The FreqGymRScaler strategy is designed to backtest trading strategies using various technical analysis (TA) indicators. Here's a breakdown of what the strategy does:

populate_indicators method: This function adds several TA indicators to the given DataFrame, such as Plus Directional Movement (+DM), Plus Directional Indicator (+DI), Minus Directional Movement (-DM), Minus Directional Indicator (-DI), Awesome Oscillator (AO), Ultimate Oscillator (UO), EWO (Elder's Force Index Weighted Oscillator), Average Directional Index (ADX), Williams %R (WR), Commodity Channel Index (CCI), Relative Strength Index (RSI), Fisher Transform of RSI, Aroon indicators (Aroon Up, Aroon Down, Aroon Oscillator), Chande Momentum Oscillator (CMO), and Money Flow Index (MFI). populate_buy_trend method: This function populates the buy signal for the given DataFrame based on the TA indicators.

It uses a reinforcement learning (RL) model (rl_model_predict) to determine the buy action.

populate_sell_trend method: Similar to the populate_buy_trend method, this function populates the sell signal for the DataFrame based on the TA indicators using the RL model.

output calculation: This section creates a DataFrame called output and populates it with predictions from the RL model. It uses a sliding window approach to generate observations from the TA indicators and predicts the corresponding action using the model. Calculation of SMA difference: This part calculates the difference between two Exponential Moving Averages (EMAs) and normalizes it by dividing it by the closing price of the asset. The result is multiplied by 100 to express it as a percentage. Williams %R calculation: This snippet calculates the Williams %R oscillator, which indicates the current closing price's position relative to the high and low of the past N days. It calculates the highest high and lowest low within a specified time period and calculates %R as a ratio. The result is multiplied by -100 to obtain a negative scale value. Overall, the strategy focuses on incorporating a variety of TA indicators and using an RL model for making buy and sell decisions based on these indicators.

It uses a reinforcement learning (RL) model (rl_model_predict) to determine the buy action.

populate_sell_trend method: Similar to the populate_buy_trend method, this function populates the sell signal for the DataFrame based on the TA indicators using the RL model.

output calculation: This section creates a DataFrame called output and populates it with predictions from the RL model. It uses a sliding window approach to generate observations from the TA indicators and predicts the corresponding action using the model. Calculation of SMA difference: This part calculates the difference between two Exponential Moving Averages (EMAs) and normalizes it by dividing it by the closing price of the asset. The result is multiplied by 100 to express it as a percentage. Williams %R calculation: This snippet calculates the Williams %R oscillator, which indicates the current closing price's position relative to the high and low of the past N days. It calculates the highest high and lowest low within a specified time period and calculates %R as a ratio. The result is multiplied by -100 to obtain a negative scale value. Overall, the strategy focuses on incorporating a variety of TA indicators and using an RL model for making buy and sell decisions based on these indicators.

Unable to parse Traceback (Logfile Exceeded Limit)

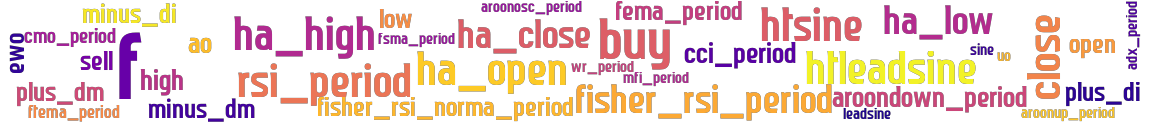

stoploss: -0.99 timeframe: 5m hash(sha256): 366583a957bfd0fce1e415092018101f8b6529ba7d7b2c12ac2777c0811fa019 indicators: sell minus_dm plus_dm f"aroondown_period close uo f"aroonosc_period ewo f"rsi_period plus_di f"mfi_period f"cci_period f"wr_period f"fisher_rsi_norma_period f"adx_period buy f"aroonup_period minus_di f"cmo_period ao f"fisher_rsi_period

Similar Strategies: (based on used indicators)

Strategy: FreqGym_2, Similarity Score: 95.45%

last change: 2025-01-12 00:59:58