Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BigZ0407 strategy is a trading strategy that utilizes various indicators and conditions to determine buy signals in the market. Here is a brief description of what the strategy does:

populate_indicators: This function populates the indicators used in the strategy by merging data from different timeframes and calculating the necessary indicators. populate_buy_trend: This function determines the buy conditions for the strategy.

It defines multiple sets of conditions, each representing a different buy signal.

Here are the key elements of each condition: Condition 1: Checks for a combination of price, moving averages, Bollinger Bands, RSI, volume, and candlestick patterns.

Condition 2: Checks for a combination of price, moving averages, Bollinger Bands, RSI, and volume. Condition 3: Checks for a combination of price, moving averages, Bollinger Bands, RSI, and volume. Condition 4: Checks for a combination of RSI, price, Bollinger Bands, and volume. Condition 5: Checks for a combination of price, moving averages, MACD, Bollinger Bands, and volume. Condition 6: Checks for a combination of RSI, moving averages, and volume. Each condition evaluates a set of criteria, such as the relationship between price and indicators, the direction of indicators, and the volume compared to previous periods. If all the criteria for a particular condition are met, a buy signal is generated. The strategy incorporates various technical indicators, such as moving averages (ema), Bollinger Bands (bb), relative strength index (rsi), and moving average convergence divergence (macd), to identify potential buying opportunities in the market. It also considers volume-related factors for confirmation. Note: The provided code snippet seems to be incomplete, as the description ends abruptly.

It defines multiple sets of conditions, each representing a different buy signal.

Here are the key elements of each condition: Condition 1: Checks for a combination of price, moving averages, Bollinger Bands, RSI, volume, and candlestick patterns.

Condition 2: Checks for a combination of price, moving averages, Bollinger Bands, RSI, and volume. Condition 3: Checks for a combination of price, moving averages, Bollinger Bands, RSI, and volume. Condition 4: Checks for a combination of RSI, price, Bollinger Bands, and volume. Condition 5: Checks for a combination of price, moving averages, MACD, Bollinger Bands, and volume. Condition 6: Checks for a combination of RSI, moving averages, and volume. Each condition evaluates a set of criteria, such as the relationship between price and indicators, the direction of indicators, and the volume compared to previous periods. If all the criteria for a particular condition are met, a buy signal is generated. The strategy incorporates various technical indicators, such as moving averages (ema), Bollinger Bands (bb), relative strength index (rsi), and moving average convergence divergence (macd), to identify potential buying opportunities in the market. It also considers volume-related factors for confirmation. Note: The provided code snippet seems to be incomplete, as the description ends abruptly.

startup_candle_count : 200 ema_50_1h: 0.001% ema_100_1h: -0.041% hist: -0.001% ema_100: 0.014% zema: 0.007%

Unable to parse Traceback (Logfile Exceeded Limit)

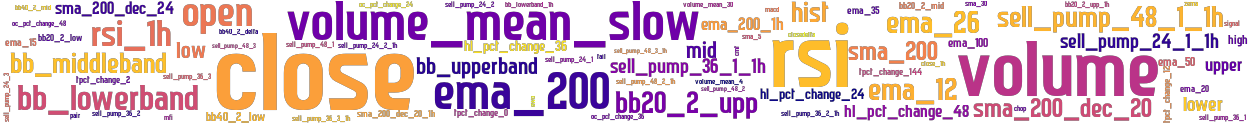

stoploss: -0.99 timeframe: 5m hash(sha256): 2859a48563dc3f535cb2ecfcf9124db67e1eb53aebbe4068194adee4085a4f24 indicators: sell_pump_36_3_1h upper close ema_15 sell_pump_36_2 sma_5 sell_pump_24_1_1h bb_lowerband ema_200_1h ewo volume sma_200_dec_20 sell_pump_36_1_1h ema_20 oc_pct_change_48 sell_pump_48_1_1h high tpct_change_2 sell_pump_48_3 rsi_1h bb20_2_mid hist ema_12 tpct_change_12 sell_pump_48_2 ema_26 sell_pump_24_1 chop oc_pct_change_36 bb20_2_upp_1h closedelta bb20_2_low volume_mean_4 tpct_change_0 bb_lowerband_1h sell_pump_48_2_1h lower signal rsi sell_pump_24_3 sell_pump_36_2_1h hl_pct_change_36 ema_50 tail

Similar Strategies: (based on used indicators)

Strategy: BigZ0407HO, Similarity Score: 97.78%

Strategy: BigZ04NextHO, Similarity Score: 88.89%

Strategy: BigZ07Next, Similarity Score: 84.44%

Strategy: BigZ07Next2, Similarity Score: 84.44%

Strategy: V87XH, Similarity Score: 82.22%

last change: 2025-01-14 13:40:53