The FreqGym strategy is a trading strategy that aims to backtest various indicators and generate buy and sell signals based on these indicators. Here is a breakdown of its components:

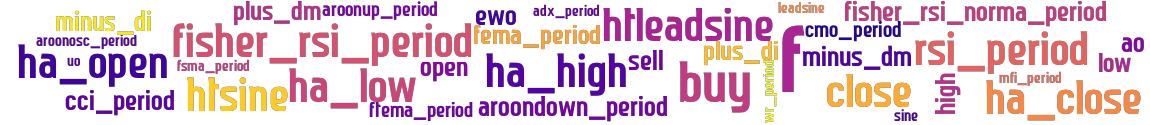

populate_indicators: This function adds multiple technical analysis (TA) indicators to the given DataFrame. These indicators include plus_dm, plus_di, minus_dm, minus_di, ao (awesome oscillator), uo (ultimate oscillator), ewo (Elliott Wave Oscillator), and several others.

These indicators provide additional information about the market trends and help in making trading decisions.

populate_buy_trend: This function generates the buy signal for the DataFrame based on the TA indicators.

It uses an RL (reinforcement learning) model to predict the action to take. If the predicted action is 1, it sets the "buy" column in the DataFrame to 1 (indicating a buy signal). populate_sell_trend: This function generates the sell signal for the DataFrame based on the TA indicators. Similar to the populate_buy_trend function, it uses an RL model to predict the action. If the predicted action is 2, it sets the "sell" column in the DataFrame to 1 (indicating a sell signal). output: This section prepares the output DataFrame and applies the model's predictions to it. It initializes an output DataFrame with zeros, extracts the required indicators from the input DataFrame, and then predicts the output values using a model. The resulting predictions are stored in the output DataFrame. df: This code block creates a copy of the input DataFrame for further calculations. It calculates the difference between two exponential moving averages (sma1 and sma2) and divides it by the closing price to get a percentage value. This value represents the SMA (Simple Moving Average) difference. Williams %R: This section describes the calculation of the Williams %R indicator. Williams %R is a technical analysis oscillator that compares the current closing price to the highest high and lowest low of the past N days. The formula calculates the percentage of the distance between the highest high and the current closing price. The result is multiplied by -100 to bring the oscillator to a negative scale. Overall, the FreqGym strategy focuses on adding multiple TA indicators to the DataFrame, generating buy and sell signals based on these indicators, and utilizing an RL model for prediction. It also includes calculations for SMA difference and Williams %R indicator.

These indicators provide additional information about the market trends and help in making trading decisions.

populate_buy_trend: This function generates the buy signal for the DataFrame based on the TA indicators.

It uses an RL (reinforcement learning) model to predict the action to take. If the predicted action is 1, it sets the "buy" column in the DataFrame to 1 (indicating a buy signal). populate_sell_trend: This function generates the sell signal for the DataFrame based on the TA indicators. Similar to the populate_buy_trend function, it uses an RL model to predict the action. If the predicted action is 2, it sets the "sell" column in the DataFrame to 1 (indicating a sell signal). output: This section prepares the output DataFrame and applies the model's predictions to it. It initializes an output DataFrame with zeros, extracts the required indicators from the input DataFrame, and then predicts the output values using a model. The resulting predictions are stored in the output DataFrame. df: This code block creates a copy of the input DataFrame for further calculations. It calculates the difference between two exponential moving averages (sma1 and sma2) and divides it by the closing price to get a percentage value. This value represents the SMA (Simple Moving Average) difference. Williams %R: This section describes the calculation of the Williams %R indicator. Williams %R is a technical analysis oscillator that compares the current closing price to the highest high and lowest low of the past N days. The formula calculates the percentage of the distance between the highest high and the current closing price. The result is multiplied by -100 to bring the oscillator to a negative scale. Overall, the FreqGym strategy focuses on adding multiple TA indicators to the DataFrame, generating buy and sell signals based on these indicators, and utilizing an RL model for prediction. It also includes calculations for SMA difference and Williams %R indicator.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -0.99 timeframe: 5m hash(sha256): 377ad34f4be8f43194ed201524dea1ca755d2df3c3c0d8bbb2b82dbf0fd000e1 indicators: sell minus_dm plus_dm f"aroondown_period close uo f"aroonosc_period ewo f"rsi_period plus_di f"mfi_period f"cci_period f"wr_period f"fisher_rsi_norma_period f"adx_period buy f"aroonup_period minus_di f"cmo_period ao f"fisher_rsi_period

Similar Strategies: (based on used indicators)

Strategy: FreqGym_rscaler_2, Similarity Score: 95.45%

last change: 2025-01-14 13:20:22