The BTCEMABounce strategy is a trading strategy implemented as a class that extends the IStrategy class. It aims to generate buy and sell signals based on various technical indicators. Here's a breakdown of what the strategy does:

populate_indicators method:

This method adds several technical analysis (TA) indicators to the provided DataFrame.

It retrieves additional data for the BTC/USD pair with a 5-minute timeframe.

Calculates MACD (Moving Average Convergence Divergence) and its components (macd, macdsignal, macdhist) for the BTC/USD pair.

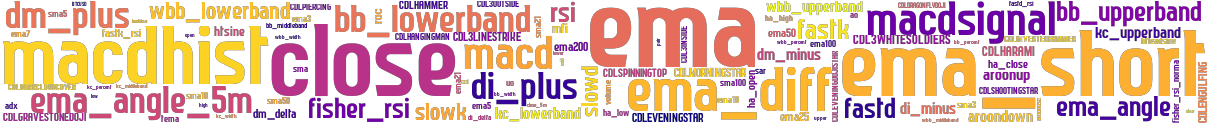

Calculates EMA (Exponential Moving Average) for both long and short periods. Calculates the slope of the short EMA (ema_angle) and the difference between EMA and the close price (ema_diff). Merges the BTC/USD data into the original DataFrame based on the timeframe. Calculates RSI (Relative Strength Index) for the original DataFrame. Calculates Bollinger Bands (bb_lowerband, bb_middleband, bb_upperband) and the percentage and width based on the close price. Calculates SMA (Simple Moving Average) for the original DataFrame. Calculates SAR (Stop and Reverse) for the original DataFrame. Returns the DataFrame with all the calculated indicators. populate_buy_trend method: This method populates the buy signal for the given DataFrame based on the indicators. Defines a list of conditions that must be satisfied for a buy signal. Checks if the volume is greater than 0 (volume condition). Checks if the MACD histogram is greater than or equal to 0 (MACD condition) if enabled. Checks if the short EMA slope crossed above 0. Checks if the EMA difference is greater than 0.0. If all the conditions are met, the 'buy' column of the DataFrame is set to 1 for those rows. Returns the DataFrame with the 'buy' column populated. populate_sell_trend method: This method populates the sell signal for the given DataFrame based on the indicators. Defines a list of conditions that must be satisfied for a sell signal. Checks if the hold condition is enabled (sell_hold value). If hold is enabled, it sets the 'sell' column to 0 for all rows. If hold is not enabled, it checks if the short EMA slope crossed below 0. Checks if the close price is greater than the EMA. Checks if the EMA difference is greater than or equal to the negative sell difference value. If all the conditions are met, the 'sell' column of the DataFrame is set to 1 for those rows. Returns the DataFrame with the 'sell' column populated. Overall, the BTCEMABounce strategy calculates various TA indicators and uses them to generate buy and sell signals based on specific conditions. The strategy can be customized by enabling or disabling certain indicators and adjusting parameter values.

It retrieves additional data for the BTC/USD pair with a 5-minute timeframe.

Calculates MACD (Moving Average Convergence Divergence) and its components (macd, macdsignal, macdhist) for the BTC/USD pair.

Calculates EMA (Exponential Moving Average) for both long and short periods. Calculates the slope of the short EMA (ema_angle) and the difference between EMA and the close price (ema_diff). Merges the BTC/USD data into the original DataFrame based on the timeframe. Calculates RSI (Relative Strength Index) for the original DataFrame. Calculates Bollinger Bands (bb_lowerband, bb_middleband, bb_upperband) and the percentage and width based on the close price. Calculates SMA (Simple Moving Average) for the original DataFrame. Calculates SAR (Stop and Reverse) for the original DataFrame. Returns the DataFrame with all the calculated indicators. populate_buy_trend method: This method populates the buy signal for the given DataFrame based on the indicators. Defines a list of conditions that must be satisfied for a buy signal. Checks if the volume is greater than 0 (volume condition). Checks if the MACD histogram is greater than or equal to 0 (MACD condition) if enabled. Checks if the short EMA slope crossed above 0. Checks if the EMA difference is greater than 0.0. If all the conditions are met, the 'buy' column of the DataFrame is set to 1 for those rows. Returns the DataFrame with the 'buy' column populated. populate_sell_trend method: This method populates the sell signal for the given DataFrame based on the indicators. Defines a list of conditions that must be satisfied for a sell signal. Checks if the hold condition is enabled (sell_hold value). If hold is enabled, it sets the 'sell' column to 0 for all rows. If hold is not enabled, it checks if the short EMA slope crossed below 0. Checks if the close price is greater than the EMA. Checks if the EMA difference is greater than or equal to the negative sell difference value. If all the conditions are met, the 'sell' column of the DataFrame is set to 1 for those rows. Returns the DataFrame with the 'sell' column populated. Overall, the BTCEMABounce strategy calculates various TA indicators and uses them to generate buy and sell signals based on specific conditions. The strategy can be customized by enabling or disabling certain indicators and adjusting parameter values.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -0.144 timeframe: 5m hash(sha256): 5d04633e7c59c3f96759cc44fae6cb487233140b5a504ecac968b518cd183912 indicators: upper close bb_lowerband bb_percent ema_angle_5m macdhist sma volume ema_dif sar ema_diff macdsignal ema mid ema_angle bb_width macd lower bb_middleband rsi bb_upperband ema_short close_5m

Similar Strategies: (based on used indicators)

Strategy: BTCEMABounce_2, Similarity Score: 95.83%

last change: 2025-01-14 05:10:22