58 | -107.78 | -323.602 | -24.89 | 4:06:00 | 106 | 0 | 81 | 56.7 | 342.992 | 26.31 | 51.4 | USDT | binance | -22.57 | -22.57 | -17.3 | -62.34 | 202504 | |||

| BinHV27_long | 207 | -0.27 | -56.2 | -168.721 | -12.98 | 4:10:00 | 115 | 0 | 92 | 55.6 | 194.783 | 14.7 | 55.1 | USDT | binance | -21.19 | -21.19 | -22.88 | -56.23 | 202505 | |||

| BinHV27_long | 205 | -0.09 | -19.16 | -57.4905 | -4.42 | 4:21:00 | 129 | 0 | 76 | 62.9 | 149.769 | 11.4 | 56.4 | USDT | binance | -8.04 | -8.04 | -7.66 | -26.47 | 202506 | |||

| BinHV27_long | 275 | 0.15 | 40.69 | 122.221 | 9.4 | 3:31:00 | 196 | 0 | 79 | 71.3 | 77.898 | 5.19 | 58.3 | USDT | binance | 19.26 | 19.26 | 16.59 | 115.3 | 202507 | |||

| BinHV27_long | 221 | -0.17 | -37.92 | -113.886 | -11.39 | 3:47:00 | 144 | 0 | 77 | 65.2 | 229.77 | 21.76 | 110.7 | BUSD | binance | -2 | -2 | -2.33 | -3.71 | 202201 | |||

| BinHV27_long | 207 | -0.11 | -22.34 | -67.0871 | -6.71 | 3:30:00 | 143 | 0 | 64 | 69.1 | 200.245 | 18.41 | 99.9 | BUSD | binance | -2.32 | -2.32 | -2.81 | -4.61 | 202202 | |||

| BinHV27_long | 312 | 0.25 | 77.96 | 234.119 | 23.41 | 3:33:00 | 221 | 0 | 91 | 70.8 | 80.269 | 7.26 | 137 | BUSD | binance | 4.88 | 4.88 | 9.03 | 102 | 202203 | |||

| BinHV27_long | 251 | -0.13 | -31.57 | -94.8078 | -9.48 | 3:54:00 | 165 | 0 | 86 | 65.7 | 177.905 | 16.43 | 123.8 | BUSD | binance | -2.16 | -2.16 | -2.59 | -4.76 | 202204 | |||

| BinHV27_long | 224 | -0.14 | -30.48 | -91.5381 | -9.15 | 2:54:00 | 157 | 0 | 67 | 70.1 | 301.776 | 28.66 | 97.8 | BUSD | binance | -1.36 | -1.36 | -1.65 | -2.95 | 202205 | |||

| BinHV27_long | 201 | -0.16 | -31.4 | -94.2881 | -9.43 | 3:19:00 | 137 | 0 | 64 | 68.2 | 141.931 | 13.85 | 95.7 | BUSD | binance | -2.07 | -2.07 | -2.68 | -6.19 | 202206 | |||

| BinHV27_long | 238 | 0.09 | 20.79 | 62.4446 | 6.24 | 3:36:00 | 163 | 0 | 75 | 68.5 | 82.232 | 7.38 | 102.8 | BUSD | binance | 1.35 | 1.35 | 1.83 | 10.43 | 202207 | |||

| BinHV27_long | 189 | -0.28 | -52.6 | -157.965 | -15.8 | 3:47:00 | 117 | 0 | 72 | 61.9 | 167.751 | 16.74 | 89.6 | BUSD | binance | -3.78 | -3.78 | -4.04 | -5.39 | 202208 | |||

| BinHV27_long | 210 | -0.13 | -27.06 | -81.2638 | -8.13 | 3:40:00 | 131 | 0 | 79 | 62.4 | 181.019 | 16.46 | 93.1 | BUSD | binance | -1.71 | -1.71 | -1.88 | -3.93 | 202209 | |||

| BinHV27_long | 281 | 0.05 | 12.85 | 38.5798 | 3.86 | 3:32:00 | 174 | 0 | 107 | 61.9 | 91.725 | 8.9 | 116.9 | BUSD | binance | 1.49 | 1.49 | 2.32 | 8.18 | 202210 | |||

| BinHV27_long | 251 | 0.07 | 18.41 | 55.2757 | 5.53 | 3:30:00 | 180 | 0 | 71 | 71.7 | 109.132 | 10.03 | 114.5 | BUSD | binance | 1.67 | 1.67 | 2.2 | 11.27 | 202211 | |||

| BinHV27_long | 239 | -0.31 | -74.08 | -222.476 | -22.25 | 4:10:00 | 132 | 0 | 107 | 55.2 | 256.626 | 24.82 | 127.7 | BUSD | binance | -8.38 | -8.38 | -7.74 | -3.9 | 202212 | |||

