You will be redirected to the original Strategy in 15 seconds.

The custom strategy described above is a trading strategy that utilizes various indicators and conditions to determine buy signals in backtesting. Here is a breakdown of its key components:

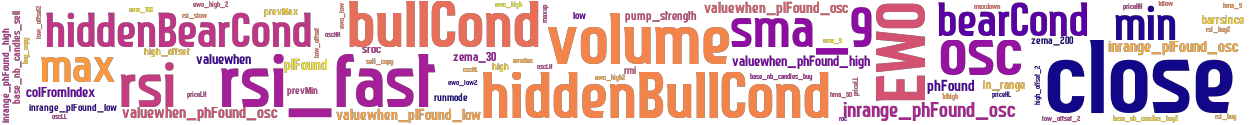

The strategy begins by populating indicators such as RSI (Relative Strength Index), rolling minimums and maximums, and valuewhen calculations based on certain conditions. It calculates values related to bullish and bearish conditions, including price thresholds, oscillation levels, and hidden conditions.

The strategy also incorporates moving averages (EMA and SMA), hull moving averages (HMA), exponential moving averages (EMA), EWO (Elliott Wave Oscillator), ZEMA (Zero-Lag Exponential Moving Average), RMI (Relative Momentum Index), ROC (Rate of Change), and other indicators to assess market trends and momentum.

Additionally, it incorporates informative data from another timeframe and merges it with the current dataframe.

The populate_buy_trend function defines the conditions for entering a buy trade, which involve combinations of indicators such as bullish conditions, moving averages, RSI levels, EWO values, and volume thresholds. Overall, this custom strategy aims to identify favorable market conditions for executing buy trades based on the specified indicators and conditions.

The strategy also incorporates moving averages (EMA and SMA), hull moving averages (HMA), exponential moving averages (EMA), EWO (Elliott Wave Oscillator), ZEMA (Zero-Lag Exponential Moving Average), RMI (Relative Momentum Index), ROC (Rate of Change), and other indicators to assess market trends and momentum.

Additionally, it incorporates informative data from another timeframe and merges it with the current dataframe.

The populate_buy_trend function defines the conditions for entering a buy trade, which involve combinations of indicators such as bullish conditions, moving averages, RSI levels, EWO values, and volume thresholds. Overall, this custom strategy aims to identify favorable market conditions for executing buy trades based on the specified indicators and conditions.

stoploss: -0.11 timeframe: 5m hash(sha256): 3db98103885dc27814b41bac6e804aa84af3bd4833ab8a35ce52d978aaa1957f

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-26 19:34:05