The SmoothOperator strategy is a trading strategy that utilizes various technical indicators to generate buy and sell signals. Here is a breakdown of what the strategy does:

Indicators: The strategy starts by populating several indicators based on the provided price data. These indicators include CCI (Commodity Channel Index), RSI (Relative Strength Index), ADX (Average Directional Index), MFI (Money Flow Index), and various moving averages.

Bollinger Bands: The strategy calculates Bollinger Bands using the closing prices and adds the lower, upper, and middle bands to the dataframe.

MACD: The strategy calculates MACD (Moving Average Convergence Divergence) and adds MACD line, MACD signal line, and MACD histogram values to the dataframe.

Entry Bollinger Bands: Another set of Bollinger Bands is calculated with slightly different parameters and added to the dataframe. These bands will be used for entry conditions. Bollinger Percent and Bollinger Sharpness: The strategy calculates the percentage position of the closing price within the Bollinger Bands and the sharpness of the bands. These values are added to the dataframe. MFI, RSI, CCI Smoothing: The strategy smooths the MFI, RSI, and CCI indicators using exponential moving averages (EMAs) and calculates a combined value. This combined value is further smoothed using TEMA (Triple Exponential Moving Average) and added to the dataframe. Candle Size and Averages: The strategy calculates the size of each candle and calculates various simple moving averages (SMAs) of the closing prices over different time periods. These values are added to the dataframe. Buy Trend: The strategy determines the buy signals based on multiple conditions. These conditions involve the comparison of current and past values of moving averages, Bollinger Bands, CCI, RSI, and MFI. If the conditions are met, the corresponding row in the dataframe is marked as a buy signal. Sell Trend: The strategy determines the sell signals based on several conditions. These conditions involve the comparison of the current and past values of the smoothed MFI, RSI, CCI, and a helper function called eight_green_candles. If the conditions are met, the corresponding row in the dataframe is marked as a sell signal. Overall, the SmoothOperator strategy combines various technical indicators and conditions to generate buy and sell signals for backtesting trading strategies.

Bollinger Bands: The strategy calculates Bollinger Bands using the closing prices and adds the lower, upper, and middle bands to the dataframe.

MACD: The strategy calculates MACD (Moving Average Convergence Divergence) and adds MACD line, MACD signal line, and MACD histogram values to the dataframe.

Entry Bollinger Bands: Another set of Bollinger Bands is calculated with slightly different parameters and added to the dataframe. These bands will be used for entry conditions. Bollinger Percent and Bollinger Sharpness: The strategy calculates the percentage position of the closing price within the Bollinger Bands and the sharpness of the bands. These values are added to the dataframe. MFI, RSI, CCI Smoothing: The strategy smooths the MFI, RSI, and CCI indicators using exponential moving averages (EMAs) and calculates a combined value. This combined value is further smoothed using TEMA (Triple Exponential Moving Average) and added to the dataframe. Candle Size and Averages: The strategy calculates the size of each candle and calculates various simple moving averages (SMAs) of the closing prices over different time periods. These values are added to the dataframe. Buy Trend: The strategy determines the buy signals based on multiple conditions. These conditions involve the comparison of current and past values of moving averages, Bollinger Bands, CCI, RSI, and MFI. If the conditions are met, the corresponding row in the dataframe is marked as a buy signal. Sell Trend: The strategy determines the sell signals based on several conditions. These conditions involve the comparison of the current and past values of the smoothed MFI, RSI, CCI, and a helper function called eight_green_candles. If the conditions are met, the corresponding row in the dataframe is marked as a sell signal. Overall, the SmoothOperator strategy combines various technical indicators and conditions to generate buy and sell signals for backtesting trading strategies.

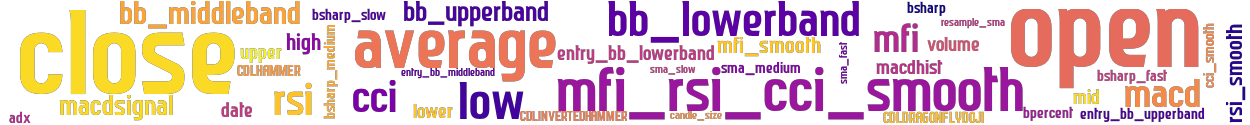

stoploss: -0.05 timeframe: 5T hash(sha256): 95f829abe630bc5cf6d0d0ab52d7e84b7f0d9f14bef05792741b0842a092cc59 indicators: mfi_rsi_cci_smooth mfi_smooth upper close entry_bb_middleband mfi bb_lowerband macdhist bsharp_medium entry_bb_upperband bsharp sma_slow average date sma_fast open bsharp_slow entry_bb_lowerband high macdsignal cci_smooth mid rsi_smooth cci sma_medium macd bsharp_fast open high low close candle_size adx lower bpercent bb_middleband rsi bb_upperband low resample_sma

Similar Strategies: (based on used indicators)

Strategy: SmoothOperator, Similarity Score: 97.56%

Strategy: SmoothOperator_2, Similarity Score: 97.56%

Strategy: SmoothOperator_3, Similarity Score: 97.56%

Strategy: SmoothOperator_4, Similarity Score: 97.56%

Strategy: chl, Similarity Score: 97.56%

Strategy: sample_strategy4, Similarity Score: 97.56%

Strategy: strategy_test, Similarity Score: 97.56%

Strategy: SmoothOperator_213, Similarity Score: 92.68%

last change: 2024-04-29 00:09:13