| BinHV27_long | 256 | 0.23 | 57.95 | 174.016 | 17.4 | 3:39:00 | 175 | 0 | 81 | 68.4 | 40.576 | 3.42 | 121.3 | BUSD | binance | 6.8 | 6.8 | 13.31 | 241.63 | 202301 | |||

| BinHV27_long | 251 | 0.07 | 17.16 | 51.5397 | 3.96 | 3:28:00 | 176 | 0 | 75 | 70.1 | 157.14 | 11.4 | 115.9 | BUSD | binance | 6.93 | 6.93 | 5.97 | 23.74 | 202302 | |||

| BinHV27_long | 256 | -0.09 | -21.76 | -65.3279 | -5.03 | 3:44:00 | 155 | 0 | 101 | 60.5 | 165.801 | 12.59 | 133.6 | BUSD | binance | -7.51 | -7.51 | -6.34 | -24.6 | 202303 | |||

| BinHV27_long | 283 | -0.07 | -19.45 | -58.4389 | -4.5 | 4:00:00 | 176 | 0 | 107 | 62.2 | 120.78 | 8.93 | 146.4 | BUSD | binance | -8.19 | -8.19 | -7.2 | -32.06 | 202304 | |||

| BinHV27_long | 363 | -0.13 | -45.63 | -136.983 | -10.54 | 3:43:00 | 209 | 0 | 154 | 57.6 | 155.477 | 11.99 | 171.1 | BUSD | binance | -24.68 | -24.68 | -23.74 | -54.14 | 202305 | |||

| BinHV27_long | 368 | -0.05 | -19.19 | -57.5788 | -4.43 | 3:20:00 | 241 | 0 | 127 | 65.5 | 211.523 | 15.33 | 156 | BUSD | binance | -6.99 | -6.99 | -5.03 | -18.4 | 202306 | |||

| BinHV27_long | 420 | -0.06 | -23.16 | -69.5273 | -5.35 | 3:19:00 | 255 | 0 | 165 | 60.7 | 145.484 | 11.05 | 133.8 | BUSD | binance | -12.19 | -12.19 | -13.75 | -29.84 | 202307 | |||

| BinHV27_long | 453 | -0.08 | -34.4 | -103.271 | -7.94 | 3:30:00 | 270 | 0 | 183 | 59.6 | 110.734 | 8.52 | 162.2 | BUSD | binance | -15.83 | -15.83 | -15.06 | -57.48 | 202308 | |||

| BinHV27_long | 388 | 0.02 | 8.8 | 26.4121 | 2.64 | 3:12:00 | 238 | 0 | 150 | 61.3 | 78.466 | 7.75 | 133 | BUSD | binance | 6.59 | 6.59 | 6.13 | 21.71 | 202309 | |||

| BinHV27_long | 383 | 0.06 | 22.7 | 68.157 | 5.24 | 3:17:00 | 254 | 0 | 129 | 66.3 | 142.827 | 10.78 | 139.1 | BUSD | binance | 11.44 | 11.44 | 9.61 | 29.98 | 202310 | |||

| BinHV27_long | 185 | 0.28 | 51.07 | 153.357 | 11.8 | 3:19:00 | 133 | 0 | 52 | 71.9 | 57.02 | 4 | 70 | BUSD | binance | 23.8 | 23.8 | 19.96 | 194.11 | 202311 | |||

| BinHV27_long | 209 | -0.28 | -58.21 | -174.811 | -17.48 | 4:04:00 | 124 | 0 | 85 | 59.3 | 242.707 | 23.85 | 113.4 | USDT | kucoin | -3.25 | -3.25 | -3.73 | -4.07 | 202201 | |||

| BinHV27_long | 235 | 0.06 | 14.22 | 42.6902 | 4.27 | 3:43:00 | 163 | 0 | 72 | 69.4 | 133.472 | 11.93 | 115.5 | USDT | kucoin | -0.1 | -0.1 | -0.15 | -1.42 | 202202 | |||

| BinHV27_long | 225 | -0.01 | -2.28 | -6.85283 | -0.69 | 3:44:00 | 154 | 0 | 71 | 68.4 | 176.286 | 16.83 | 113.5 | USDT | kucoin | -0.86 | -0.86 | -1.05 | -2.71 | 202203 | |||

| BinHV27_long | 208 | -0.36 | -74.24 | -222.929 | -22.29 | 4:20:00 | 121 | 0 | 87 | 58.2 | 274.4 | 26.1 | 119 | USDT | kucoin | -5.89 | -5.89 | -5.9 | -3.72 | 202204 | |||

| BinHV27_long | 257 | -0.01 | -1.51 | -4.52316 | -0.45 | 2:57:00 | 184 | 0 | 73 | 71.6 | 201.16 | 18.96 | 106.1 | USDT | kucoin | -0.38 | -0.38 | -0.48 | -2.18 | 202205 | |||

