The BigDrop strategy is a trading strategy that utilizes various technical indicators to generate buy and sell signals for backtesting. Here's a breakdown of what the strategy does:

Indicator Calculation:

Moving Average Convergence Divergence (MACD): Calculates the MACD line and the MACD signal line. Money Flow Index (MFI): Calculates the MFI indicator.

Stochastic Fast (STOCHF): Calculates the fast %K and %D values.

Relative Strength Index (RSI): Calculates the RSI indicator.

Fisher Transform of RSI: Applies the Fisher Transform to the RSI indicator. Weighted Bollinger Bands (BB): Calculates the upper band, middle band, and lower band of Bollinger Bands. Exponential Moving Averages (EMA): Calculates EMA values for different time periods. Stop and Reverse (SAR): Calculates the SAR indicator. Buy Signal Generation: The strategy checks for specific conditions to generate a buy signal: Money Flow Index (MFI) condition: If enabled, the MFI value should be below a certain threshold. Fisher Transform of RSI condition: If enabled, the Fisher Transform of RSI should be below a certain threshold. Bollinger Bands (BB) condition: If enabled, the closing price should be below the lower Bollinger Band. Buy drop condition: The price drop over a specified number of candles should be greater than or equal to a given threshold. Sell Signal Generation: The strategy sets the sell signal to 0 for all data points where the closing price is greater than or equal to 0. The strategy calculates multiple indicators and uses specific conditions to generate buy signals. It sets the sell signal to 0 for all data points where the closing price is greater than or equal to 0.

Stochastic Fast (STOCHF): Calculates the fast %K and %D values.

Relative Strength Index (RSI): Calculates the RSI indicator.

Fisher Transform of RSI: Applies the Fisher Transform to the RSI indicator. Weighted Bollinger Bands (BB): Calculates the upper band, middle band, and lower band of Bollinger Bands. Exponential Moving Averages (EMA): Calculates EMA values for different time periods. Stop and Reverse (SAR): Calculates the SAR indicator. Buy Signal Generation: The strategy checks for specific conditions to generate a buy signal: Money Flow Index (MFI) condition: If enabled, the MFI value should be below a certain threshold. Fisher Transform of RSI condition: If enabled, the Fisher Transform of RSI should be below a certain threshold. Bollinger Bands (BB) condition: If enabled, the closing price should be below the lower Bollinger Band. Buy drop condition: The price drop over a specified number of candles should be greater than or equal to a given threshold. Sell Signal Generation: The strategy sets the sell signal to 0 for all data points where the closing price is greater than or equal to 0. The strategy calculates multiple indicators and uses specific conditions to generate buy signals. It sets the sell signal to 0 for all data points where the closing price is greater than or equal to 0.

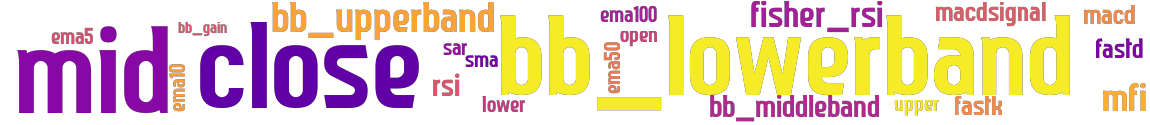

stoploss: 0 timeframe: 5m hash(sha256): 530e12256c06a2741d810f891cc90b1383fbc07bff8a27676c4d6db66c42d0a0 indicators: upper close bb_gain mfi bb_lowerband ema5 fastk sma open fastd ema10 sar macdsignal mid fisher_rsi ema100 macd lower bb_middleband rsi bb_upperband ema50

Similar Strategies: (based on used indicators)

Strategy: BTCBigDrop, Similarity Score: 95.65%

Strategy: BTCBigDrop_2, Similarity Score: 95.65%

Strategy: BTCJump, Similarity Score: 95.65%

Strategy: BTCNDrop, Similarity Score: 95.65%

Strategy: BTCNDrop_2, Similarity Score: 95.65%

Strategy: BTCNSeq, Similarity Score: 95.65%

Strategy: BTCNSeq_2, Similarity Score: 95.65%

Strategy: BigDrop_2, Similarity Score: 95.65%

Strategy: BollingerBounce, Similarity Score: 95.65%

Strategy: BollingerBounce_2, Similarity Score: 95.65%

Strategy: ComboHold, Similarity Score: 95.65%

Strategy: NDrop, Similarity Score: 95.65%

Strategy: NDrop_2, Similarity Score: 95.65%

Strategy: NSeq, Similarity Score: 95.65%

Strategy: NSeq_2, Similarity Score: 95.65%

Strategy: DonchianBounce, Similarity Score: 91.3%

Strategy: DonchianBounce_2, Similarity Score: 91.3%

Strategy: DonchianChannel, Similarity Score: 91.3%

Strategy: DonchianChannel_2, Similarity Score: 91.3%

Strategy: KeltnerBounce, Similarity Score: 91.3%

Strategy: KeltnerBounce_2, Similarity Score: 91.3%

last change: 2024-04-29 19:40:41