Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The Combined_NFIv6_SMA strategy is a backtesting strategy that combines various indicators to generate buy signals for trading. Here is a short description of what the strategy does:

The populate_indicators function takes a dataframe and additional metadata as input. It first calculates informative indicators on a 1-hour timeframe using the informative_1h_indicators function and merges them with the original dataframe using the merge_informative_pair function.

Then, it calculates normal timeframe indicators using the normal_tf_indicators function.

The updated dataframe with all the indicators is returned.

The populate_buy_trend function is responsible for generating buy signals based on specific conditions. It creates a list of conditions for a potential buy signal, which include: The rolling sum of the 'rsi_slow_descending' column is equal to 1. The 'rsi_fast' column is less than 35. The 'uptrend_1h' column is greater than 0. The 'close' price is less than the 'ma_lower' column. The 'open' price is greater than the 'ma_lower' column. The 'volume' is greater than 0. The open price is either below or above the 'ema_fast_1h' column, depending on the 'low' price compared to 'ema_fast_1h'. Additional buy protections and logic are applied based on user-defined settings, such as moving averages, close price conditions, and safe dips/pump indicators. The buy signals are stored in the 'buy_01_trigger', 'buy_02_trigger', and 'buy_03_trigger' columns of the dataframe, depending on the enabled buy conditions. Overall, the strategy combines multiple indicators and conditions to generate buy signals for backtesting trading strategies.

Then, it calculates normal timeframe indicators using the normal_tf_indicators function.

The updated dataframe with all the indicators is returned.

The populate_buy_trend function is responsible for generating buy signals based on specific conditions. It creates a list of conditions for a potential buy signal, which include: The rolling sum of the 'rsi_slow_descending' column is equal to 1. The 'rsi_fast' column is less than 35. The 'uptrend_1h' column is greater than 0. The 'close' price is less than the 'ma_lower' column. The 'open' price is greater than the 'ma_lower' column. The 'volume' is greater than 0. The open price is either below or above the 'ema_fast_1h' column, depending on the 'low' price compared to 'ema_fast_1h'. Additional buy protections and logic are applied based on user-defined settings, such as moving averages, close price conditions, and safe dips/pump indicators. The buy signals are stored in the 'buy_01_trigger', 'buy_02_trigger', and 'buy_03_trigger' columns of the dataframe, depending on the enabled buy conditions. Overall, the strategy combines multiple indicators and conditions to generate buy signals for backtesting trading strategies.

startup_candle_count : 400 ema_100_1h: 0.001% ema_200_1h: 0.078% ewo: 0.086%

Unable to parse Traceback (Logfile Exceeded Limit)

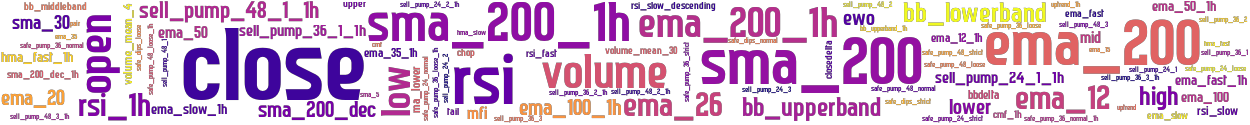

stoploss: -0.99 timeframe: 5m hash(sha256): 65188d2eb9f2e17e572ac214aeaf82cef8e2fa5f2855dcaa6172a3befd1d4bbc indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo rsi_fast volume rsi_slow_descending sell_pump_36_1_1h ema_20 uptrend_1h sell_pump_48_1_1h bb_upperband_1h high safe_pump_24_normal sell_pump_48_3 rsi_1h ema_12 sell_pump_48_2 ema_slow ema_26 ema_fast_1h cmf_1h sell_pump_24_1 chop bbdelta closedelta safe_dips_loose ema_fast safe_dips_normal safe_pump_48_loose volume_mean_4 sell_pump_48_2_1h lower rsi sell_pump_24_

Similar Strategies: (based on used indicators)

Strategy: Combined_NFIv6_SMA_863, Similarity Score: 97.73%

Strategy: NostalgiaForInfinityNext_76, Similarity Score: 79.55%

last change: 2024-08-02 08:40:00