| BinHV27_long | 193 | -0.17 | -32.57 | -97.8069 | -9.78 | 3:51:00 | 124 | 0 | 69 | 64.2 | 253.6 | 24.35 | 106 | USDT | kucoin | -1.03 | -1.03 | -1.25 | -2.46 | 202206 | |||

| BinHV27_long | 211 | 0.11 | 24.01 | 72.0981 | 7.21 | 3:45:00 | 147 | 0 | 64 | 69.7 | 81.073 | 7.69 | 134.2 | USDT | kucoin | 1.31 | 1.31 | 1.68 | 10.12 | 202207 | |||

| BinHV27_long | 209 | -0.11 | -23.04 | -69.183 | -6.92 | 4:09:00 | 124 | 0 | 85 | 59.3 | 143.609 | 13.57 | 108 | USDT | kucoin | -1.57 | -1.57 | -1.78 | -4.21 | 202208 | |||

| BinHV27_long | 223 | -0.16 | -36.5 | -109.612 | -10.96 | 4:01:00 | 140 | 0 | 83 | 62.8 | 191.984 | 18.05 | 108.1 | USDT | kucoin | -2.24 | -2.24 | -2.46 | -4.75 | 202209 | |||

| BinHV27_long | 333 | 0.23 | 77.97 | 233.924 | 23.39 | 3:41:00 | 234 | 4 | 95 | 70.3 | 115.899 | 10.47 | 138.4 | USDT | kucoin | 5.71 | 5.71 | 11.55 | 105.43 | 202210 | |||

| BinHV27_long | 255 | 0.13 | 32.89 | 98.7737 | 9.88 | 3:54:00 | 179 | 0 | 76 | 70.2 | 174.231 | 15.28 | 130.3 | USDT | kucoin | 1.61 | 1.61 | 2.02 | 8.77 | 202211 | |||

| BinHV27_long | 393 | 0.17 | 66.97 | 201.112 | 20.11 | 3:40:00 | 252 | 0 | 141 | 64.1 | 74.385 | 6.28 | 170.6 | USDT | kucoin | 4.52 | 4.52 | 9.83 | 118.59 | 202212 | |||

| BinHV27_long | 329 | 0.29 | 94.75 | 284.544 | 28.45 | 3:31:00 | 235 | 0 | 94 | 71.4 | 48.624 | 4.53 | 155.7 | USDT | kucoin | 7.87 | 7.87 | 17.29 | 496.8 | 202301 | |||

| BinHV27_long | 338 | 0.05 | 16.97 | 50.9473 | 3.92 | 3:28:00 | 233 | 0 | 105 | 68.9 | 67.76 | 4.78 | 142.3 | USDT | kucoin | 5.38 | 5.38 | 4.34 | 55.99 | 202302 | |||

| BinHV27_long | 307 | 0.01 | 3.69 | 11.0816 | 0.85 | 4:00:00 | 202 | 0 | 105 | 65.8 | 98.781 | 7.34 | 151.1 | USDT | kucoin | 1.26 | 1.26 | 1.33 | 7.16 | 202303 | |||

| BinHV27_long | 318 | -0.07 | -21.56 | -64.737 | -4.98 | 4:16:00 | 191 | 0 | 127 | 60.1 | 167.034 | 12.21 | 162.3 | USDT | kucoin | -7.79 | -7.79 | -7.69 | -25.97 | 202304 | |||

| BinHV27_long | 358 | 0.05 | 16.89 | 50.7301 | 3.9 | 4:07:00 | 213 | 0 | 145 | 59.5 | 82.429 | 6.3 | 173.8 | USDT | kucoin | 7.67 | 7.67 | 8.93 | 38.17 | 202305 | |||

| BinHV27_long | 324 | -0.13 | -42.73 | -128.329 | -9.87 | 3:51:00 | 202 | 0 | 122 | 62.3 | 243.997 | 18.3 | 150.3 | USDT | kucoin | -13.74 | -13.74 | -11.34 | -34.35 | 202306 | |||

| BinHV27_long | 383 | -0.11 | -43.09 | -129.392 | -9.95 | 3:47:00 | 212 | 0 | 171 | 55.4 | 136.853 | 10.47 | 135.9 | USDT | kucoin | -21.06 | -21.06 | -21.7 | -58.6 | 202307 | |||

| BinHV27_long | 359 | -0.33 | -118.27 | -355.168 | -27.32 | 3:48:00 | 206 | 0 | 153 | 57.4 | 356.511 | 27.41 | 133.4 | USDT | kucoin | -31.82 | -31.82 | -23.58 | -63.49 | 202308 | |||

