You will be redirected to the original Strategy in 15 seconds.

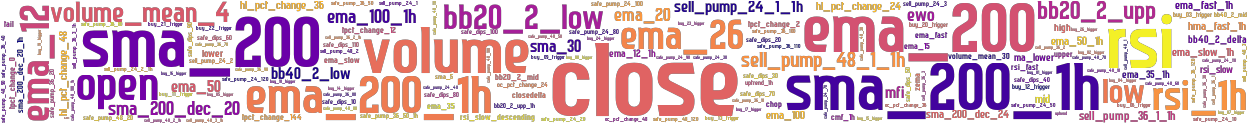

The Combined_NFIv7_SMA strategy is a trading strategy that combines various indicators to generate buy signals. Here is a breakdown of its key components:

Indicators Population:

The strategy first populates the required indicators by processing the input dataframe and metadata. It retrieves informative indicators for the 1-hour timeframe and merges them with the current timeframe.

It then calculates normal timeframe indicators.

Buy Signal Generation: The strategy defines multiple conditions for generating buy signals.

The first set of conditions includes: RSI (Relative Strength Index) slow descending. RSI fast below 35. Uptrend in the 1-hour timeframe. Close price below the lower moving average (ma_lower). Open price above the lower moving average. Positive volume. Price crossing above or below the exponential moving average (ema_fast_1h). Additional protection conditions can be enabled, such as: EMA (Exponential Moving Average) fast and slow conditions. Close price above EMA fast or slow. SMA (Simple Moving Average) 200 rising conditions. Safe dips and safe pump conditions. Buy logic conditions are defined for each protection and include: Intersection of all protection conditions. Price increase compared to the minimum open price over the last 36 periods. RSI 1-hour value within specified limits. RSI value below a certain threshold. MFI (Money Flow Index) value below a specified threshold. Buy Signal Aggregation: The strategy assigns a buy_01_trigger value based on the logical AND combination of buy_01_logic conditions. If enabled, additional buy conditions (buy_02_trigger and buy_03_trigger) can be applied, following a similar logic as buy_01_logic. Overall, the Combined_NFIv7_SMA strategy aims to identify buying opportunities based on a combination of technical indicators, including RSI, moving averages, volume, and price patterns. By adjusting the strategy's parameters and enabling various protection conditions, users can customize the buy signals according to their preferences and trading strategies.

It then calculates normal timeframe indicators.

Buy Signal Generation: The strategy defines multiple conditions for generating buy signals.

The first set of conditions includes: RSI (Relative Strength Index) slow descending. RSI fast below 35. Uptrend in the 1-hour timeframe. Close price below the lower moving average (ma_lower). Open price above the lower moving average. Positive volume. Price crossing above or below the exponential moving average (ema_fast_1h). Additional protection conditions can be enabled, such as: EMA (Exponential Moving Average) fast and slow conditions. Close price above EMA fast or slow. SMA (Simple Moving Average) 200 rising conditions. Safe dips and safe pump conditions. Buy logic conditions are defined for each protection and include: Intersection of all protection conditions. Price increase compared to the minimum open price over the last 36 periods. RSI 1-hour value within specified limits. RSI value below a certain threshold. MFI (Money Flow Index) value below a specified threshold. Buy Signal Aggregation: The strategy assigns a buy_01_trigger value based on the logical AND combination of buy_01_logic conditions. If enabled, additional buy conditions (buy_02_trigger and buy_03_trigger) can be applied, following a similar logic as buy_01_logic. Overall, the Combined_NFIv7_SMA strategy aims to identify buying opportunities based on a combination of technical indicators, including RSI, moving averages, volume, and price patterns. By adjusting the strategy's parameters and enabling various protection conditions, users can customize the buy signals according to their preferences and trading strategies.

stoploss: -0.99 timeframe: 5m hash(sha256): 7634e9a5fc952f26a73566ee42b1ad6104336e7e8d48d246d9b8af8c17daf84d

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08