Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The InkkerSlower strategy is a trading strategy that uses the Relative Strength Index (RSI) and a combination of moving averages and other indicators to generate buy and sell signals. Here is a brief explanation of the strategy:

The strategy begins by populating various indicators on the provided DataFrame, including informative 1-hour indicators and normal time frame indicators. Next, the strategy calculates the RSI (Relative Strength Index) using the price data.

RSI is a momentum oscillator that measures the speed and change of price movements.

The calculated RSI values are stored in a DataFrame called rsi_df.

The strategy then proceeds to generate buy and sell signals based on the RSI values. It iterates through the RSI values and checks for specific conditions: If the RSI value crosses below 30 (indicating oversold condition) after being above 30, a buy signal is generated. The price at which the buy signal occurs is stored in the buy_price list, while the sell_price and rsi_signal lists are updated accordingly. If the RSI value crosses above 70 (indicating overbought condition) after being below 70, a sell signal is generated. The price at which the sell signal occurs is stored in the sell_price list, while the buy_price and rsi_signal lists are updated accordingly. If none of the above conditions are met, no signal is generated, and the respective lists are updated with NaN values. After generating the buy and sell signals, the strategy moves on to populate the entry trend on the DataFrame. It checks for a combination of conditions involving moving averages (ema), an IFTCombo indicator, histogram (hist), CRSI indicator, and volume. If the conditions are met, the 'enter_long' column in the DataFrame is set to 1 for the corresponding rows. Finally, the strategy populates the exit trend on the DataFrame. It checks for a combination of conditions involving moving averages (ema), an IFTCombo indicator, histogram (hist), CRSI indicator, and volume. If the conditions are met, the 'exit_long' column in the DataFrame is set to 1 for the corresponding rows. Overall, the InkkerSlower strategy combines RSI signals with other technical indicators to generate entry and exit signals for long positions in the market.

RSI is a momentum oscillator that measures the speed and change of price movements.

The calculated RSI values are stored in a DataFrame called rsi_df.

The strategy then proceeds to generate buy and sell signals based on the RSI values. It iterates through the RSI values and checks for specific conditions: If the RSI value crosses below 30 (indicating oversold condition) after being above 30, a buy signal is generated. The price at which the buy signal occurs is stored in the buy_price list, while the sell_price and rsi_signal lists are updated accordingly. If the RSI value crosses above 70 (indicating overbought condition) after being below 70, a sell signal is generated. The price at which the sell signal occurs is stored in the sell_price list, while the buy_price and rsi_signal lists are updated accordingly. If none of the above conditions are met, no signal is generated, and the respective lists are updated with NaN values. After generating the buy and sell signals, the strategy moves on to populate the entry trend on the DataFrame. It checks for a combination of conditions involving moving averages (ema), an IFTCombo indicator, histogram (hist), CRSI indicator, and volume. If the conditions are met, the 'enter_long' column in the DataFrame is set to 1 for the corresponding rows. Finally, the strategy populates the exit trend on the DataFrame. It checks for a combination of conditions involving moving averages (ema), an IFTCombo indicator, histogram (hist), CRSI indicator, and volume. If the conditions are met, the 'exit_long' column in the DataFrame is set to 1 for the corresponding rows. Overall, the InkkerSlower strategy combines RSI signals with other technical indicators to generate entry and exit signals for long positions in the market.

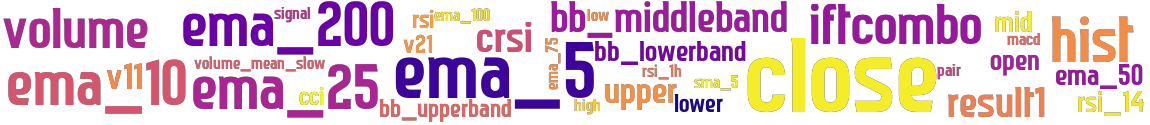

stoploss: -0.99 timeframe: 5m hash(sha256): 6e2213c77f107c8cbae13043babfc59fff874f12cdfdae3d99b977b0073bea71 indicators: upper v21 iftcombo ema_200 ema_50 close sma_5 bb_lowerband crsi ema_25 volume open volume_mean_slow rsi_14 high mid cci macd rsi_1h v11 ema_100 hist lower signal ema_5 rsi ema_10 bb_middleband ema_75 bb_upperband low result1

No similar strategies found. (based on used indicators)

last change: 2023-07-01 19:01:23