| BinHV27_long | 467 | 0.08 | 36.97 | 111.035 | 8.54 | 3:25:00 | 281 | 0 | 186 | 60.2 | 62.473 | 4.8 | 141.7 | USDT | kucoin | 17.49 | 17.49 | 29.15 | 113.31 | 202309 | |||

| BinHV27_long | 447 | 0.22 | 97.67 | 293.292 | 22.56 | 3:16:00 | 309 | 0 | 138 | 69.1 | 93.195 | 6.98 | 174.5 | USDT | kucoin | 49.25 | 49.25 | 48.94 | 199.33 | 202310 | |||

| BinHV27_long | 419 | 0.26 | 108.45 | 325.68 | 25.05 | 3:19:00 | 287 | 0 | 132 | 68.5 | 68.208 | 4.14 | 163.3 | USDT | kucoin | 45.98 | 45.98 | 50.39 | 385.67 | 202311 | |||

| BinHV27_long | 402 | 0.14 | 55.28 | 166.005 | 12.77 | 3:24:00 | 275 | 0 | 127 | 68.4 | 157.153 | 11.22 | 162.1 | USDT | kucoin | 18.64 | 18.64 | 17.77 | 70.13 | 202312 | |||

| BinHV27_long | 272 | -0.22 | -60.49 | -181.663 | -13.97 | 3:40:00 | 181 | 0 | 91 | 66.5 | 199.781 | 15.35 | 124.2 | USDT | kucoin | -16.5 | -16.5 | -14.41 | -56.1 | 202401 | |||

| BinHV27_long | 362 | 0.11 | 40.15 | 120.569 | 9.27 | 3:20:00 | 251 | 0 | 111 | 69.3 | 83.997 | 6.36 | 115.1 | USDT | kucoin | 13.31 | 13.31 | 9.46 | 96.11 | 202402 | |||

| BinHV27_long | 323 | -0.05 | -16.06 | -48.1928 | -3.71 | 3:12:00 | 221 | 0 | 102 | 68.4 | 181.82 | 12.98 | 77 | USDT | kucoin | -4.2 | -4.2 | -3.15 | -17.6 | 202403 | |||

| BinHV27_long | 265 | -0.34 | -91.28 | -274.097 | -21.08 | 3:41:00 | 165 | 0 | 100 | 62.3 | 345.974 | 26.6 | 74.5 | USDT | kucoin | -18.21 | -18.21 | -13.48 | -50.48 | 202404 | |||

| BinHV27_long | 414 | 0.11 | 44.45 | 133.504 | 10.27 | 3:30:00 | 273 | 0 | 141 | 65.9 | 59.752 | 4.21 | 96.9 | USDT | kucoin | 20.08 | 20.08 | 18.96 | 150.37 | 202405 | |||

| BinHV27_long | 343 | -0.16 | -55.69 | -167.245 | -12.87 | 3:46:00 | 200 | 0 | 143 | 58.3 | 318.014 | 23.69 | 91.4 | USDT | kucoin | -19.55 | -19.55 | -17.78 | -34.59 | 202406 | |||

| BinHV27_long | 306 | -0.13 | -40.63 | -122.018 | -9.39 | 3:47:00 | 191 | 0 | 115 | 62.4 | 194.776 | 14.87 | 83.3 | USDT | kucoin | -13.55 | -13.55 | -11.33 | -38.9 | 202407 | |||

| BinHV27_long | 794 | 0.41 | 328.93 | 0.0329261 | 36.58 | 3:35:00 | 525 | 0 | 269 | 90.2 | 0.00169678 | 1.82 | 23.7 | USDT | kucoin | 119.31 | 119.31 | 164.05 | 1279.98 | 202408 | |||

| BinHV27_long | 305 | -0.07 | -20.77 | -62.3758 | -4.8 | 3:46:00 | 186 | 0 | 119 | 61 | 127.469 | 9.8 | 82.6 | USDT | kucoin | -10.17 | -10.17 | -10.3 | -32.27 | 202409 | |||

| BinHV27_long | 341 | 0.01 | 4.9 | 14.7112 | 1.13 | 3:33:00 | 213 | 0 | 128 | 62.5 | 96.782 | 6.89 | 84.6 | USDT | kucoin | 1.85 | 1.85 | 1.73 | 10.12 | 202410 | |||

| BinHV27_long | 306 | 0.21 | 64.96 | 195.097 | 15.01 | 3:19:00 | 216 | 0 | 90 | 70.6 | 82.023 | 5.94 | 77.6 | USDT | kucoin | 20.8 | 20.8 | 19.02 | 160.93 | 202411 | |||

| BinHV27_long | 287 | 0.01 | 2.07 | 6.227 | 0.48 | 3:34:00 | 184 | 0 | 103 | 64.1 | 195.014 | 13.58 | 77.1 | USDT | kucoin | 0.62 | 0.62 | 0.65 | 2.17 | 202412 | |||

