Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BB_RPB_TSL_SMA_Tranz_TB_1_1_1 strategy is a trading strategy implemented in a backtesting website. It belongs to the IStrategy class. The strategy involves populating various indicators on the provided dataframe to analyze market conditions.

It uses informative data from different timeframes, such as 1-hour and 15-minute intervals, to gather additional insights.

The indicators are merged into the original dataframe to facilitate further analysis.

For the buy trend, the strategy defines several conditions based on different indicators. Some of the important conditions include: "buy_12_protections": A set of protections that evaluate various moving averages, close prices, and other factors to determine if it's suitable for buying. "is_dip": Checks if certain indicators (RMI, CCI, SRSI) are below specified thresholds. "is_sqzOff": Determines if the Bollinger Bands and Keltner Channels are in a state that indicates a potential buying opportunity. "is_break": Evaluates the Bollinger Bands and closedelta to identify breakouts. "is_local_uptrend": Considers indicators like EMA, BB factors, and closedelta to identify local uptrends. "is_local_dip": Looks for indicators such as EMA, RSI, and CRSI to identify local dips. "is_ewo" and "is_ewo_2": Checks the relationship between various indicators (RSI, EMA, EWO) to detect potential buying opportunities. "is_nfix_3": Examines several indicators (BB, CTI, R, etc.) to identify specific market conditions for buying. "is_r_deadfish": Analyzes indicators such as EMAs, BB width, volume, and CTI to identify potential reverse deadfish scenarios. "is_clucHA": Considers indicators like ROCR, BB, and HA close prices to identify buying opportunities. "is_cofi": Based on the work of "CofiBit," this condition evaluates indicators like EMA, fastk/fastd, ADX, EWO, and CTI to determine buying opportunities. By evaluating these conditions, the strategy aims to generate buy signals on the dataframe. The specific implementation details and parameters of these conditions are not provided in the code snippet.

It uses informative data from different timeframes, such as 1-hour and 15-minute intervals, to gather additional insights.

The indicators are merged into the original dataframe to facilitate further analysis.

For the buy trend, the strategy defines several conditions based on different indicators. Some of the important conditions include: "buy_12_protections": A set of protections that evaluate various moving averages, close prices, and other factors to determine if it's suitable for buying. "is_dip": Checks if certain indicators (RMI, CCI, SRSI) are below specified thresholds. "is_sqzOff": Determines if the Bollinger Bands and Keltner Channels are in a state that indicates a potential buying opportunity. "is_break": Evaluates the Bollinger Bands and closedelta to identify breakouts. "is_local_uptrend": Considers indicators like EMA, BB factors, and closedelta to identify local uptrends. "is_local_dip": Looks for indicators such as EMA, RSI, and CRSI to identify local dips. "is_ewo" and "is_ewo_2": Checks the relationship between various indicators (RSI, EMA, EWO) to detect potential buying opportunities. "is_nfix_3": Examines several indicators (BB, CTI, R, etc.) to identify specific market conditions for buying. "is_r_deadfish": Analyzes indicators such as EMAs, BB width, volume, and CTI to identify potential reverse deadfish scenarios. "is_clucHA": Considers indicators like ROCR, BB, and HA close prices to identify buying opportunities. "is_cofi": Based on the work of "CofiBit," this condition evaluates indicators like EMA, fastk/fastd, ADX, EWO, and CTI to determine buying opportunities. By evaluating these conditions, the strategy aims to generate buy signals on the dataframe. The specific implementation details and parameters of these conditions are not provided in the code snippet.

startup_candle_count : 400 ema_200_1h: 0.008% EWO_1h: -0.146% ema_200: 0.020% EWO: -0.878% ema_200_15m: -0.005% ewo_15m: 0.162%

Unable to parse Traceback (Logfile Exceeded Limit)

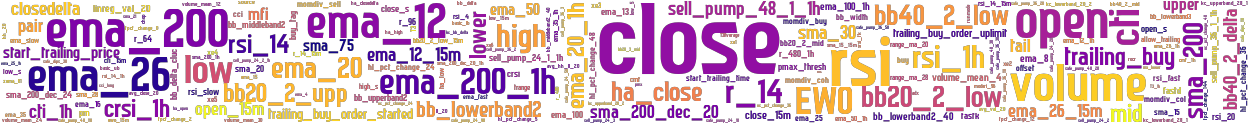

stoploss: -0.99 timeframe: 5m hash(sha256): 3fd18fcbd7d67bd69f088570b29f0d555fffeb2132fb763cdc04e4b1da9c0482 indicators: sell_pump_36_3_1h sma_200_1h upper safe_pump_24_30 close sell_pump_36_2 ema_15 sma_5 low_s sell_pump_24_1_1h volume_mean_12 ema_25 ema_200_1h safe_dump_50 ewo rsi_fast avg_val_20 r_480_1h safe_pump_24_100 sma_15_15m volume rsi_4 sma_200_dec_20 xe1 safe_pump_24_120 rsi_slow_descending ema_20 sell_pump_36_1_1h source safe_pump_48_30 ha_closedelta safe_dips_70 momdiv_coh bb20_3_low oc_pct_change_48 buy_tag trange rsi_14 bb_upperband2 sell_pump_48_1_1h volume_mean_24 high tpct_change_2 safe_dips_30

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL_SMA_Tranz3, Similarity Score: 95.65%

Strategy: BB_RPB_TSL_SMA_Tranz_TB_1_1_1201, Similarity Score: 93.48%

last change: 2025-01-13 19:55:04