You will be redirected to the original Strategy in 15 seconds.

The MultiMA_TSL3 strategy is a backtesting strategy that incorporates multiple indicators to determine buy signals in trading. Here's a brief explanation of what the strategy does:

In the populate_indicators function:

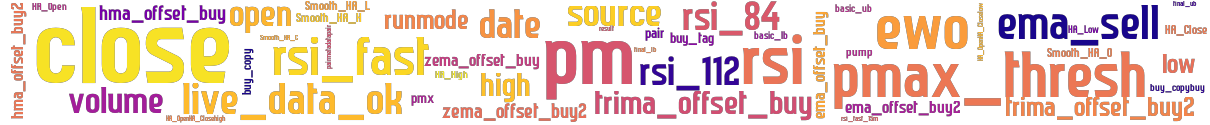

Calculates the EWO (Elliott Wave Oscillator) using the specified fast and slow EWO values. Calculates the RSI (Relative Strength Index) with a time period of 14, as well as faster RSI values with time periods of 4, 84, and 112.

Applies Heikin-Ashi transformation to the dataframe and adds a volume column.

Calculates the PM and PMX indicators using the pmax function.

Calculates the source price based on the average of high, low, open, and close prices. Calculates the EMA (Exponential Moving Average) with a time period of 9 for the source price. Applies the Heikin-Ashi transformation to the dataframe with a smoothing factor of 4. Sets a flag (live_data_ok) to indicate whether the strategy is running in live or dry-run mode. In the populate_buy_trend function: Calculates various offset values for EMA, TRIMA, and HMA indicators based on different parameters. Checks for buy conditions based on offset values and other criteria such as price movement, RSI values, and PM threshold. Appends a tag to indicate the trigger type for each buy condition. Updates the buy tag and buy copy columns based on the buy conditions. Returns the updated dataframe. In the populate_sell_trend function: Sets the sell column to 0 (no sell signals). Returns the dataframe. The MultiMA_TSL3a class is a subclass of MultiMA_TSL3 and provides additional functionality in the populate_indicators function. It includes informative 15-minute indicators and merges them with the current timeframe indicators before performing the calculations mentioned above. It also calculates the pump warning based on the maximum change in price. These strategies utilize various indicators and conditions to generate buy signals, and the specific parameters and logic used can be further customized based on the requirements of the backtesting website.

Applies Heikin-Ashi transformation to the dataframe and adds a volume column.

Calculates the PM and PMX indicators using the pmax function.

Calculates the source price based on the average of high, low, open, and close prices. Calculates the EMA (Exponential Moving Average) with a time period of 9 for the source price. Applies the Heikin-Ashi transformation to the dataframe with a smoothing factor of 4. Sets a flag (live_data_ok) to indicate whether the strategy is running in live or dry-run mode. In the populate_buy_trend function: Calculates various offset values for EMA, TRIMA, and HMA indicators based on different parameters. Checks for buy conditions based on offset values and other criteria such as price movement, RSI values, and PM threshold. Appends a tag to indicate the trigger type for each buy condition. Updates the buy tag and buy copy columns based on the buy conditions. Returns the updated dataframe. In the populate_sell_trend function: Sets the sell column to 0 (no sell signals). Returns the dataframe. The MultiMA_TSL3a class is a subclass of MultiMA_TSL3 and provides additional functionality in the populate_indicators function. It includes informative 15-minute indicators and merges them with the current timeframe indicators before performing the calculations mentioned above. It also calculates the pump warning based on the maximum change in price. These strategies utilize various indicators and conditions to generate buy signals, and the specific parameters and logic used can be further customized based on the requirements of the backtesting website.

stoploss: -0.15 timeframe: 5m hash(sha256): 135f5c5be04dc57748b44d4e71bdde1fdb1c1b2aab1be9bbe2d274a3030c8865

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-25 06:15:59