Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The given code snippet appears to be a part of a larger codebase for implementing trading strategies. It defines a class called NFI7HO2 that implements the IStrategy interface. The class contains several methods, but I will focus on two of them: populate_indicators and populate_buy_trend.

The populate_indicators method takes a DataFrame and some metadata as input and returns a modified DataFrame after populating it with various indicators.

It first calls the informative_1h_indicators method to calculate indicators based on a 1-hour timeframe.

Then it merges the resulting indicators with the original DataFrame using the merge_informative_pair function. Finally, it calls the normal_tf_indicators method to calculate indicators based on the normal timeframe and returns the modified DataFrame. The populate_buy_trend method populates the buy signals or triggers in the DataFrame based on certain conditions. It initializes an empty list called conditions to store the conditions for each buy signal. Then it defines multiple lists (buy_01_protections, buy_02_protections, etc.) that contain boolean expressions representing protection conditions for each buy signal. These conditions depend on various indicators and their values. Next, the method creates logic for each buy signal by appending boolean expressions to corresponding lists (buy_01_logic, buy_02_logic, etc.). These expressions involve comparisons between indicators and certain values or thresholds. The expressions are combined using logical AND operations. After defining the protection conditions and buy logic for each buy signal, the method assigns the result of the logical AND operations to new columns in the DataFrame (buy_01_trigger, buy_02_trigger, etc.) using the reduce function. The reduce function combines the boolean values in the lists using logical AND operations. Finally, if the corresponding buy condition is enabled (buy_condition_1_enable, buy_condition_2_enable, etc.), the method adds the trigger column to the conditions list. These conditions represent the final buy signals based on the defined logic and protection conditions. In summary, the given strategy class calculates various indicators based on different timeframes and populates buy signals in a DataFrame based on predefined conditions and protection rules. The strategy aims to generate buy signals for trading based on the values of multiple indicators and their relationships.

The populate_indicators method takes a DataFrame and some metadata as input and returns a modified DataFrame after populating it with various indicators.

It first calls the informative_1h_indicators method to calculate indicators based on a 1-hour timeframe.

Then it merges the resulting indicators with the original DataFrame using the merge_informative_pair function. Finally, it calls the normal_tf_indicators method to calculate indicators based on the normal timeframe and returns the modified DataFrame. The populate_buy_trend method populates the buy signals or triggers in the DataFrame based on certain conditions. It initializes an empty list called conditions to store the conditions for each buy signal. Then it defines multiple lists (buy_01_protections, buy_02_protections, etc.) that contain boolean expressions representing protection conditions for each buy signal. These conditions depend on various indicators and their values. Next, the method creates logic for each buy signal by appending boolean expressions to corresponding lists (buy_01_logic, buy_02_logic, etc.). These expressions involve comparisons between indicators and certain values or thresholds. The expressions are combined using logical AND operations. After defining the protection conditions and buy logic for each buy signal, the method assigns the result of the logical AND operations to new columns in the DataFrame (buy_01_trigger, buy_02_trigger, etc.) using the reduce function. The reduce function combines the boolean values in the lists using logical AND operations. Finally, if the corresponding buy condition is enabled (buy_condition_1_enable, buy_condition_2_enable, etc.), the method adds the trigger column to the conditions list. These conditions represent the final buy signals based on the defined logic and protection conditions. In summary, the given strategy class calculates various indicators based on different timeframes and populates buy signals in a DataFrame based on predefined conditions and protection rules. The strategy aims to generate buy signals for trading based on the values of multiple indicators and their relationships.

startup_candle_count : 400 ema_200_1h: 0.035% ema_200: -0.013% ewo: 1.969%

Unable to parse Traceback (Logfile Exceeded Limit)

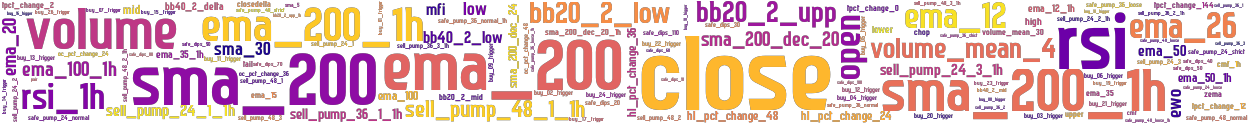

stoploss: -0.99 timeframe: 5m hash(sha256): bb70aa6196beb442d61d79f5dc58574994c22f022d05f9b23609e3165859f691 indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h buy_22_trigger ema_200_1h ewo buy_17_trigger volume sma_200_dec_20 buy_09_trigger safe_dips_70 sell_pump_36_1_1h ema_20 buy_21_trigger oc_pct_change_48 sell_pump_48_1_1h high tpct_change_2 safe_dips_30 safe_pump_24_normal sell_pump_48_3 safe_dips_80 rsi_1h bb20_2_mid ema_12 tpct_change_12 sell_pump_48_2 ema_26 buy_04_trigger safe_dips_100 cmf_1h sell_pump_24_1 chop oc_pct_change_36 bb20_2_u

No similar strategies found. (based on used indicators)

last change: 2024-08-02 10:00:24