Strategy 002 is a trading strategy designed to backtest and analyze the performance of different trading strategies. It uses various technical analysis (TA) indicators to make buy and sell decisions. The strategy calculates the Stochastic Oscillator (STOCH) and adds the slow %K value to the dataframe.

It also calculates the Relative Strength Index (RSI) and applies the Inverse Fisher transform to obtain values between -1.0 and 1.0.

Additionally, Bollinger Bands and the Parabolic SAR indicator are calculated and added to the dataframe.

The Hammer candlestick pattern is also identified. For the buy signal, the strategy considers the following conditions: RSI is below 30, the slow %K of Stochastic is below 20, the Bollinger Bands lower band is above the closing price, and the Hammer pattern is present. For the sell signal, the strategy considers the conditions: the Parabolic SAR value is above the closing price, and the Fisher RSI value is above 0.3. By backtesting different trading strategies using this approach, users can evaluate their performance and make informed decisions for their trading activities. To use this strategy, one can run the freqtrade script with the -s Strategy002 argument.

It also calculates the Relative Strength Index (RSI) and applies the Inverse Fisher transform to obtain values between -1.0 and 1.0.

Additionally, Bollinger Bands and the Parabolic SAR indicator are calculated and added to the dataframe.

The Hammer candlestick pattern is also identified. For the buy signal, the strategy considers the following conditions: RSI is below 30, the slow %K of Stochastic is below 20, the Bollinger Bands lower band is above the closing price, and the Hammer pattern is present. For the sell signal, the strategy considers the conditions: the Parabolic SAR value is above the closing price, and the Fisher RSI value is above 0.3. By backtesting different trading strategies using this approach, users can evaluate their performance and make informed decisions for their trading activities. To use this strategy, one can run the freqtrade script with the -s Strategy002 argument.

Unable to parse Traceback (Logfile Exceeded Limit)

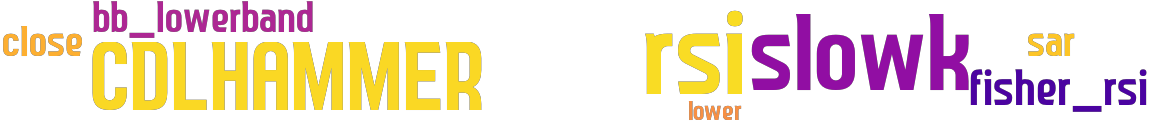

stoploss: -0.3 timeframe: 5m hash(sha256): 9f305b6a07ee9de3df660082df18fef724ac62e70360a6bc39048033e26c3f91 indicators: slowk lower fisher_rsi close rsi bb_lowerband CDLHAMMER sar

No similar strategies found. (based on used indicators)

last change: 2025-01-14 06:34:39