Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

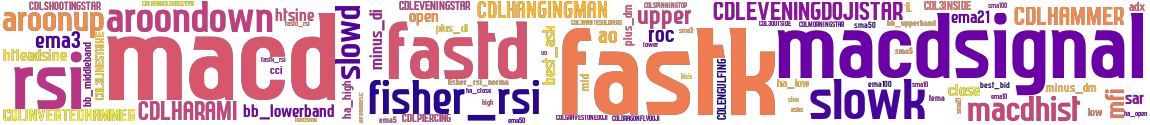

The MACDStrategy is a trading strategy that utilizes various technical indicators to generate buy and sell signals for a given dataset. The strategy aims to identify potential buying opportunities when certain conditions are met and suggests selling opportunities when different conditions are fulfilled. The strategy begins by populating the dataset with several technical indicators, including ADX (Average Directional Index), CCI (Commodity Channel Index), RSI (Relative Strength Index), Stochastic Fast, MACD (Moving Average Convergence Divergence), MFI (Money Flow Index), Bollinger Bands, SAR (Stop and Reverse), TEMA (Triple Exponential Moving Average), and HTSINE (Hilbert Transform - SineWave).

These indicators provide insights into market trends, volatility, momentum, and potential reversals.

Once the indicators are calculated and added to the dataset, the strategy determines the buy signal based on specific conditions.

In this case, the strategy suggests buying when the RSI is greater than 50, the Stochastic Fast value is above 50, and the MACD line is above the MACD signal line. Similarly, the sell signal is determined based on the condition that the MACD line is below the MACD signal line. By applying these buy and sell signals to the dataset, the strategy provides a DataFrame with the "buy" and "sell" columns indicating the recommended actions to take in the given market conditions.

These indicators provide insights into market trends, volatility, momentum, and potential reversals.

Once the indicators are calculated and added to the dataset, the strategy determines the buy signal based on specific conditions.

In this case, the strategy suggests buying when the RSI is greater than 50, the Stochastic Fast value is above 50, and the MACD line is above the MACD signal line. Similarly, the sell signal is determined based on the condition that the MACD line is below the MACD signal line. By applying these buy and sell signals to the dataset, the strategy provides a DataFrame with the "buy" and "sell" columns indicating the recommended actions to take in the given market conditions.

startup_candle_count : 30 rsi: 13.070% sar: 0.565% tema: -0.013%

stoploss: -0.1 timeframe: 15m hash(sha256): 0df90bc31c1528b13f46686d0f8f820c30b2b864568a2820862af20ead1850be indicators: upper CDLDRAGONFLYDOJI CDLGRAVESTONEDOJI close CDLSPINNINGTOP bb_lowerband bb_percent CDL3WHITESOLDIERS kc_middleband sma10 high fisher_rsi_norma cci ha_high adx aroonosc ema50 minus_dm plus_dm CDLHANGINGMAN aroondown CDLEVENINGDOJISTAR plus_di ha_open slowk macdsignal fastk_rsi minus_di roc lower rsi sma3 sine kc_percent wbb_upperband htsine tema wbb_lowerband uo mfi ema5 kc_width macdhist CDLHAMMER htleadsine CDLEVENINGSTAR sma100 ema10 best_ask sar wbb_width CDL3OUTSIDE bids mid fisher_rsi sm

Similar Strategies: (based on used indicators)

Strategy: BBands, Similarity Score: 98.25%

Strategy: Neat_RL, Similarity Score: 98.25%

Strategy: sample_strategy_284, Similarity Score: 98.25%

Strategy: sample_strategy_3, Similarity Score: 98.25%

Strategy: stoploss, Similarity Score: 98.25%

Strategy: TenderEnter, Similarity Score: 94.74%

Strategy: TestStrategy, Similarity Score: 94.74%

Strategy: bbl3h1rsi, Similarity Score: 94.74%

Strategy: BotE, Similarity Score: 92.98%

Strategy: FRAYSTRAT_BTCUSDT_1H, Similarity Score: 92.98%

Strategy: poimacd, Similarity Score: 92.98%

Strategy: Discord_BuzzzMoneyV1, Similarity Score: 87.72%

Strategy: MACDCross, Similarity Score: 87.72%

Strategy: MACDcross, Similarity Score: 87.72%

Strategy: ElliotV2, Similarity Score: 80.7%

Strategy: ElliotV2_1, Similarity Score: 80.7%

Strategy: ElliotV2_dca_meneguzzo, Similarity Score: 80.7%

Strategy: Discord_3_ElliotV5, Similarity Score: 77.19%

Strategy: Discord_ElliotV2, Similarity Score: 77.19%

Strategy: Discord_ElliotV4, Similarity Score: 77.19%

Strategy: Discord_ElliotV5, Similarity Score: 77.19%

Strategy: ElliotV3_983, Similarity Score: 77.19%

Strategy: ElliotV4, Similarity Score: 77.19%

Strategy: ElliotV4_961, Similarity Score: 77.19%

Strategy: ElliotV4_984, Similarity Score: 77.19%

Strategy: ElliotV5HO_264, Similarity Score: 77.19%

Strategy: ElliotV5_SMA, Similarity Score: 77.19%

Strategy: MarwoSkipVol, Similarity Score: 77.19%

Strategy: MarwoSkipVol15, Similarity Score: 77.19%

Strategy: Discord_ElliotV5HO, Similarity Score: 75.44%

Strategy: ElliotV531, Similarity Score: 75.44%

Strategy: ElliotV5_309, Similarity Score: 75.44%

Strategy: Ichimoku, Similarity Score: 75.44%

Strategy: ichimoku, Similarity Score: 75.44%

Strategy: MarwoHeiken, Similarity Score: 71.93%

last change: 2023-07-05 16:36:10