| BinHV27_long | 244 | -0.27 | -65 | -195.19 | -15.01 | 3:54:00 | 152 | 0 | 92 | 62.3 | 290.423 | 21.48 | 75.1 | USDT | kucoin | -14.49 | -14.49 | -11.53 | -43.07 | 202501 | |||

| BinHV27_long | 270 | -0.15 | -40.22 | -120.781 | -9.29 | 3:39:00 | 177 | 0 | 93 | 65.6 | 151.552 | 11.62 | 79.1 | USDT | kucoin | -11.06 | -11.06 | -8.92 | -54.56 | 202502 | |||

| BinHV27_long | 233 | -0.52 | -121.46 | -364.742 | -28.06 | 4:07:00 | 142 | 0 | 91 | 60.9 | 430.824 | 32.65 | 76.7 | USDT | kucoin | -23.53 | -23.53 | -19.05 | -52.96 | 202503 | |||

| BinHV27_long | 384 | 0.28 | 107.7 | 323.428 | 24.88 | 3:29:00 | 271 | 0 | 113 | 70.6 | 118.127 | 8.94 | 91.6 | USDT | kucoin | 40.23 | 40.23 | 37.96 | 177.13 | 202504 | |||

| BinHV27_long | 323 | -0 | -0.47 | -1.41139 | -0.11 | 3:39:00 | 208 | 0 | 115 | 64.4 | 166.442 | 11.4 | 85.5 | USDT | kucoin | -0.16 | -0.16 | -0.15 | -0.59 | 202505 | |||

| BinHV27_long | 286 | -0.17 | -47.96 | -144.028 | -11.08 | 4:17:00 | 172 | 0 | 114 | 60.1 | 209.982 | 15.84 | 86.9 | USDT | kucoin | -18.11 | -18.11 | -15.63 | -46.09 | 202506 | |||

| BinHV27_long | 324 | -0 | -0.9 | -2.71947 | -0.21 | 3:46:00 | 225 | 0 | 99 | 69.4 | 164.603 | 11.26 | 84.8 | USDT | kucoin | -0.29 | -0.29 | -0.23 | -1.14 | 202507 | |||

| BinHV27_long | 314 | -0.13 | -41 | -0.00410416 | -5.13 | 4:13:00 | 183 | 0 | 131 | 58.3 | 0.00604279 | 7.49 | 157.7 | BTC | binance | -2.62 | -2.62 | -2.99 | -8.34 | 202201 | |||

| BinHV27_long | 278 | -0.15 | -40.88 | -0.00409233 | -5.12 | 4:33:00 | 168 | 0 | 110 | 60.4 | 0.00553453 | 6.85 | 150.3 | BTC | binance | -2.78 | -2.78 | -3.08 | -11.31 | 202202 | |||

| BinHV27_long | 358 | 0.03 | 10.84 | 0.00108471 | 1.36 | 4:06:00 | 215 | 0 | 143 | 60.1 | 0.00196863 | 2.46 | 172.7 | BTC | binance | 0.9 | 0.9 | 1.33 | 7.39 | 202203 | |||

| BinHV27_long | 347 | -0.17 | -59.27 | -0.00593247 | -7.42 | 4:14:00 | 196 | 0 | 151 | 56.5 | 0.00710724 | 8.76 | 170 | BTC | binance | -5.75 | -5.75 | -5.8 | -11.37 | 202204 | |||

| BinHV27_long | 340 | -0.08 | -25.99 | -0.0026013 | -3.25 | 3:35:00 | 223 | 0 | 117 | 65.6 | 0.00625511 | 7.69 | 148.4 | BTC | binance | -1.71 | -1.71 | -2.02 | -6.64 | 202205 | |||

| BinHV27_long | 370 | 0.03 | 12.85 | 0.00128641 | 1.61 | 3:20:00 | 245 | 0 | 125 | 66.2 | 0.00586678 | 7.22 | 149.6 | BTC | binance | 0.45 | 0.45 | 0.74 | 1.6 | 202206 | |||

| BinHV27_long | 381 | 0.08 | 30.7 | 0.00307322 | 3.84 | 3:40:00 | 242 | 0 | 139 | 63.5 | 0.0027457 | 3.25 | 152.2 | BTC | binance | 1.95 | 1.95 | 2.72 | 10.25 | 202207 | |||

| BinHV27_long | 375 | -0.02 | -8.58 | -0.0008591 | -1.07 | 3:55:00 | 219 | 0 | 156 | 58.4 | 0.00215612 | 2.68 | 155.2 | BTC | binance | 0.25 | 0.25 | 0.35 | 1.47 | 202208 | |||

