The BinHV27_combined strategy is a trading strategy that uses various technical indicators to determine entry points for long and short trades. Here's a breakdown of what the strategy does:

Indicator Calculation: The strategy begins by calculating several technical indicators based on the input dataframe and metadata. The indicators include RSI (Relative Strength Index), EMA (Exponential Moving Average), ADX (Average Directional Index), MINUS_DI, PLUS_DI, and various moving averages.

Bollinger Bands: The strategy also calculates Bollinger Bands using the typical price of the dataframe.

Informative Pair: An informative pair dataframe (inf_dataframe) is retrieved using the provided pair and timeframe.

It includes additional calculations such as the HLC3 (average of high, low, and close) and TSF (Time Series Forecast). Long Entry Conditions: The strategy defines several conditions for entering long trades. These conditions involve the comparison of various indicators, such as allow_long, slowsma, close, highsma, lowsma, minusdi, minusdiema, rsi, adx, emarsi, and bigdown. Different combinations of these conditions are checked using logical operators. Short Entry Conditions: Similar to long trades, the strategy defines conditions for entering short trades. These conditions involve the comparison of indicators like allow_short, slowsma, close, highsma, lowsma, minusdi, minusdiema, rsi, adx, emarsi, and bigdown. Entry Tagging: The strategy assigns tags to each entry condition that is satisfied. These tags are stored in the enter_tag column of the dataframe. Entry Signals: Based on the fulfilled entry conditions, the strategy sets the enter_long and enter_short columns of the dataframe to indicate whether a long or short trade should be initiated. It's important to note that the provided code snippet is incomplete, and there may be additional code or logic related to exit conditions and position management that is not included.

Bollinger Bands: The strategy also calculates Bollinger Bands using the typical price of the dataframe.

Informative Pair: An informative pair dataframe (inf_dataframe) is retrieved using the provided pair and timeframe.

It includes additional calculations such as the HLC3 (average of high, low, and close) and TSF (Time Series Forecast). Long Entry Conditions: The strategy defines several conditions for entering long trades. These conditions involve the comparison of various indicators, such as allow_long, slowsma, close, highsma, lowsma, minusdi, minusdiema, rsi, adx, emarsi, and bigdown. Different combinations of these conditions are checked using logical operators. Short Entry Conditions: Similar to long trades, the strategy defines conditions for entering short trades. These conditions involve the comparison of indicators like allow_short, slowsma, close, highsma, lowsma, minusdi, minusdiema, rsi, adx, emarsi, and bigdown. Entry Tagging: The strategy assigns tags to each entry condition that is satisfied. These tags are stored in the enter_tag column of the dataframe. Entry Signals: Based on the fulfilled entry conditions, the strategy sets the enter_long and enter_short columns of the dataframe to indicate whether a long or short trade should be initiated. It's important to note that the provided code snippet is incomplete, and there may be additional code or logic related to exit conditions and position management that is not included.

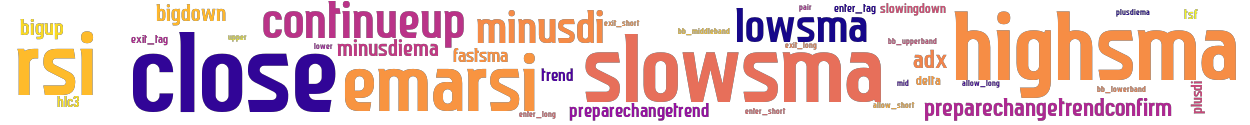

stoploss: -0.99 timeframe: 5m hash(sha256): 36cb6d227e67dca14fa9488ed7e2f7255b748aca9da1920121018cbb6cfae78d indicators: upper preparechangetrend tsf close lowsma exit_long exit_tag bb_lowerband delta trend hlc3 minusdi slowingdown continueup slowsma highsma bigdown mid emarsi bigup allow_long minusdiema adx lower plusdi fastsma preparechangetrendconfirm bb_middleband rsi enter_long enter_tag bb_upperband exit_short exit_tag enter_short enter_tag ts plusdiema allow_short

Similar Strategies: (based on used indicators)

Strategy: BinHV27JP, Similarity Score: 97.5%

Strategy: SMAIP3_combine, Similarity Score: 92.5%

Strategy: Frieza, Similarity Score: 90%

Strategy: SFrieza, Similarity Score: 90%

Strategy: AMD_combined, Similarity Score: 87.5%

Strategy: Discord_BinHV27_combined_test, Similarity Score: 87.5%

Strategy: amd_3m, Similarity Score: 87.5%

last change: 2025-08-04 11:09:31