Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BB_RPB_TSL strategy is a trading strategy that involves multiple conditions to determine buy and sell signals. Here is a brief description of what the strategy does:

populate_indicators(): This function populates various indicators on the provided dataframe, such as informative indicators and normal timeframe indicators. populate_buy_trend(): This function determines the buy signals based on several conditions.

These conditions include checking for dips in specific indicators (RMI, CCI, SRSI), price breakouts above certain thresholds (BB Delta, BB Width), Ichimoku Cloud confirmation, local uptrend confirmation, EWO (Elliott Wave Oscillator) confirmation, COFI (Crossover of FastK and FastD indicators) confirmation, and specific conditions for NFI (Next Financial Indicator) and BTC (Bitcoin) safety.

populate_sell_trend(): This function determines the sell signals based on two main conditions.

The first condition checks for a decrease in BTC (Bitcoin) safety or specific conditions related to the price being below the EMA (Exponential Moving Average) 200, CMF (Chaikin Money Flow) indicator, EMA close delta, and RSI (Relative Strength Index) increase. Overall, the strategy combines multiple indicators and conditions to generate buy and sell signals for backtesting trading strategies.

These conditions include checking for dips in specific indicators (RMI, CCI, SRSI), price breakouts above certain thresholds (BB Delta, BB Width), Ichimoku Cloud confirmation, local uptrend confirmation, EWO (Elliott Wave Oscillator) confirmation, COFI (Crossover of FastK and FastD indicators) confirmation, and specific conditions for NFI (Next Financial Indicator) and BTC (Bitcoin) safety.

populate_sell_trend(): This function determines the sell signals based on two main conditions.

The first condition checks for a decrease in BTC (Bitcoin) safety or specific conditions related to the price being below the EMA (Exponential Moving Average) 200, CMF (Chaikin Money Flow) indicator, EMA close delta, and RSI (Relative Strength Index) increase. Overall, the strategy combines multiple indicators and conditions to generate buy and sell signals for backtesting trading strategies.

Biased Indicators

chikou_span_1h

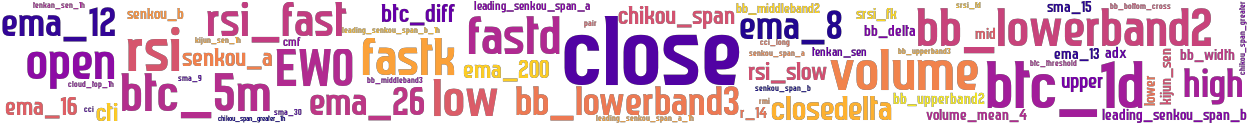

stoploss: -0.99 timeframe: 5m hash(sha256): 93bf53f7df7d7e9deb55f7ea324e8619cfca55e9d33b8da98eebdee7c80c1520 indicators: upper bb_middleband3 bb_upperband3 btc_1d EWO ema_200 btc_5m leading_senkou_span_b_1h ema_13 close senkou_a cloud_top_1h cci_length_val tenkan_sen fastk rsi_fast srsi_fk r_14 bb_middleband2 volume srsi_fd cci_long tenkan_sen_1h leading_senkou_span_a senkou_a senkou_b closedelta bb_bottom_cross leading_senkou_span_b open bb_delta chikou_span_greater btc_threshold fastd btc_diff sma_15 bb_upperband2 high kijun_sen volume_mean_4 mid kijun_sen_1h chikou_span_greater_1h senkou_span_a bb_width ema_8 e

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL_c7c477d_20211030, Similarity Score: 97.92%

Strategy: BB_RPB_TSL_v102, Similarity Score: 97.92%

Strategy: TheMessenger, Similarity Score: 97.92%

last change: 2023-07-05 08:24:02