| BinHV27_long | 348 | -0.04 | -14.99 | -0.00150004 | -1.88 | 3:58:00 | 205 | 0 | 143 | 58.9 | 0.00540495 | 6.63 | 146.7 | BTC | binance | -1.75 | -1.75 | -2.33 | -4.87 | 202209 | |||

| BinHV27_long | 432 | -0.02 | -9.84 | -0.00098453 | -1.23 | 3:39:00 | 253 | 0 | 179 | 58.6 | 0.00333825 | 4.15 | 165.9 | BTC | binance | -1.18 | -1.18 | -1.41 | -3.6 | 202210 | |||

| BinHV27_long | 397 | 0.14 | 54.85 | 0.00549089 | 6.86 | 3:19:00 | 254 | 0 | 143 | 64 | 0.00238134 | 2.81 | 155.9 | BTC | binance | 4.91 | 4.91 | 8.09 | 40.93 | 202211 | |||

| BinHV27_long | 491 | -0.07 | -35.91 | -0.00359476 | -4.49 | 3:23:00 | 293 | 0 | 198 | 59.7 | 0.0072757 | 8.73 | 199.4 | BTC | binance | -3.16 | -3.16 | -3.63 | -7.25 | 202212 | |||

| BinHV27_long | 414 | 0.07 | 28.56 | 0.00285855 | 3.57 | 3:38:00 | 257 | 0 | 157 | 62.1 | 0.0028487 | 3.41 | 175.3 | BTC | binance | 2.73 | 2.73 | 4.99 | 12.56 | 202301 | |||

| BinHV27_long | 454 | 0.01 | 3.83 | 0.0003863 | 0.43 | 3:46:00 | 292 | 0 | 162 | 64.3 | 0.00431637 | 4.65 | 196.5 | BTC | binance | 1.73 | 1.73 | 1.55 | 6.29 | 202302 | |||

| BinHV27_long | 547 | -0.07 | -35.76 | -0.00357811 | -3.98 | 3:26:00 | 326 | 0 | 221 | 59.6 | 0.00999739 | 10.98 | 219 | BTC | binance | -12.96 | -12.96 | -10.75 | -22.31 | 202303 | |||

| BinHV27_long | 744 | 0.11 | 78.37 | 0.00784363 | 8.72 | 3:06:00 | 503 | 1 | 240 | 67.6 | 0.00235659 | 2.48 | 266.1 | BTC | binance | 49.46 | 49.46 | 41.25 | 223.57 | 202304 | |||

| BinHV27_long | 771 | 0 | -1.65 | -0.00016067 | -0.18 | 3:21:00 | 466 | 0 | 305 | 60.4 | 0.00700057 | 7.67 | 297.8 | BTC | binance | -0.7 | -0.7 | -0.51 | -1.43 | 202305 | |||

| BinHV27_long | 742 | 0.04 | 27.16 | 0.00271987 | 3.02 | 3:17:00 | 477 | 0 | 265 | 64.3 | 0.00981182 | 10.47 | 279.7 | BTC | binance | 8.18 | 8.18 | 5.9 | 18.38 | 202306 | |||

| BinHV27_long | 954 | 0.17 | 165.68 | 0.0165838 | 18.43 | 3:02:00 | 628 | 0 | 326 | 65.8 | 0.00206856 | 2.23 | 253.5 | BTC | binance | 110.2 | 110.2 | 126.82 | 509.39 | 202307 | |||

| BinHV27_long | 983 | 0.19 | 187.43 | 0.0187623 | 20.85 | 3:02:00 | 643 | 0 | 340 | 65.4 | 0.00186189 | 1.87 | 267.6 | BTC | binance | 127.84 | 127.84 | 149.31 | 685.83 | 202308 | |||

| BinHV27_long | 966 | 0.2 | 190.81 | 0.0190995 | 21.22 | 2:58:00 | 625 | 0 | 341 | 64.7 | 0.00213251 | 2.23 | 253.7 | BTC | binance | 105.31 | 105.31 | 145.54 | 606.17 | 202309 | |||

| BinHV27_long | 984 | 0.19 | 190.94 | 0.0191126 | 23.89 | 3:11:00 | 630 | 0 | 354 | 64 | 0.00328186 | 3.52 | 353.8 | BTC | binance | 99.1 | 99.1 | 111.46 | 418.27 | 202310 | |||

| BinHV27_long | 734 | 0.32 | 232.81 | 0.023303 | 25.89 | 2:54:00 | 526 | 0 | 208 | 71.7 | 0.00273882 | 2.5 | 231.2 | BTC | binance | 113.78 | 113.78 | 109.79 | 660.63 | 202311 | |||

