The "EMABounce" strategy is a trading strategy that uses various technical analysis indicators to generate buy and sell signals. Here is a breakdown of what the strategy does:

In the populate_indicators method:

Relative Strength Index (RSI) indicator is calculated and added to the DataFrame. Moving Average Convergence Divergence (MACD) indicator is calculated and its components (macd, macdsignal, macdhist) are added to the DataFrame.

Bollinger Bands indicator is calculated using the typical price, and its lower band, middle band, upper band, percent value, and width are added to the DataFrame.

Exponential Moving Average (EMA) is calculated using different time periods, and the EMA values are added to the DataFrame.

Simple Moving Average (SMA) is calculated using a specific time period and added to the DataFrame. Stop and Reverse (SAR) indicator is calculated and added to the DataFrame. The modified DataFrame with all the indicators is returned. In the populate_buy_trend method: Conditions for generating a buy signal are defined. Volume is checked to be greater than 0. If the MACD histogram is enabled, it is checked to be greater than or equal to 0. The EMA angle is checked to have crossed above 0. The EMA difference is checked to be greater than 0. If all the conditions are met, the 'buy' column in the DataFrame is set to 1 for those rows. In the populate_sell_trend method: Conditions for generating a sell signal are defined. If the sell hold parameter is enabled, the 'sell' column is set to 0 for all rows. If the sell hold parameter is not enabled, the following conditions are checked: The EMA angle is checked to have crossed below 0. The closing price is checked to be greater than the EMA. The EMA difference is checked to be greater than or equal to the negative sell difference parameter. If all the conditions are met, the 'sell' column in the DataFrame is set to 1 for those rows. Overall, the strategy uses indicators such as RSI, MACD, Bollinger Bands, EMA, SMA, and SAR to determine buy and sell signals based on specific conditions. The signals are then marked in the 'buy' and 'sell' columns of the DataFrame.

Bollinger Bands indicator is calculated using the typical price, and its lower band, middle band, upper band, percent value, and width are added to the DataFrame.

Exponential Moving Average (EMA) is calculated using different time periods, and the EMA values are added to the DataFrame.

Simple Moving Average (SMA) is calculated using a specific time period and added to the DataFrame. Stop and Reverse (SAR) indicator is calculated and added to the DataFrame. The modified DataFrame with all the indicators is returned. In the populate_buy_trend method: Conditions for generating a buy signal are defined. Volume is checked to be greater than 0. If the MACD histogram is enabled, it is checked to be greater than or equal to 0. The EMA angle is checked to have crossed above 0. The EMA difference is checked to be greater than 0. If all the conditions are met, the 'buy' column in the DataFrame is set to 1 for those rows. In the populate_sell_trend method: Conditions for generating a sell signal are defined. If the sell hold parameter is enabled, the 'sell' column is set to 0 for all rows. If the sell hold parameter is not enabled, the following conditions are checked: The EMA angle is checked to have crossed below 0. The closing price is checked to be greater than the EMA. The EMA difference is checked to be greater than or equal to the negative sell difference parameter. If all the conditions are met, the 'sell' column in the DataFrame is set to 1 for those rows. Overall, the strategy uses indicators such as RSI, MACD, Bollinger Bands, EMA, SMA, and SAR to determine buy and sell signals based on specific conditions. The signals are then marked in the 'buy' and 'sell' columns of the DataFrame.

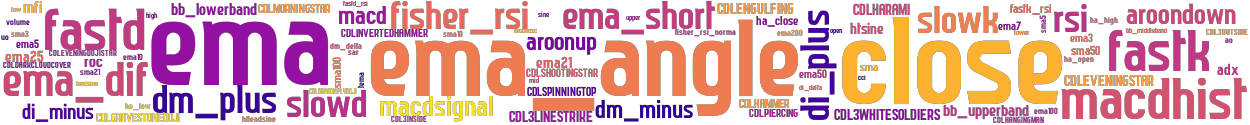

stoploss: 0 timeframe: 5m hash(sha256): 7831289cb0ecc99e8ccbb033f86031e62b4301ebc7810c73bd9d78494e943083 indicators: upper close bb_lowerband bb_percent macdhist sma volume ema_dif sar ema_diff macdsignal ema mid ema_angle bb_width macd lower bb_middleband rsi bb_upperband ema_short

Similar Strategies: (based on used indicators)

Strategy: BTCEMABounce, Similarity Score: 95.45%

Strategy: BTCEMABounce_2, Similarity Score: 95.45%

Strategy: EMABounce_2, Similarity Score: 95.45%

Strategy: TEMABounce, Similarity Score: 95.45%

Strategy: TEMABounce_2, Similarity Score: 95.45%

last change: 2024-04-29 01:43:10