Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

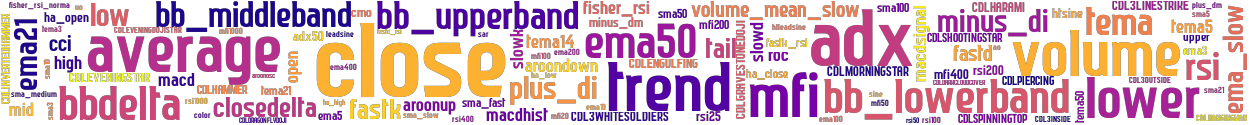

The strategy, represented by the S096 class, is designed to backtest trading strategies using various technical analysis (TA) indicators. It consists of two main functions: populate_indicators and populate_buy_trend. The populate_indicators function takes a DataFrame of exchange data and adds multiple TA indicators to it.

These indicators include ADX (Average Directional Index), DM (Directional Movement), CCI (Commodity Channel Index), RSI (Relative Strength Index), MFI (Money Flow Index), ROC (Rate of Change), Bollinger Bands, EMA (Exponential Moving Average), SAR (Stop and Reverse), TEMA (Triple Exponential Moving Average), HT_SINE (Hilbert Transform - SineWave), and various moving averages.

These indicators provide insights into price trends, volatility, and market momentum.

The populate_buy_trend function determines the buy signals based on the populated indicators. The strategy considers different conditions to identify bullish, bearish, or sideways trends. Some of the conditions include the trend value being greater than 120 or less than 80, the crossover of moving averages (TEMA5 and TEMA14), the crossover of RSI above 60, the price crossing above the Bollinger Bands' middle band, the ADX value exceeding certain thresholds, the CCI crossing above -100, and specific patterns in the moving averages and average price. By backtesting different trading strategies using this framework, users can evaluate the historical performance of their strategies and make informed decisions about their trading approach.

These indicators include ADX (Average Directional Index), DM (Directional Movement), CCI (Commodity Channel Index), RSI (Relative Strength Index), MFI (Money Flow Index), ROC (Rate of Change), Bollinger Bands, EMA (Exponential Moving Average), SAR (Stop and Reverse), TEMA (Triple Exponential Moving Average), HT_SINE (Hilbert Transform - SineWave), and various moving averages.

These indicators provide insights into price trends, volatility, and market momentum.

The populate_buy_trend function determines the buy signals based on the populated indicators. The strategy considers different conditions to identify bullish, bearish, or sideways trends. Some of the conditions include the trend value being greater than 120 or less than 80, the crossover of moving averages (TEMA5 and TEMA14), the crossover of RSI above 60, the price crossing above the Bollinger Bands' middle band, the ADX value exceeding certain thresholds, the CCI crossing above -100, and specific patterns in the moving averages and average price. By backtesting different trading strategies using this framework, users can evaluate the historical performance of their strategies and make informed decisions about their trading approach.

stoploss: -0.05 timeframe: 1h hash(sha256): 77e9df6164d08eb43b82863974a549d847b18b21617132092fe3e7709f793a59 indicators: upper CDLDRAGONFLYDOJI CDLGRAVESTONEDOJI close CDLSPINNINGTOP bb_lowerband bb_percent CDL3WHITESOLDIERS kc_middleband volume trend average sma10 tema5 rsi25 ema400 high tema3 fisher_rsi_norma mfi50 cci rsi400 mfi1000 ha_high adx aroonosc mfi100 tema21 ema_slow ema50 cmo minus_dm mfi200 plus_dm CDLHANGINGMAN aroondown bbdelta CDLEVENINGDOJISTAR closedelta plus_di rsi200 ha_open tema50 mfi400 slowk macdsignal adx50 fastk_rsi mfi20 sma_medium minus_di roc lower rsi sma3 sine kc_percent rsi100 wbb_u

No similar strategies found. (based on used indicators)

last change: 2023-07-05 06:13:31