| BinHV27_long | 667 | 0.12 | 83.36 | 0.00834302 | 9.27 | 3:23:00 | 430 | 0 | 237 | 64.5 | 0.00290075 | 3.2 | 252.7 | BTC | binance | 38.92 | 38.92 | 40.64 | 178.47 | 202312 | |||

| BinHV27_long | 707 | 0.18 | 127.64 | 0.0127768 | 14.2 | 3:06:00 | 449 | 0 | 258 | 63.5 | 0.00558085 | 5.99 | 265.5 | BTC | binance | 57.16 | 57.16 | 62.78 | 146.14 | 202401 | |||

| BinHV27_long | 804 | 0.24 | 192.57 | 0.019277 | 21.42 | 3:04:00 | 508 | 0 | 296 | 63.2 | 0.00241255 | 2.16 | 218 | BTC | binance | 96.58 | 96.58 | 111.12 | 676.58 | 202402 | |||

| BinHV27_long | 630 | 0.14 | 89.72 | 0.00898273 | 9.98 | 3:15:00 | 410 | 0 | 220 | 65.1 | 0.00279571 | 3 | 108.2 | BTC | binance | 34.97 | 34.97 | 35 | 211.72 | 202403 | |||

| BinHV27_long | 668 | 0.02 | 14.5 | 0.00145271 | 1.61 | 3:22:00 | 416 | 0 | 252 | 62.3 | 0.011501 | 12.76 | 123.8 | BTC | binance | 4.71 | 4.71 | 3.85 | 8.33 | 202404 | |||

| BinHV27_long | 824 | 0.22 | 184.58 | 0.0184778 | 20.53 | 3:20:00 | 538 | 0 | 286 | 65.3 | 0.00196766 | 1.96 | 151.2 | BTC | binance | 81.38 | 81.38 | 90.49 | 668.57 | 202405 | |||

| BinHV27_long | 738 | 0.24 | 178.44 | 0.017862 | 19.85 | 3:37:00 | 463 | 0 | 275 | 62.7 | 0.00390264 | 4.01 | 147.2 | BTC | binance | 73.59 | 73.59 | 83.31 | 325.95 | 202406 | |||

| BinHV27_long | 807 | 0.34 | 277.94 | 0.0278218 | 30.91 | 3:33:00 | 521 | 0 | 286 | 64.6 | 0.00500869 | 5.34 | 155.5 | BTC | binance | 102.78 | 102.78 | 124.98 | 368.81 | 202407 | |||

| BinHV27_long | 794 | 0.41 | 328.93 | 0.0329261 | 36.58 | 3:35:00 | 525 | 0 | 269 | 66.1 | 0.00169678 | 1.82 | 152.3 | BTC | binance | 119.31 | 119.31 | 164.05 | 1279.98 | 202408 | |||

| BinHV27_long | 845 | 0.42 | 358.53 | 0.0358879 | 39.88 | 3:28:00 | 568 | 0 | 277 | 67.2 | 0.00137289 | 1.28 | 156.3 | BTC | binance | 161.12 | 161.12 | 231.3 | 2058.28 | 202409 | |||

| BinHV27_long | 870 | 0.37 | 325.42 | 0.032574 | 36.19 | 3:17:00 | 596 | 0 | 274 | 68.5 | 0.00283528 | 3.05 | 156.2 | BTC | binance | 129.59 | 129.59 | 171.72 | 732.01 | 202410 | |||

| BinHV27_long | 713 | 0.71 | 507.03 | 0.0507534 | 56.39 | 2:57:00 | 518 | 0 | 195 | 72.7 | 0.00279729 | 2.55 | 113.7 | BTC | binance | 165.57 | 165.57 | 223.8 | 1409.84 | 202411 | |||

| BinHV27_long | 617 | 0.41 | 250.05 | 0.0250305 | 27.81 | 3:12:00 | 408 | 0 | 209 | 66.1 | 0.00270468 | 2.75 | 106.9 | BTC | binance | 73.04 | 73.04 | 89.58 | 623.65 | 202412 | |||

| BinHV27_long | 664 | 0.46 | 302.84 | 0.0303142 | 33.68 | 3:25:00 | 412 | 0 | 252 | 62 | 0.00283431 | 2.76 | 123.9 | BTC | binance | 89.6 | 89.6 | 129.91 | 752.6 | 202501 | |||

| BinHV27_long | 593 | 0.52 | 306.98 | 0.0307287 | 34.14 | 3:38:00 | 400 | 0 | 193 | 67.5 | 0.00274865 | 3.03 | 120.3 | BTC | binance | 113.22 | 113.22 | 143.77 | 768.42 | 202502 | |||

| BinHV27_long | 649 | 0.43 | 280.45 | 0.0280736 | 31.19 | 3:47:00 | 412 | 0 | 237 | 63.5 | 0.00328801 | 2.82 | 139.4 | BTC | binance | 93.01 | 93.01 | 111.33 | 682.55 | 202503 | |||

