The TAD (Technical Analysis and Data) strategy is a backtesting strategy that involves populating indicators, identifying buy and sell conditions, and generating trading signals. In the populate_indicators method, the strategy calculates the Relative Strength Index (RSI) indicator using a 14-day time period and adds it to the dataframe. Additionally, it merges informative data from 5-minute and 1-hour timeframes to the main dataframe.

The dontbuy column is created based on specific conditions.

It checks if the day of the week is Sunday (6) and the hour is greater than or equal to 6, or if the day of the week is Monday (0) and the hour is less than 6.

If either condition is met, the dontbuy value is set to True. In the populate_buy_trend method, the strategy defines buy conditions. It checks if the pair is not "BTC/USDT," the dontbuy value is False, and the volume is greater than 0. If these conditions are met, the corresponding row in the dataframe is marked as a potential buy signal. In the populate_sell_trend method, the strategy defines sell conditions. It checks if the volume is greater than 0, indicating that there is a position to sell. If the condition is met, the corresponding row in the dataframe is marked as a potential sell signal. Overall, the TAD strategy utilizes the RSI indicator, merges informative data, and incorporates specific buy and sell conditions to generate trading signals.

The dontbuy column is created based on specific conditions.

It checks if the day of the week is Sunday (6) and the hour is greater than or equal to 6, or if the day of the week is Monday (0) and the hour is less than 6.

If either condition is met, the dontbuy value is set to True. In the populate_buy_trend method, the strategy defines buy conditions. It checks if the pair is not "BTC/USDT," the dontbuy value is False, and the volume is greater than 0. If these conditions are met, the corresponding row in the dataframe is marked as a potential buy signal. In the populate_sell_trend method, the strategy defines sell conditions. It checks if the volume is greater than 0, indicating that there is a position to sell. If the condition is met, the corresponding row in the dataframe is marked as a potential sell signal. Overall, the TAD strategy utilizes the RSI indicator, merges informative data, and incorporates specific buy and sell conditions to generate trading signals.

Unable to parse Traceback (Logfile Exceeded Limit)

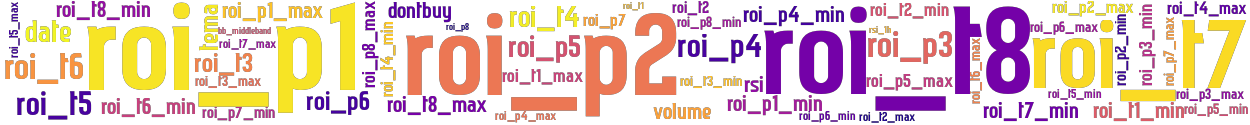

stoploss: -0.184 timeframe: 5m hash(sha256): 2ad1e538cbef17344aca81638137fa3cb8ea5fe220af8a093026fc97d853a53f indicators: roi_t1 roi_p6 roi_t8 roi_p3_min roi_p4_min roi_p5_min roi_t3 roi_p8_max roi_t3_min roi_t8_min roi_t6_min roi_p1_min roi_t3_max roi_t7 roi_t8_max roi_p5_max roi_p6_max roi_t5_min volume roi_p1 roi_t4 roi_p2 roi_t4_min roi_p3 roi_t5 roi_p7 date roi_t1_min roi_p3_max roi_p2_max roi_p7_max roi_p1_max roi_t2_max roi_p6_min roi_p4 roi_t7_min roi_p2_min roi_t6_max roi_t1_max roi_t2_min roi_p4_max roi_p7_min rsi roi_p5 roi_p8 roi_t7_max roi_t2 roi_t4_max roi_t6 dontbuy roi_p8_min roi_t5_max

Similar Strategies: (based on used indicators)

Strategy: Discord_SampleROITables, Similarity Score: 90.57%

Strategy: Discord_TAD, Similarity Score: 83.02%

Strategy: Discord_1_TAD, Similarity Score: 81.13%

last change: 2025-01-13 07:12:53