Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The Bzed strategy is a backtesting strategy that involves the following steps:

Populate Indicators: This step calculates various indicators using the provided dataframe. It includes the following calculations:

Bollinger Bands with a window of 200 and standard deviations of 3. Bollinger Bands with a window of 20 and standard deviations of 3.

Bollinger Bands with a window of 20 and standard deviations of 2.

MACD (Moving Average Convergence Divergence) and its components (macd, macdsignal, macdhist).

Additional informative indicators for the 1-hour timeframe. Populate Buy Trend: This step determines the buy signals based on the calculated indicators and conditions. It includes the following conditions: If multiple conditions related to Bollinger Bands, closing price, moving averages, and MACD are met, a buy signal is generated. If conditions related to a different strategy called "BinHV45" are met, a buy signal is generated. If conditions related to a different strategy called "ClucMay72018" are met, a buy signal is generated. If conditions related to a different set of indicators and criteria are met, a buy signal is generated. The buy signal is marked as '1' in the dataframe. Populate Sell Trend: This step determines the sell signals based on specific conditions. It includes the following condition: If the closing price crosses above the upper Bollinger Band and the previous closing price was also above the upper Bollinger Band, a sell signal is generated. The sell signal is marked as '1' in the dataframe. The Bzed strategy combines various technical indicators and conditions to generate buy and sell signals for backtesting trading strategies.

Bollinger Bands with a window of 20 and standard deviations of 2.

MACD (Moving Average Convergence Divergence) and its components (macd, macdsignal, macdhist).

Additional informative indicators for the 1-hour timeframe. Populate Buy Trend: This step determines the buy signals based on the calculated indicators and conditions. It includes the following conditions: If multiple conditions related to Bollinger Bands, closing price, moving averages, and MACD are met, a buy signal is generated. If conditions related to a different strategy called "BinHV45" are met, a buy signal is generated. If conditions related to a different strategy called "ClucMay72018" are met, a buy signal is generated. If conditions related to a different set of indicators and criteria are met, a buy signal is generated. The buy signal is marked as '1' in the dataframe. Populate Sell Trend: This step determines the sell signals based on specific conditions. It includes the following condition: If the closing price crosses above the upper Bollinger Band and the previous closing price was also above the upper Bollinger Band, a sell signal is generated. The sell signal is marked as '1' in the dataframe. The Bzed strategy combines various technical indicators and conditions to generate buy and sell signals for backtesting trading strategies.

startup_candle_count : 200 bb_lowerband_3sd: 0.179% macdhist: -0.001% ema_50_1h: 0.001%

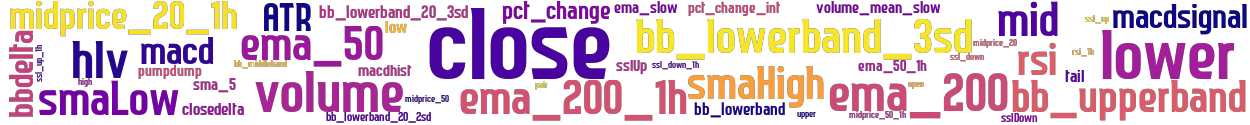

stoploss: -0.99 timeframe: 5m hash(sha256): 27af6dd4c29d4d92298724b39cb571f08e7c07957172cdd0cc499e4159834a56 indicators: upper bb_lowerband_20_3sd ema_200 ema_50 close sma_5 tail bb_lowerband pct_change ema_200_1h bbdelta macdhist midprice_50_1h volume smaHigh ATR ssl_up closedelta sslDown open hlv volume_mean_slow pct_change_int ema_50_1h smaLow high sslUp bb_lowerband_3sd mid macdsignal midprice_20_1h macd ssl_down_1h ssl_down rsi_1h pumpdump lower bb_middleband rsi midprice_20 midprice_50 bb_lowerband_20_2sd bb_upperband ema_slow low ssl_up_1h

Similar Strategies: (based on used indicators)

Strategy: HybridMonster, Similarity Score: 85.11%

last change: 2023-08-03 15:13:21