| BinHV27_long | 808 | 0.84 | 675.69 | 0.0676361 | 75.15 | 3:17:00 | 578 | 0 | 230 | 71.5 | 0.00195035 | 1.89 | 147.3 | BTC | binance | 221.29 | 221.29 | 337.44 | 2531.29 | 202504 | |||

| BinHV27_long | 761 | 0.76 | 579.43 | 0.058001 | 64.45 | 3:29:00 | 521 | 0 | 240 | 68.5 | 0.00196991 | 2.06 | 142.9 | BTC | binance | 177.92 | 177.92 | 245.98 | 1991.24 | 202505 | |||

| BinHV27_long | 757 | 0.98 | 740.76 | 0.0741493 | 82.39 | 3:46:00 | 537 | 0 | 220 | 70.9 | 0.00233913 | 1.95 | 159.2 | BTC | binance | 221.37 | 221.37 | 368.67 | 2785.16 | 202506 | |||

| BinHV27_long | 760 | 1.07 | 815.01 | 0.0815813 | 90.65 | 3:09:00 | 575 | 0 | 185 | 75.7 | 0.00329491 | 2.04 | 134.8 | BTC | binance | 254.85 | 254.85 | 357.05 | 2826.5 | 202507 |

The BinHV27_long strategy is a trading strategy implemented in the backtesting website. Here is a brief description of what the strategy does:

The strategy begins by populating various indicators, including RSI (Relative Strength Index), EMA (Exponential Moving Average), ADX (Average Directional Index), MINUS_DI, PLUS_DI, and Bollinger Bands. The entry conditions for long positions are defined based on multiple criteria, including the relationship between moving averages (fastsma and slowsma), RSI, ADX, and EMA values.

There are four sets of buy conditions (buy_1, buy_2, buy_3, buy_4) that are checked to determine if a long position should be entered.

The exit conditions for long positions are determined based on the current profit, as well as specific sell conditions.

There are five sets of sell conditions (sell_1, sell_2, sell_3, sell_4, sell_5) that are checked to determine if a long position should be exited. The proposed leverage for the position is determined based on the defined leverage_num value. In summary, the BinHV27_long strategy uses various technical indicators and conditions to identify entry and exit points for long positions in trading.

There are four sets of buy conditions (buy_1, buy_2, buy_3, buy_4) that are checked to determine if a long position should be entered.

The exit conditions for long positions are determined based on the current profit, as well as specific sell conditions.

There are five sets of sell conditions (sell_1, sell_2, sell_3, sell_4, sell_5) that are checked to determine if a long position should be exited. The proposed leverage for the position is determined based on the defined leverage_num value. In summary, the BinHV27_long strategy uses various technical indicators and conditions to identify entry and exit points for long positions in trading.

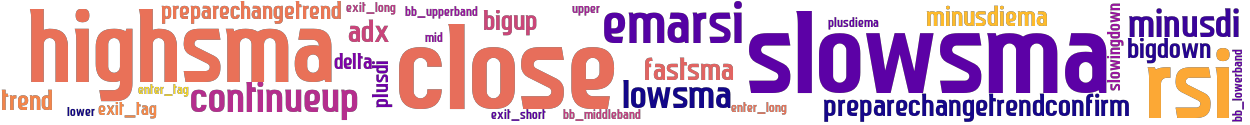

stoploss: -0.99 timeframe: 5m hash(sha256): 892acbb0c9e345804d6d22d54fcc15c6b84ff13390a69d717345f3ad348cb695 indicators: upper preparechangetrend close lowsma exit_long exit_tag bb_lowerband delta trend minusdi slowingdown continueup slowsma highsma bigdown mid emarsi bigup minusdiema adx lower plusdi fastsma preparechangetrendconfirm bb_middleband rsi bb_upperband plusdiema

Similar Strategies: (based on used indicators)

Strategy: BinHV27JP, Similarity Score: 96.55%

Strategy: BinHV27_long_hz, Similarity Score: 96.55%

Strategy: Discord_BinHV27_combined, Similarity Score: 96.55%

Strategy: Frieza, Similarity Score: 93.1%

Strategy: SFrieza, Similarity Score: 93.1%

Strategy: SMAIP3_combine, Similarity Score: 93.1%

Strategy: AMD_combined, Similarity Score: 89.66%

Strategy: CombinedAMD1, Similarity Score: 89.66%

Strategy: CombinedAMD2, Similarity Score: 89.66%

Strategy: Discord_BinHV27_combined_test, Similarity Score: 89.66%

Strategy: amd_3m, Similarity Score: 89.66%

Strategy: jazz, Similarity Score: 86.21%

Strategy: jazz_2, Similarity Score: 86.21%

last change: 2025-08-04 04:25:09