You will be redirected to the original Strategy in 15 seconds.

The SMA1CTE1 strategy is a backtesting strategy designed for trading. Here's a breakdown of what the strategy does:

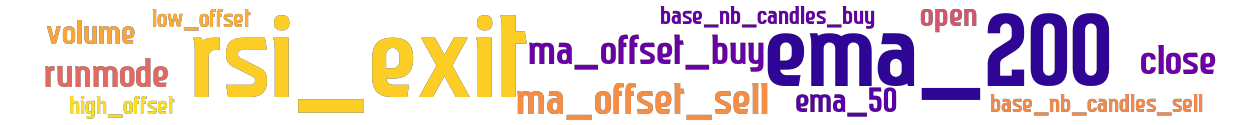

It uses the Simple Moving Average (SMA) and Exponential Moving Average (EMA) indicators to make trading decisions. The strategy has specific parameters for buying and selling:

For buying, it uses a base number of candles (time periods) defined by the base_nb_candles_buy parameter and a low offset defined by the low_offset parameter.

For selling, it uses a base number of candles defined by the base_nb_candles_sell parameter and a high offset defined by the high_offset parameter.

The timeframe for analyzing the data is set to 5 minutes (timeframe = '5m').

It sets a stop loss of -0.23, which means that if the price drops by 23% from the entry price, the trade will be closed with a loss. It defines a minimal return on investment (ROI) of 10%, meaning that the strategy aims to achieve at least a 10% profit before considering selling. The strategy does not use a trailing stop, which means it does not dynamically adjust the stop loss as the price moves in the desired direction. It uses a sell signal to determine when to sell, and it does not limit the selling to only profitable trades. It considers the ROI even if there is a buy signal. It processes only new candles and requires a startup candle count of 400 to build initial indicators. The strategy implements the confirm_trade_exit function to confirm the exit of a trade based on certain conditions. The populate_indicators function calculates additional indicators such as the 50-day EMA, 200-day EMA, and RSI (Relative Strength Index) exit. The populate_buy_trend function determines the conditions for buying, including the crossover of the 50-day EMA above the 200-day EMA and the price being below the buy offset. The populate_sell_trend function determines the conditions for selling, including the price being above the sell offset. Overall, the strategy aims to generate buy signals when the price meets certain criteria involving moving averages and offsets, and it generates sell signals when the price reaches the sell offset.

For selling, it uses a base number of candles defined by the base_nb_candles_sell parameter and a high offset defined by the high_offset parameter.

The timeframe for analyzing the data is set to 5 minutes (timeframe = '5m').

It sets a stop loss of -0.23, which means that if the price drops by 23% from the entry price, the trade will be closed with a loss. It defines a minimal return on investment (ROI) of 10%, meaning that the strategy aims to achieve at least a 10% profit before considering selling. The strategy does not use a trailing stop, which means it does not dynamically adjust the stop loss as the price moves in the desired direction. It uses a sell signal to determine when to sell, and it does not limit the selling to only profitable trades. It considers the ROI even if there is a buy signal. It processes only new candles and requires a startup candle count of 400 to build initial indicators. The strategy implements the confirm_trade_exit function to confirm the exit of a trade based on certain conditions. The populate_indicators function calculates additional indicators such as the 50-day EMA, 200-day EMA, and RSI (Relative Strength Index) exit. The populate_buy_trend function determines the conditions for buying, including the crossover of the 50-day EMA above the 200-day EMA and the price being below the buy offset. The populate_sell_trend function determines the conditions for selling, including the price being above the sell offset. Overall, the strategy aims to generate buy signals when the price meets certain criteria involving moving averages and offsets, and it generates sell signals when the price reaches the sell offset.

stoploss: -0.23 timeframe: 5m hash(sha256): eab9d9102e3c68727d4d982633c5e71f0ac16cdfd802effec2eb05939e2bfb94

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08