You will be redirected to the original Strategy in 15 seconds.

The Combined_NFIv6_SMA strategy is a trading strategy that combines various indicators to generate buy signals. Here is a breakdown of its important parts:

Indicators:

The strategy first populates indicators using two sets of data: informative_1h and normal_tf (presumably representing different timeframes). The informative_1h indicators are merged with the main dataframe.

Other normal timeframe indicators are calculated and added to the dataframe.

Buy Signal Conditions: The strategy defines multiple sets of conditions to generate buy signals.

Each set of conditions is represented by a list. For each set, various criteria are checked, including RSI (Relative Strength Index), uptrend_1h, close and open prices relative to moving averages (ma_lower and ema_fast_1h), and volume. Additionally, there are multiple optional buy protections that can be enabled or disabled, such as EMA (Exponential Moving Average), SMA (Simple Moving Average), and safe dips/pumps. Logic operations (AND, OR) are applied to combine the individual conditions. The resulting buy triggers are stored in the dataframe. Buy Conditions: The strategy allows for the enablement of multiple buy conditions. Each buy condition is associated with a specific buy trigger set (buy_01, buy_02, buy_03). If a buy condition is enabled, the corresponding buy trigger set is considered in the final buy signal decision. Overall, the strategy utilizes a combination of indicators, conditions, and buy triggers to generate buy signals for trading.

Other normal timeframe indicators are calculated and added to the dataframe.

Buy Signal Conditions: The strategy defines multiple sets of conditions to generate buy signals.

Each set of conditions is represented by a list. For each set, various criteria are checked, including RSI (Relative Strength Index), uptrend_1h, close and open prices relative to moving averages (ma_lower and ema_fast_1h), and volume. Additionally, there are multiple optional buy protections that can be enabled or disabled, such as EMA (Exponential Moving Average), SMA (Simple Moving Average), and safe dips/pumps. Logic operations (AND, OR) are applied to combine the individual conditions. The resulting buy triggers are stored in the dataframe. Buy Conditions: The strategy allows for the enablement of multiple buy conditions. Each buy condition is associated with a specific buy trigger set (buy_01, buy_02, buy_03). If a buy condition is enabled, the corresponding buy trigger set is considered in the final buy signal decision. Overall, the strategy utilizes a combination of indicators, conditions, and buy triggers to generate buy signals for trading.

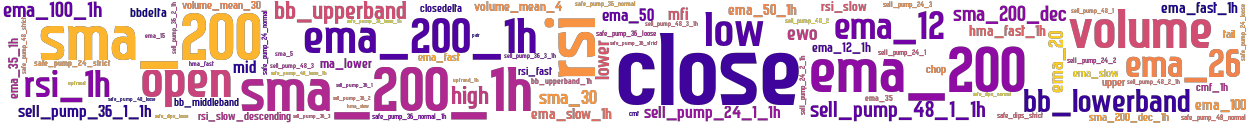

stoploss: -0.99 timeframe: 5m hash(sha256): 34426e74e0bc2d74b6dfb25d6b7a414101f0bf7dcdafc5005a92d0ab671ee032 indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo rsi_fast volume rsi_slow_descending sell_pump_36_1_1h ema_20 uptrend_1h sell_pump_48_1_1h bb_upperband_1h high safe_pump_24_normal sell_pump_48_3 rsi_1h ema_12 sell_pump_48_2 ema_slow ema_26 ema_fast_1h cmf_1h sell_pump_24_1 chop bbdelta closedelta safe_dips_loose ema_fast safe_dips_normal safe_pump_48_loose volume_mean_4 sell_pump_48_2_1h lower rsi sell_pump_24_

Similar Strategies: (based on used indicators)

Strategy: Combined_NFIv6_SMA, Similarity Score: 97.73%

Strategy: NostalgiaForInfinityNext_76, Similarity Score: 79.55%

last change: 2024-08-01 04:44:02